Intro

Discover expert 5 Navy Credit Union Loan Tips, including naval loan options, credit union benefits, and financial management strategies for military personnel and veterans, to make informed borrowing decisions.

The Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial products and services to its members. One of the most popular services offered by the Navy Federal Credit Union is its loan program, which provides members with access to affordable and flexible loans for various purposes. If you're considering taking out a loan from the Navy Federal Credit Union, here are five tips to help you make the most of your loan experience.

The Navy Federal Credit Union offers a variety of loan options, including personal loans, auto loans, mortgages, and more. Each type of loan has its own set of benefits and requirements, so it's essential to choose the right loan for your needs. For example, if you're looking to purchase a new car, an auto loan may be the best option. On the other hand, if you need to consolidate debt or cover unexpected expenses, a personal loan may be a better choice.

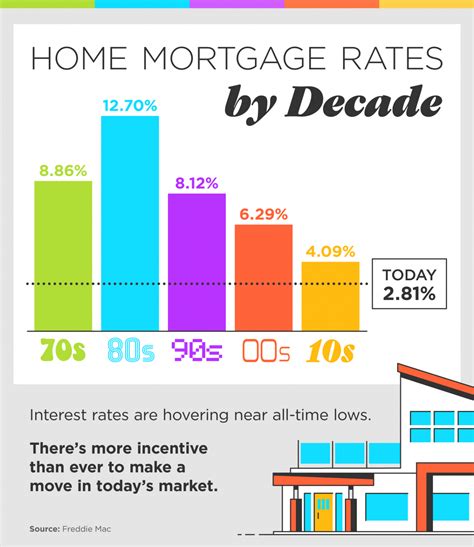

When applying for a loan from the Navy Federal Credit Union, it's crucial to understand the terms and conditions of the loan. This includes the interest rate, repayment term, and any fees associated with the loan. The Navy Federal Credit Union offers competitive interest rates and flexible repayment terms, but it's still important to carefully review the loan agreement before signing. You should also consider factors such as your credit score, income, and debt-to-income ratio to ensure that you can afford the loan payments.

Understanding Navy Federal Credit Union Loan Options

The Navy Federal Credit Union offers a range of loan options, including:

- Personal loans: These loans can be used for various purposes, such as consolidating debt, covering unexpected expenses, or financing a large purchase.

- Auto loans: These loans are specifically designed for purchasing a new or used vehicle.

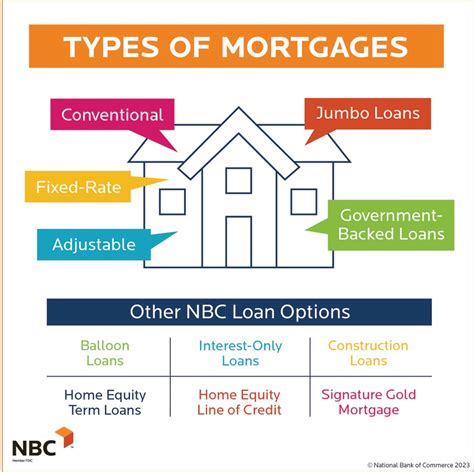

- Mortgages: The Navy Federal Credit Union offers a variety of mortgage options, including fixed-rate and adjustable-rate loans.

- Student loans: These loans are designed to help students finance their education expenses.

- Home equity loans: These loans allow homeowners to borrow against the equity in their home.

Benefits of Navy Federal Credit Union Loans

The Navy Federal Credit Union loans offer several benefits, including: * Competitive interest rates: The Navy Federal Credit Union offers some of the most competitive interest rates in the industry. * Flexible repayment terms: The credit union offers flexible repayment terms, including the option to make bi-weekly payments. * No prepayment penalties: The Navy Federal Credit Union does not charge prepayment penalties, so you can pay off your loan early without incurring additional fees. * Low fees: The credit union charges low fees, including no origination fees or application fees.Applying for a Navy Federal Credit Union Loan

Applying for a Navy Federal Credit Union loan is a relatively straightforward process. You can apply online, by phone, or in person at a branch location. To apply, you'll need to provide some basic information, including:

- Your name and address

- Your Social Security number

- Your income and employment information

- Your credit history

You'll also need to provide documentation, such as:

- Pay stubs

- Bank statements

- Tax returns

Navy Federal Credit Union Loan Requirements

The Navy Federal Credit Union has certain requirements that you must meet to be eligible for a loan. These requirements include: * You must be a member of the credit union * You must have a good credit history * You must have a stable income and employment history * You must meet the credit union's debt-to-income ratio requirementsNavy Federal Credit Union Loan Rates and Terms

The Navy Federal Credit Union offers competitive interest rates and flexible repayment terms. The interest rates vary depending on the type of loan and your creditworthiness. For example:

- Personal loans: 7.99% - 18.00% APR

- Auto loans: 2.99% - 12.00% APR

- Mortgages: 3.50% - 6.00% APR

The repayment terms also vary depending on the type of loan. For example:

- Personal loans: 12 - 60 months

- Auto loans: 36 - 72 months

- Mortgages: 15 - 30 years

Navy Federal Credit Union Loan Calculator

The Navy Federal Credit Union offers a loan calculator that can help you determine how much you can borrow and what your monthly payments will be. The calculator takes into account factors such as the interest rate, repayment term, and loan amount.Navy Federal Credit Union Loan Customer Service

The Navy Federal Credit Union offers excellent customer service to its members. You can contact the credit union by phone, email, or online chat. The credit union also has a comprehensive FAQ section on its website that can help answer many of your questions.

Navy Federal Credit Union Loan Reviews

The Navy Federal Credit Union has received excellent reviews from its members. Many members have praised the credit union's competitive interest rates, flexible repayment terms, and excellent customer service. Some members have also noted that the credit union's loan application process is easy and straightforward.Navy Federal Credit Union Loan Alternatives

If you're not eligible for a Navy Federal Credit Union loan or prefer to explore other options, there are several alternatives available. These include:

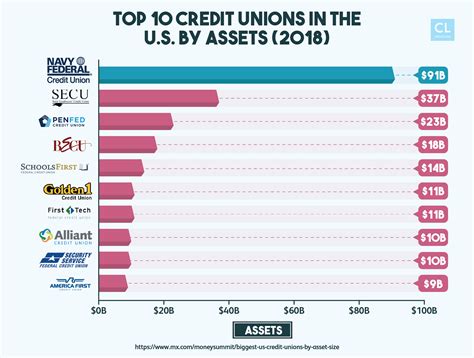

- Other credit unions: There are many other credit unions that offer similar loan products and services.

- Banks: Banks offer a wide range of loan products, including personal loans, auto loans, and mortgages.

- Online lenders: Online lenders offer a convenient and often faster way to apply for a loan.

Navy Federal Credit Union Loan Comparison

It's essential to compare the Navy Federal Credit Union loan rates and terms with those of other lenders. This can help you determine which loan is the best option for your needs. You should consider factors such as the interest rate, repayment term, and fees when comparing loans.Navy Federal Credit Union Loan Image Gallery

What are the benefits of a Navy Federal Credit Union loan?

+The benefits of a Navy Federal Credit Union loan include competitive interest rates, flexible repayment terms, and no prepayment penalties.

How do I apply for a Navy Federal Credit Union loan?

+You can apply for a Navy Federal Credit Union loan online, by phone, or in person at a branch location.

What are the requirements for a Navy Federal Credit Union loan?

+The requirements for a Navy Federal Credit Union loan include being a member of the credit union, having a good credit history, and meeting the credit union's debt-to-income ratio requirements.

How do I repay my Navy Federal Credit Union loan?

+You can repay your Navy Federal Credit Union loan through automatic payments, online payments, or by mail.

Can I refinance my Navy Federal Credit Union loan?

+Yes, you can refinance your Navy Federal Credit Union loan. Contact the credit union for more information.

In conclusion, the Navy Federal Credit Union offers a wide range of loan options with competitive interest rates and flexible repayment terms. By understanding the different types of loans available, the application process, and the requirements for approval, you can make an informed decision about which loan is right for you. Remember to always review the terms and conditions of the loan carefully and consider seeking advice from a financial advisor if you're unsure about any aspect of the loan. With the right loan and a solid understanding of the terms, you can achieve your financial goals and enjoy the benefits of being a Navy Federal Credit Union member. We encourage you to share your experiences with Navy Federal Credit Union loans in the comments section below and to share this article with others who may be considering a loan from the credit union.