Intro

Discover 5 ways Navy Federal auto loan benefits members, including low rates, flexible terms, and exclusive discounts, making car financing easy and affordable with personalized loan options and expert guidance.

Navy Federal auto loans have become a popular choice for individuals looking to purchase a new or used vehicle. With competitive interest rates, flexible repayment terms, and exclusive benefits for military personnel and their families, Navy Federal auto loans offer a range of advantages. In this article, we will explore five ways Navy Federal auto loans can benefit you, whether you're a first-time car buyer or a seasoned vehicle owner.

The importance of finding the right auto loan cannot be overstated. A good auto loan can save you thousands of dollars in interest payments over the life of the loan, while a bad one can lead to financial strain and stress. Navy Federal auto loans are designed to provide members with a hassle-free and cost-effective way to finance their vehicle purchases. With a long history of serving the military community, Navy Federal has developed a deep understanding of the unique needs and challenges faced by military personnel and their families.

Navy Federal auto loans offer a range of benefits, from competitive interest rates to flexible repayment terms. Whether you're looking to purchase a new car, truck, or SUV, or refinance an existing loan, Navy Federal has a range of options to suit your needs. In addition to competitive interest rates, Navy Federal auto loans also offer exclusive benefits for military personnel and their families, including discounts on interest rates and waived fees. With a Navy Federal auto loan, you can enjoy the peace of mind that comes with knowing you're working with a lender that understands your unique needs and challenges.

Benefits of Navy Federal Auto Loans

How to Apply for a Navy Federal Auto Loan

Types of Navy Federal Auto Loans

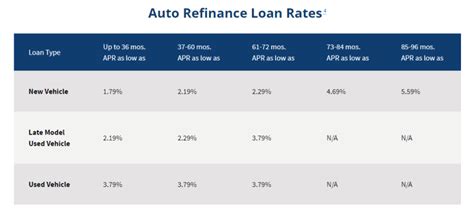

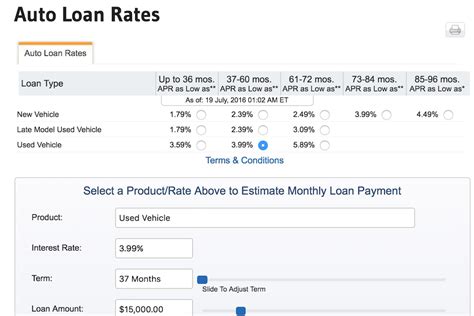

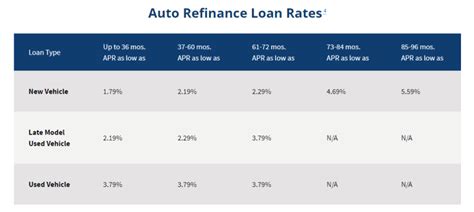

Navy Federal Auto Loan Rates and Terms

Navy Federal Auto Loan Calculator

Navy Federal Auto Loan Image Gallery

What are the benefits of a Navy Federal auto loan?

+Navy Federal auto loans offer a range of benefits, including competitive interest rates, flexible repayment terms, and exclusive discounts for military personnel and their families.

How do I apply for a Navy Federal auto loan?

+To apply for a Navy Federal auto loan, you can visit the Navy Federal website or visit a branch in person. You will need to provide some basic information, including your name, address, and employment history, as well as details about the vehicle you wish to purchase.

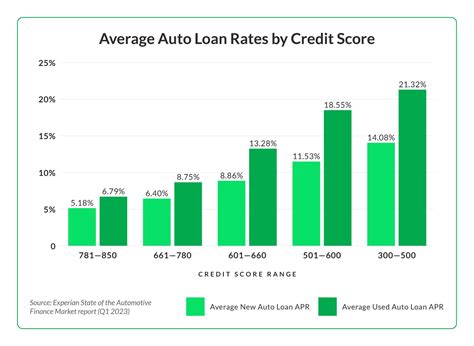

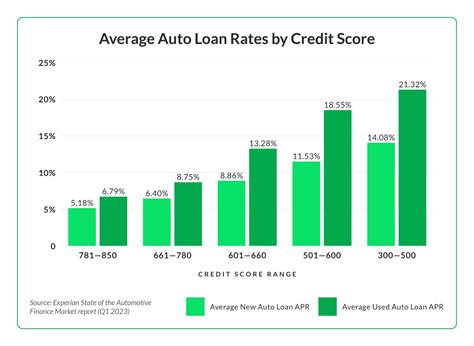

What are the interest rates for Navy Federal auto loans?

+Navy Federal auto loan interest rates are competitive with other lenders in the industry. The interest rate you qualify for will depend on your credit score and other factors.

Can I refinance my existing auto loan with Navy Federal?

+Yes, Navy Federal offers refinance options for existing auto loans. You can visit the Navy Federal website or visit a branch in person to learn more about your options.

Are Navy Federal auto loans only available to military personnel?

+No, Navy Federal auto loans are available to anyone who is eligible for Navy Federal membership, including military personnel, veterans, and their families.

In conclusion, Navy Federal auto loans offer a range of benefits and advantages for individuals looking to purchase a new or used vehicle. With competitive interest rates, flexible repayment terms, and exclusive discounts for military personnel and their families, Navy Federal auto loans can help you save money and achieve your financial goals. Whether you're a first-time car buyer or a seasoned vehicle owner, Navy Federal has a range of options to suit your needs. We encourage you to share this article with others who may be interested in learning more about Navy Federal auto loans, and to visit the Navy Federal website to learn more about their products and services. By choosing a Navy Federal auto loan, you can enjoy the peace of mind that comes with knowing you're working with a lender that understands your unique needs and challenges.