Intro

Discover the ins and outs of MoneyGrams online services in our comprehensive review. Learn how to send and receive money globally, track transfers, and use the MoneyGram websites features. Explore the fees, exchange rates, and security measures. Get the most out of MoneyGrams online services with our expert guide.

MoneyGram is a leading global money transfer and payment services company that enables consumers and businesses to send and receive money around the world. With a presence in over 200 countries and territories, MoneyGram has established itself as a trusted brand in the financial services industry. In this article, we will review the MoneyGram website and provide a comprehensive guide to its online services.

MoneyGram Website Review

The MoneyGram website is user-friendly and easy to navigate, making it simple for customers to access its services. The website is available in multiple languages, including English, Spanish, French, and many others, catering to a diverse customer base.

Upon visiting the website, customers can access various services, including:

- Send Money: Allows customers to send money to friends and family worldwide.

- Receive Money: Enables customers to receive money from others.

- Pay Bills: Allows customers to pay bills online, including utility bills, credit card bills, and more.

- Account Services: Enables customers to manage their MoneyGram accounts, including checking balances and transaction history.

Online Services Guide

MoneyGram offers a range of online services that cater to different customer needs. Here's a comprehensive guide to its online services:

- Send Money: MoneyGram's send money service allows customers to send money to friends and family worldwide. Customers can choose from various payment methods, including credit/debit cards, bank accounts, and cash. The recipient can receive the money in their bank account, mobile wallet, or in cash at a MoneyGram location.

- Receive Money: MoneyGram's receive money service enables customers to receive money from others. Customers can receive money in their bank account, mobile wallet, or in cash at a MoneyGram location.

- Pay Bills: MoneyGram's pay bills service allows customers to pay bills online, including utility bills, credit card bills, and more. Customers can pay bills using their credit/debit cards or bank accounts.

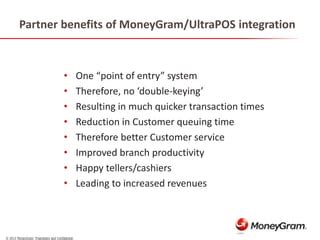

Benefits of Using MoneyGram Online Services

Using MoneyGram's online services offers several benefits, including:

- Convenience: MoneyGram's online services are available 24/7, allowing customers to send and receive money at their convenience.

- Speed: MoneyGram's online services are fast and efficient, allowing customers to send and receive money quickly.

- Security: MoneyGram's online services are secure, using advanced encryption technology to protect customer transactions.

- Cost-effective: MoneyGram's online services are cost-effective, offering competitive exchange rates and low fees.

How to Use MoneyGram Online Services

Using MoneyGram's online services is easy and straightforward. Here's a step-by-step guide:

- Visit the MoneyGram website and log in to your account.

- Choose the service you want to use, such as send money or pay bills.

- Enter the recipient's details, including their name, address, and bank account information (if applicable).

- Choose your payment method, such as credit/debit card or bank account.

- Review your transaction details and confirm.

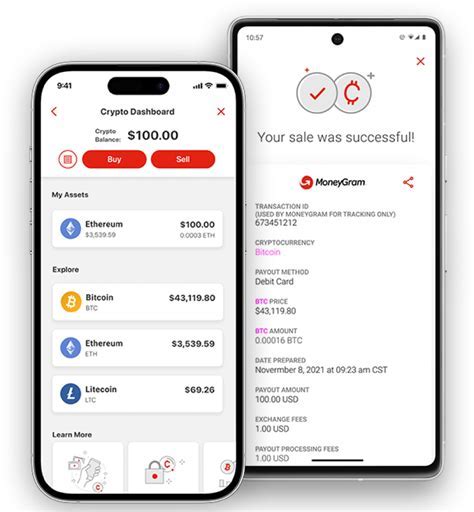

MoneyGram Mobile App

MoneyGram has a mobile app that allows customers to access its services on-the-go. The app is available for both iOS and Android devices and offers a range of features, including:

- Send Money: Allows customers to send money to friends and family worldwide.

- Receive Money: Enables customers to receive money from others.

- Pay Bills: Allows customers to pay bills online, including utility bills, credit card bills, and more.

- Account Services: Enables customers to manage their MoneyGram accounts, including checking balances and transaction history.

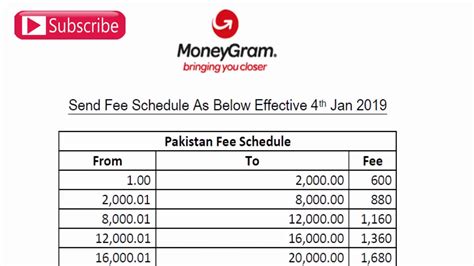

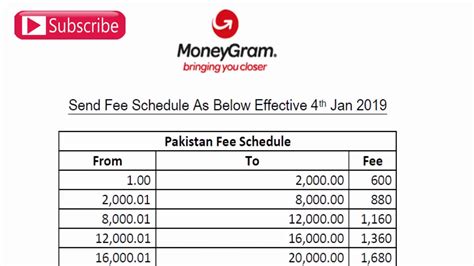

MoneyGram Fees and Exchange Rates

MoneyGram's fees and exchange rates vary depending on the service and location. Here's a breakdown of MoneyGram's fees and exchange rates:

- Send Money: MoneyGram's send money fees vary depending on the payment method and location. For example, sending money using a credit/debit card can cost between 1.5% to 3.5% of the transaction amount.

- Receive Money: MoneyGram's receive money fees vary depending on the location and payment method. For example, receiving money in cash can cost between $1 to $5.

- Pay Bills: MoneyGram's pay bills fees vary depending on the biller and payment method. For example, paying a utility bill using a credit/debit card can cost between 1.5% to 3.5% of the transaction amount.

MoneyGram Security Measures

MoneyGram takes security seriously and has implemented various measures to protect customer transactions. Here are some of MoneyGram's security measures:

- Advanced Encryption Technology: MoneyGram uses advanced encryption technology to protect customer transactions.

- Secure Sockets Layer (SSL) Protocol: MoneyGram's website and mobile app use SSL protocol to ensure secure data transmission.

- Two-Factor Authentication: MoneyGram offers two-factor authentication to add an extra layer of security to customer accounts.

MoneyGram Customer Support

MoneyGram offers customer support through various channels, including:

- Phone: MoneyGram's customer support team is available 24/7 to assist with any questions or concerns.

- Email: Customers can email MoneyGram's customer support team for assistance.

- Live Chat: MoneyGram's website and mobile app offer live chat support for customers.

Conclusion

MoneyGram's online services offer a convenient, fast, and secure way to send and receive money worldwide. With a range of services, including send money, receive money, and pay bills, MoneyGram caters to different customer needs. Its mobile app and website are user-friendly, and its security measures ensure that customer transactions are protected. With competitive exchange rates and low fees, MoneyGram is a trusted brand in the financial services industry.

MoneyGram Image Gallery

What is MoneyGram?

+MoneyGram is a leading global money transfer and payment services company that enables consumers and businesses to send and receive money around the world.

How do I send money using MoneyGram?

+To send money using MoneyGram, simply visit the MoneyGram website or mobile app, enter the recipient's details, choose your payment method, and confirm your transaction.

What are the benefits of using MoneyGram?

+The benefits of using MoneyGram include convenience, speed, security, and cost-effectiveness.