Intro

Unlock rewards with Navy Federal Amex Credit Card, offering cashback, travel perks, and exclusive benefits, including purchase protection and credit score monitoring, tailored for military members and their families with low APR and no foreign transaction fees.

The world of credit cards is vast and varied, with numerous options available to consumers. Among these, the Navy Federal Amex Credit Card stands out due to its unique blend of benefits, rewards, and exclusive features designed specifically for Navy Federal Credit Union members. For those who are part of this credit union, understanding the details of this card can help in making informed financial decisions. The Navy Federal Amex Credit Card is not just another piece of plastic in your wallet; it's a tool that can enhance your financial flexibility, offer rewards, and provide protection.

The importance of choosing the right credit card cannot be overstated. It's a decision that affects your daily spending, long-term financial health, and even your credit score. With so many options available, each with its pros and cons, selecting a card that aligns with your financial goals and spending habits is crucial. For individuals affiliated with the Navy Federal Credit Union, the Navy Federal Amex Credit Card presents a compelling option, offering a range of benefits that cater to the unique needs of its members.

In the realm of personal finance, making informed decisions is key to achieving stability and growth. The Navy Federal Amex Credit Card, with its competitive interest rates, generous rewards program, and exclusive perks, positions itself as a valuable asset for those looking to manage their finances effectively. Whether you're a seasoned credit card user or just starting to build your credit, understanding the features and benefits of this card can help you navigate the complex world of credit with confidence.

Introduction to Navy Federal Amex Credit Card

The Navy Federal Amex Credit Card is designed for members of the Navy Federal Credit Union, offering a unique set of benefits that cater to the financial needs of military personnel, veterans, and their families. With no foreign transaction fees, competitive APRs, and a robust rewards program, this card is tailored to provide value to its users, whether they're making everyday purchases or planning a trip abroad.

Benefits and Features

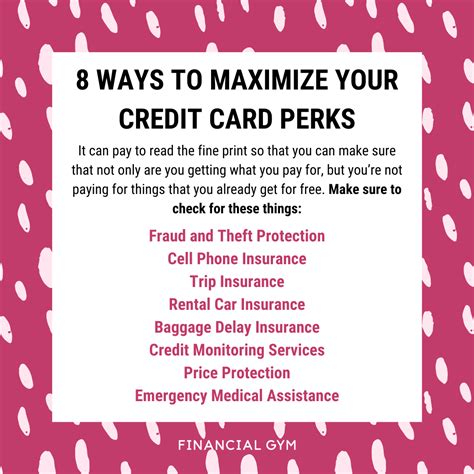

One of the standout features of the Navy Federal Amex Credit Card is its rewards program. Cardholders can earn points on every purchase, which can be redeemed for travel, merchandise, gift cards, and more. The card also offers exclusive discounts and promotions, further enhancing its value proposition. Additionally, the lack of foreign transaction fees makes it an ideal choice for international travel or purchases.

The security features of the Navy Federal Amex Credit Card are also noteworthy. With advanced fraud protection and zero liability for unauthorized transactions, cardholders can have peace of mind when using their card. The credit union's commitment to customer service, available 24/7, ensures that any issues or concerns are addressed promptly and efficiently.

Eligibility and Application Process

To be eligible for the Navy Federal Amex Credit Card, you must be a member of the Navy Federal Credit Union. Membership is open to all branches of the military, veterans, and their families. The application process is straightforward and can be completed online or through the credit union's mobile app. Applicants will need to provide personal and financial information, and approval is typically granted based on creditworthiness.

Rewards Program Details

The rewards program of the Navy Federal Amex Credit Card is designed to offer flexibility and value to cardholders. Points can be earned on every purchase, with no rotating categories or spending limits. This simplicity makes it easy for users to accumulate points, which can then be redeemed for a variety of rewards, including:

- Travel bookings, such as flights, hotels, and car rentals

- Merchandise from popular brands and retailers

- Gift cards to use at your favorite stores or restaurants

- Cash back as a statement credit or direct deposit

Redeeming points is a straightforward process, accessible through the Navy Federal Credit Union's website or mobile app. The rewards program is structured to provide a redemption value that maximizes the benefits of your points, ensuring that you get the most out of your earnings.

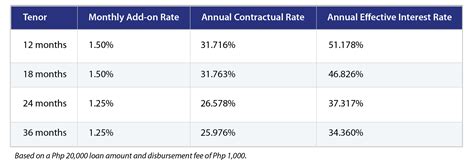

Interest Rates and Fees

Understanding the interest rates and fees associated with the Navy Federal Amex Credit Card is essential for managing your finances effectively. The card offers competitive APRs, which can vary based on your creditworthiness at the time of application. It's also important to note that there are no foreign transaction fees, making it a cost-effective option for international use.

The lack of an annual fee is another significant benefit, as it means you can enjoy the card's features and rewards without incurring a yearly charge. However, like any credit card, late payment fees and balance transfer fees may apply, so it's crucial to manage your payments and balance transfers wisely.

Customer Service and Support

The Navy Federal Credit Union is known for its commitment to customer service, offering support 24 hours a day, 7 days a week. Whether you have questions about your account, need assistance with a transaction, or are looking for advice on managing your credit, the credit union's team is available to help. This level of support can provide peace of mind, knowing that help is always just a phone call away.

Security and Fraud Protection

The security of your financial information and protection against fraud are top priorities for the Navy Federal Amex Credit Card. The card features advanced fraud detection systems, designed to identify and flag suspicious activity. If your card is lost, stolen, or compromised, the credit union's zero liability policy ensures that you won't be held responsible for unauthorized transactions.

Additionally, the card is equipped with chip technology, providing an extra layer of security for your transactions. This technology makes it more difficult for thieves to steal your card information, further protecting your financial security.

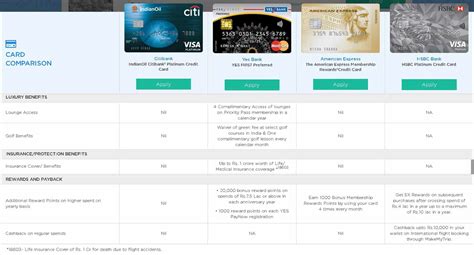

Comparison with Other Credit Cards

When considering the Navy Federal Amex Credit Card, it's natural to compare it with other credit card options available in the market. Factors such as rewards programs, interest rates, fees, and customer service all play a role in determining which card best suits your needs.

The Navy Federal Amex Credit Card stands out for its generous rewards program, lack of foreign transaction fees, and competitive interest rates. However, the eligibility requirement of being a Navy Federal Credit Union member may limit its accessibility compared to other cards. Ultimately, the decision to apply for this card should be based on your individual financial situation, spending habits, and the benefits that align with your goals.

Conclusion and Final Thoughts

In conclusion, the Navy Federal Amex Credit Card offers a compelling package of benefits, rewards, and security features that make it an attractive option for Navy Federal Credit Union members. Its unique blend of rewards, competitive interest rates, and exclusive perks positions it as a valuable financial tool for those who qualify. Whether you're looking to manage your daily expenses, plan a trip, or simply want a credit card that understands your financial needs, the Navy Federal Amex Credit Card is certainly worth considering.

Navy Federal Amex Credit Card Image Gallery

What are the benefits of the Navy Federal Amex Credit Card?

+The Navy Federal Amex Credit Card offers a rewards program, competitive interest rates, no foreign transaction fees, and exclusive perks for Navy Federal Credit Union members.

How do I apply for the Navy Federal Amex Credit Card?

+To apply, you must be a member of the Navy Federal Credit Union. You can apply online or through the credit union's mobile app, providing personal and financial information for approval.

What is the rewards program like for the Navy Federal Amex Credit Card?

+The rewards program allows you to earn points on every purchase, with no rotating categories or spending limits. Points can be redeemed for travel, merchandise, gift cards, and more.

Are there any fees associated with the Navy Federal Amex Credit Card?

+There are no annual fees or foreign transaction fees. However, late payment fees and balance transfer fees may apply, so it's essential to manage your payments and balance transfers wisely.

How does the Navy Federal Amex Credit Card protect against fraud?

+The card features advanced fraud detection systems and a zero liability policy for unauthorized transactions. It also includes chip technology for added security.

In wrapping up, the Navy Federal Amex Credit Card presents a unique opportunity for Navy Federal Credit Union members to enhance their financial flexibility and rewards. By understanding the benefits, features, and terms associated with this card, you can make an informed decision about whether it aligns with your financial goals and spending habits. Remember, the key to getting the most out of any credit card is using it responsibly and taking advantage of the rewards and benefits it offers. If you have any further questions or would like to share your experiences with the Navy Federal Amex Credit Card, please don't hesitate to comment below. Your insights can help others make more informed decisions about their financial tools.