Intro

Unlock the secrets of National Guard Reserve pay! Discover how your service affects your compensation with our in-depth guide to the 5 ways National Guard Reserve pay works, covering drill pay, annual training pay, deployment pay, and more. Learn about reserve pay charts, benefits, and how to maximize your military income.

Serving in the National Guard or Reserve can be a great way to serve your country, develop valuable skills, and earn competitive pay and benefits. If you're considering joining the National Guard or Reserve, understanding how the pay works is essential. In this article, we'll break down the five ways National Guard Reserve pay works, including the different types of pay, how drill pay is calculated, and the factors that affect your take-home pay.

Drill Pay: The Basics

Drill pay is the payment you receive for attending drills and other training exercises. It's a key component of National Guard Reserve pay and is calculated based on your rank, time in service, and the number of drills you attend.

How Drill Pay is Calculated

Drill pay is calculated using a formula that takes into account your rank, time in service, and the number of drills you attend. The formula is as follows:

Drill Pay = Base Pay x Number of Drills x Drill Pay Rate

- Base Pay: Your base pay is determined by your rank and time in service. It's the same as the base pay for active-duty military personnel.

- Number of Drills: The number of drills you attend will affect your drill pay. Typically, you'll attend one drill per month, but this can vary depending on your unit's schedule.

- Drill Pay Rate: The drill pay rate is a percentage of your base pay that's determined by the type of drill you're attending. For example, a weekend drill might pay 1/30th of your base pay, while a week-long annual training (AT) might pay 1/15th of your base pay.

Types of Pay: Understanding the Different Components

National Guard Reserve pay is composed of several different components, including:

Basic Pay

Basic pay is the foundation of your National Guard Reserve pay. It's the same as the basic pay for active-duty military personnel and is determined by your rank and time in service.

Drill Pay

Drill pay is the payment you receive for attending drills and other training exercises. It's calculated using the formula outlined above.

Special Pay

Special pay is a type of pay that's awarded for specific skills or qualifications. For example, if you're a pilot or a diver, you may receive special pay for your expertise.

Allowances

Allowances are payments that are made to help offset the costs of living. For example, you may receive a housing allowance or a food allowance, depending on your circumstances.

Factors That Affect Take-Home Pay

Several factors can affect your take-home pay as a National Guard Reserve member. These include:

Taxes

Taxes can significantly impact your take-home pay. As a National Guard Reserve member, you'll pay federal income tax on your earnings, just like any other taxpayer.

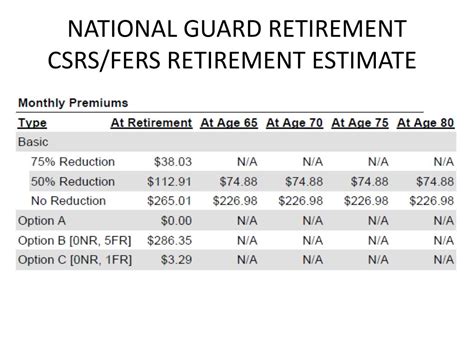

Health Insurance

Health insurance premiums can also affect your take-home pay. If you're enrolled in the military's health insurance program, TRICARE, you may see deductions from your paycheck.

Retirement Contributions

If you're contributing to the military's retirement savings plan, the Thrift Savings Plan (TSP), you may see deductions from your paycheck.

Gallery of National Guard Reserve Pay

National Guard Reserve Pay Gallery

FAQs: National Guard Reserve Pay

How is National Guard Reserve pay calculated?

+National Guard Reserve pay is calculated using a formula that takes into account your rank, time in service, and the number of drills you attend.

What are the different types of pay for National Guard Reserve members?

+National Guard Reserve pay is composed of several different components, including basic pay, drill pay, special pay, and allowances.

How do taxes affect National Guard Reserve pay?

+Taxes can significantly impact your take-home pay as a National Guard Reserve member. You'll pay federal income tax on your earnings, just like any other taxpayer.

We hope this article has provided you with a better understanding of how National Guard Reserve pay works. If you have any further questions or concerns, be sure to leave a comment below.