Intro

Discover competitive 5 Navy FCU mortgage rates, featuring flexible loan options, low APRs, and exclusive membership benefits, ideal for homebuyers and refinancers seeking affordable mortgage solutions.

The world of mortgage rates can be complex and overwhelming, especially for those navigating the process for the first time. Understanding the intricacies of mortgage rates is crucial for making informed decisions when it comes to one of the largest investments many people will ever make: their home. In this context, Navy Federal Credit Union (NFCU) stands out as a prominent financial institution offering a range of mortgage products tailored to meet the diverse needs of its members.

For individuals associated with the military, veterans, and their families, Navy Federal Credit Union is often a go-to choice due to its member-centric approach and competitive rates. The credit union's mortgage rates are designed to provide affordable financing options, whether one is looking to purchase a new home, refinance an existing mortgage, or tap into their home's equity.

The importance of selecting the right mortgage cannot be overstated. It involves considering various factors, including the type of mortgage, the interest rate, repayment terms, and associated fees. Navy Federal Credit Union's mortgage rates, like those of other lenders, fluctuate based on market conditions, borrower qualifications, and the specific characteristics of the loan. Understanding these dynamics is key to securing a mortgage that aligns with one's financial situation and long-term goals.

Navy Federal Credit Union Mortgage Overview

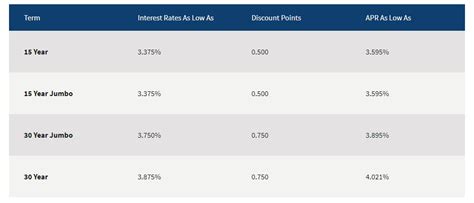

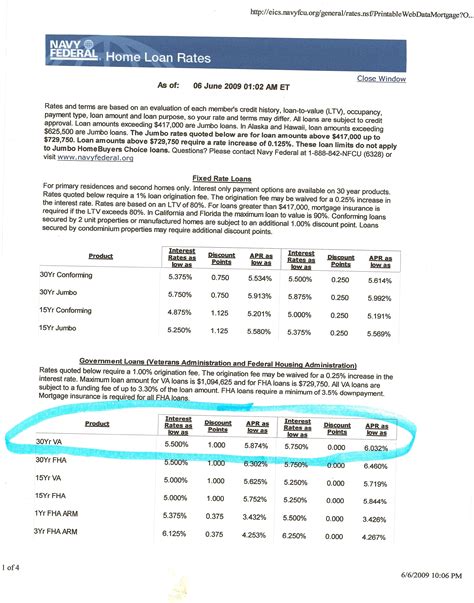

Navy Federal Credit Union offers a broad spectrum of mortgage products, including fixed-rate and adjustable-rate mortgages, jumbo loans, and government-backed loans such as VA and FHA loans. Each of these options has its own set of benefits and considerations. For example, fixed-rate mortgages provide the stability of consistent monthly payments, while adjustable-rate mortgages may offer lower initial interest rates but carry the risk of increased payments if interest rates rise.

Types of Mortgages Offered by Navy Federal Credit Union

Navy Federal Credit Union is particularly renowned for its VA loan offerings, which are exclusively available to eligible veterans, active-duty personnel, and surviving spouses. These loans often come with favorable terms, such as lower or no down payment requirements and competitive interest rates. The credit union also provides FHA loans, which are backed by the Federal Housing Administration and can be beneficial for borrowers who may not qualify for conventional loans due to stricter credit score requirements.Mortgage Rate Factors

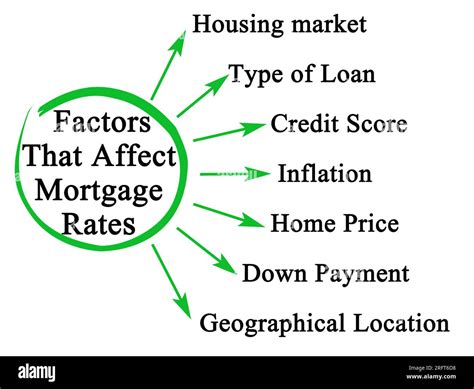

Several factors influence the mortgage rates offered by Navy Federal Credit Union, including the borrower's credit score, loan-to-value ratio, debt-to-income ratio, and the type of property being financed. A higher credit score can significantly impact the interest rate a borrower qualifies for, with better scores typically leading to more favorable rates. Similarly, the loan-to-value ratio, which compares the amount borrowed to the home's value, plays a crucial role in determining the mortgage rate, as lower ratios often result in better interest rates.

How to Qualify for the Best Mortgage Rates

To qualify for the best mortgage rates at Navy Federal Credit Union, potential borrowers should focus on improving their credit score, reducing their debt-to-income ratio, and making a substantial down payment. Additionally, considering the timing of the application is important, as mortgage rates can fluctuate frequently based on economic conditions. It's also beneficial to compare rates among different lenders and to negotiate, especially for members with excellent credit and a strong financial profile.Navy Federal Credit Union Mortgage Application Process

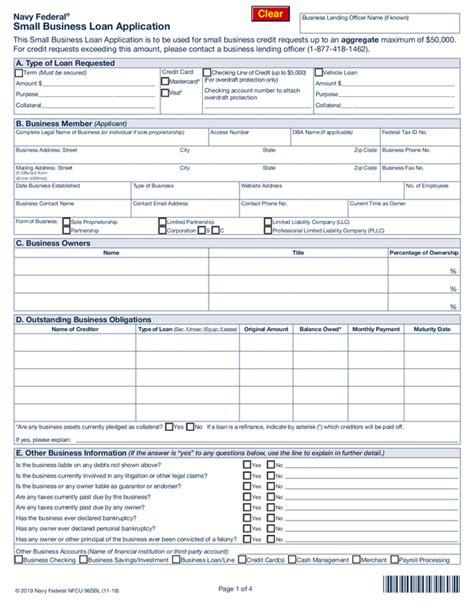

The mortgage application process at Navy Federal Credit Union is designed to be user-friendly and efficient. Members can apply online, by phone, or in person at a local branch. The process typically involves pre-approval, where the credit union evaluates the borrower's financial information to provide a preliminary approval and an estimate of how much they can borrow. This is followed by the application and underwriting phase, where more detailed financial documents are required, and the property is appraised. Finally, the loan is closed, and the borrower signs the final documents to complete the purchase or refinance of their home.

Benefits of Choosing Navy Federal Credit Union for Your Mortgage

Choosing Navy Federal Credit Union for a mortgage comes with several benefits, including competitive rates, flexible terms, and a member-centric approach that prioritizes the financial well-being of its members. The credit union also offers various resources and tools to help members through the mortgage process, from initial application to closing. For those eligible, the exclusive benefits of VA loans and other specialized products can make homeownership more accessible and affordable.Navy Federal Credit Union Mortgage Rates Comparison

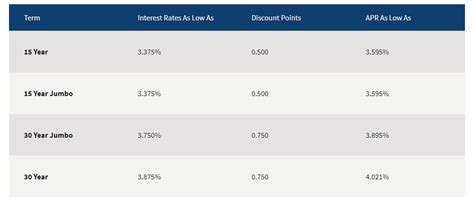

Comparing mortgage rates among different lenders is a critical step in finding the best deal. Navy Federal Credit Union's rates are often competitive with those of other major lenders, but the specific terms and conditions can vary significantly. Potential borrowers should consider not just the interest rate but also other costs associated with the loan, such as origination fees, closing costs, and private mortgage insurance (if required).

Understanding the Total Cost of a Mortgage

The total cost of a mortgage encompasses more than just the monthly payments; it includes all the fees and charges associated with the loan. Understanding these costs is essential for making an informed decision. Borrowers should review the Loan Estimate and Closing Disclosure forms carefully, which provide detailed information about the loan terms, including the annual percentage rate (APR), finance charges, and the total payments over the loan term.Navy Federal Credit Union Customer Service and Support

Navy Federal Credit Union is known for its strong commitment to customer service and support. Members can access a range of resources and tools to help navigate the mortgage process, from online educational materials to personalized assistance from mortgage specialists. The credit union's approach is centered around providing personalized solutions that meet the unique needs and goals of each member.

Importance of Customer Service in the Mortgage Process

Good customer service is invaluable during the mortgage process, which can be complex and stressful. Having access to knowledgeable and responsive support can make a significant difference, helping borrowers to understand their options, address any issues that arise, and ensure a smooth transaction from application to closing.Gallery of Navy Federal Credit Union Mortgage Options

Navy Federal Credit Union Mortgage Options Image Gallery

Frequently Asked Questions About Navy Federal Credit Union Mortgages

What types of mortgages does Navy Federal Credit Union offer?

+Navy Federal Credit Union offers a variety of mortgage products, including fixed-rate and adjustable-rate mortgages, VA loans, FHA loans, and jumbo loans, designed to meet the diverse needs of its members.

How do I apply for a mortgage with Navy Federal Credit Union?

+Members can apply for a mortgage online, by phone, or in person at a local branch. The process involves pre-approval, application, underwriting, and closing, with support available throughout from mortgage specialists.

What are the benefits of choosing Navy Federal Credit Union for my mortgage?

+Choosing Navy Federal Credit Union for a mortgage offers competitive rates, flexible terms, and a member-centric approach. Additionally, members may qualify for exclusive benefits such as those offered with VA loans, making homeownership more accessible and affordable.

How do I qualify for the best mortgage rates at Navy Federal Credit Union?

+To qualify for the best mortgage rates, focus on improving your credit score, reducing your debt-to-income ratio, and making a substantial down payment. Comparing rates and considering the timing of your application can also be beneficial.

What is the importance of customer service in the mortgage process?

+Good customer service is crucial during the mortgage process, providing personalized support and guidance from application to closing. It helps in understanding options, addressing issues, and ensuring a smooth transaction.

As you consider your mortgage options, whether you're a first-time buyer, looking to refinance, or exploring ways to tap into your home's equity, Navy Federal Credit Union stands as a reputable and member-focused lender. By understanding the factors that influence mortgage rates, the types of mortgages available, and the benefits of choosing Navy Federal Credit Union, you can make informed decisions tailored to your financial situation and goals. Remember, the journey to homeownership or refinancing your current mortgage involves careful consideration and planning, but with the right support and resources, it can be a rewarding and successful experience. We invite you to share your thoughts, ask questions, or explore the resources provided to embark on your mortgage journey with confidence.