Intro

Discover the top 5 Navy Federal benefits, including exclusive credit union perks, low-rate loans, and personalized banking services, offering military members and families financial security and stability through membership rewards and benefits.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial products and services to its members. With over 10 million members and $150 billion in assets, Navy Federal has established itself as a trusted and reliable financial institution. One of the key reasons why Navy Federal stands out from other financial institutions is its numerous benefits, which cater to the diverse needs of its members. In this article, we will delve into five Navy Federal benefits that make it an attractive choice for individuals looking for a reliable and comprehensive financial partner.

The importance of choosing the right financial institution cannot be overstated. With so many options available, it can be overwhelming to decide which one best suits your needs. Navy Federal, with its long history of serving the military and their families, has developed a unique understanding of the financial challenges and opportunities that its members face. By offering a range of benefits, Navy Federal has positioned itself as a one-stop-shop for all financial needs, providing its members with peace of mind and financial security.

Navy Federal's commitment to its members is evident in its mission to provide exceptional financial services and support. The credit union's benefits are designed to help members achieve their financial goals, whether it's saving for a down payment on a house, paying off debt, or building an emergency fund. By taking advantage of these benefits, members can improve their financial well-being and enjoy a more secure and prosperous future. With its member-centric approach and wide range of benefits, Navy Federal has become the go-to financial institution for many individuals and families.

Introduction to Navy Federal Benefits

Overview of Navy Federal Benefits

Navy Federal benefits are designed to help members achieve financial stability and security. The credit union's benefits are tailored to meet the unique needs of its members, who include active-duty military personnel, veterans, and their families. By offering a range of benefits, Navy Federal has established itself as a trusted and reliable financial partner. In the following sections, we will delve into the five Navy Federal benefits that make it an attractive choice for individuals looking for a comprehensive financial institution.Benefit 1: Competitive Loan Rates

The benefits of competitive loan rates cannot be overstated. By saving money on interest payments, members can free up more money in their budgets to invest in their future. Whether it's paying off debt, building an emergency fund, or saving for a down payment on a house, competitive loan rates can make a significant difference. Additionally, Navy Federal's loan products are designed to be flexible and convenient, with features such as online applications, quick approvals, and flexible repayment terms.

How to Apply for a Loan with Navy Federal

Applying for a loan with Navy Federal is a straightforward process. Members can apply online, by phone, or in person at a Navy Federal branch. The credit union's loan application process is designed to be quick and easy, with most applications being approved within minutes. To apply for a loan, members will need to provide some basic information, such as their income, credit score, and employment history. Once the application is approved, the loan funds can be disbursed quickly, often within a few days.Benefit 2: High-Yield Savings Accounts

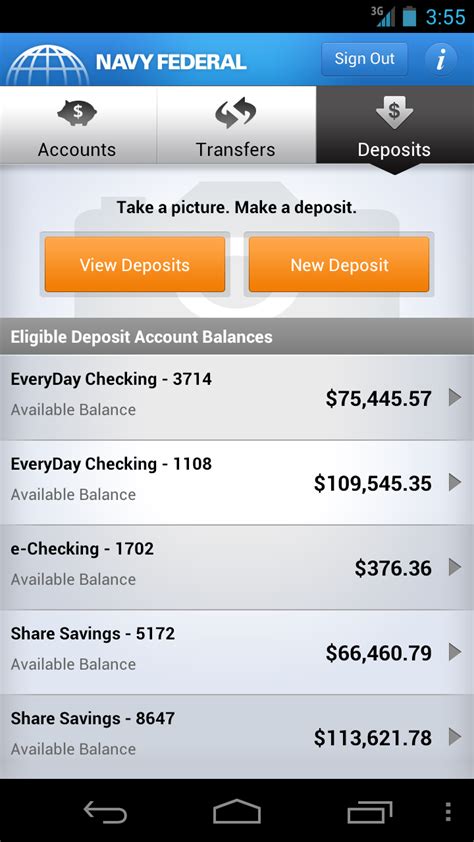

The benefits of high-yield savings accounts cannot be overstated. By earning a higher interest rate on their savings, members can grow their wealth over time and achieve their long-term financial goals. Additionally, Navy Federal's savings accounts are designed to be flexible and convenient, with features such as online banking, mobile banking, and ATM access. Members can also set up automatic transfers from their checking accounts to their savings accounts, making it easy to save money regularly.

Types of Savings Accounts Offered by Navy Federal

Navy Federal offers a range of savings accounts to meet the diverse needs of its members. These accounts include: * Basic Savings Account: This account earns a 0.25% APY and has no monthly maintenance fees. * Money Market Account: This account earns a 1.50% APY and requires a minimum balance of $1,000. * Certificates of Deposit (CDs): These accounts earn a fixed interest rate for a specified period of time, ranging from 6 months to 5 years.Benefit 3: Investment Services

The benefits of investment services cannot be overstated. By investing in a diversified portfolio of assets, members can grow their wealth over time and achieve their long-term financial goals. Additionally, Navy Federal's investment services are designed to be flexible and convenient, with features such as online trading, mobile trading, and investment advice. Members can also set up automatic investments from their checking accounts to their investment accounts, making it easy to invest regularly.

Types of Investment Services Offered by Navy Federal

Navy Federal offers a range of investment services to meet the diverse needs of its members. These services include: * Brokerage Accounts: These accounts offer a wide range of investment products, including stocks, bonds, and mutual funds. * Retirement Accounts: These accounts are designed to help members save for retirement and include products such as IRAs and 401(k)s. * Investment Advice: Navy Federal's investment advisors can provide personalized investment advice and help members create a diversified investment portfolio.Benefit 4: Insurance Products

The benefits of insurance products cannot be overstated. By protecting their assets and loved ones, members can achieve financial security and peace of mind. Additionally, Navy Federal's insurance products are designed to be flexible and convenient, with features such as online applications, quick approvals, and flexible payment terms. Members can also set up automatic payments from their checking accounts to their insurance accounts, making it easy to pay premiums regularly.

Types of Insurance Products Offered by Navy Federal

Navy Federal offers a range of insurance products to meet the diverse needs of its members. These products include: * Life Insurance: These policies offer a range of coverage options, including term life insurance and whole life insurance. * Disability Insurance: These policies provide income replacement in the event of a disability. * Homeowners Insurance: These policies provide coverage for homes and condominiums.Benefit 5: Financial Education Resources

The benefits of financial education resources cannot be overstated. By achieving financial literacy, members can make informed financial decisions and achieve their long-term financial goals. Additionally, Navy Federal's financial education resources are designed to be flexible and convenient, with features such as online access, mobile access, and personalized financial counseling. Members can also set up automatic reminders to review their financial progress and adjust their financial plans as needed.

Types of Financial Education Resources Offered by Navy Federal

Navy Federal offers a range of financial education resources to meet the diverse needs of its members. These resources include: * Online Tutorials: These tutorials provide interactive lessons on topics such as budgeting, saving, and investing. * Webinars: These webinars provide live instruction on topics such as retirement planning and investing. * Financial Counseling: Navy Federal's financial counselors can provide personalized financial advice and help members create a financial plan.Navy Federal Image Gallery

What are the benefits of joining Navy Federal?

+The benefits of joining Navy Federal include competitive loan rates, high-yield savings accounts, investment services, insurance products, and financial education resources.

How do I apply for a loan with Navy Federal?

+To apply for a loan with Navy Federal, members can apply online, by phone, or in person at a Navy Federal branch. The credit union's loan application process is designed to be quick and easy, with most applications being approved within minutes.

What types of savings accounts does Navy Federal offer?

+Navy Federal offers a range of savings accounts, including traditional savings accounts, money market accounts, and certificates of deposit (CDs). These accounts are designed to help members grow their savings over time and achieve their long-term financial goals.

Does Navy Federal offer investment services?

+Yes, Navy Federal offers a range of investment services, including brokerage accounts, retirement accounts, and investment advice. These services are designed to help members grow their wealth over time and achieve their long-term financial goals.

What types of insurance products does Navy Federal offer?

+Navy Federal offers a range of insurance products, including life insurance, disability insurance, and homeowners insurance. These products are designed to help members protect their assets and loved ones and achieve financial security.

In conclusion, Navy Federal offers a wide range of benefits that cater to the diverse needs of its members. From competitive loan rates to high-yield savings accounts, investment services, insurance products, and financial education resources, Navy Federal has established itself as a trusted and reliable financial partner. By taking advantage of these benefits, members can achieve financial stability and security and enjoy a more prosperous future. We invite you to share your thoughts and experiences with Navy Federal in the comments section below. If you found this article helpful, please share it with your friends and family who may be interested in learning more about Navy Federal's benefits. Additionally, if you have any questions or need further clarification on any of the topics discussed in this article, please don't hesitate to ask.