Intro

Discover Navy Federal Business Account Solutions, offering tailored financial services, business loans, and cash management tools, helping entrepreneurs manage finances, optimize operations, and grow their companies efficiently.

As a business owner, managing your finances is crucial to the success and growth of your company. With so many financial institutions offering business account solutions, it can be overwhelming to choose the right one for your needs. Navy Federal Credit Union is a popular option among business owners, offering a range of business account solutions tailored to meet the unique needs of businesses of all sizes. In this article, we will delve into the world of Navy Federal Business Account Solutions, exploring their features, benefits, and how they can help your business thrive.

Navy Federal Credit Union has been serving its members for over 80 years, providing a wide range of financial products and services. Their business account solutions are designed to help businesses manage their finances efficiently, save time, and reduce costs. With Navy Federal, you can expect personalized service, competitive rates, and a range of tools and resources to help you make informed financial decisions. Whether you are just starting out or are an established business, Navy Federal has the expertise and solutions to help you achieve your financial goals.

The importance of choosing the right business account solution cannot be overstated. A well-managed business account can help you stay on top of your finances, make timely payments, and avoid costly fees and penalties. It can also provide you with valuable insights into your business's financial performance, helping you identify areas for improvement and make data-driven decisions. With Navy Federal Business Account Solutions, you can enjoy a range of benefits, including low fees, high-yield savings rates, and access to a network of branches and ATMs.

Navy Federal Business Account Types

Features and Benefits of Navy Federal Business Accounts

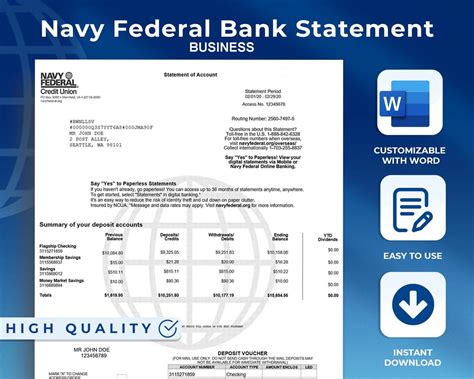

Navy Federal Business Account Fees and Rates

Navy Federal Business Account Security and Support

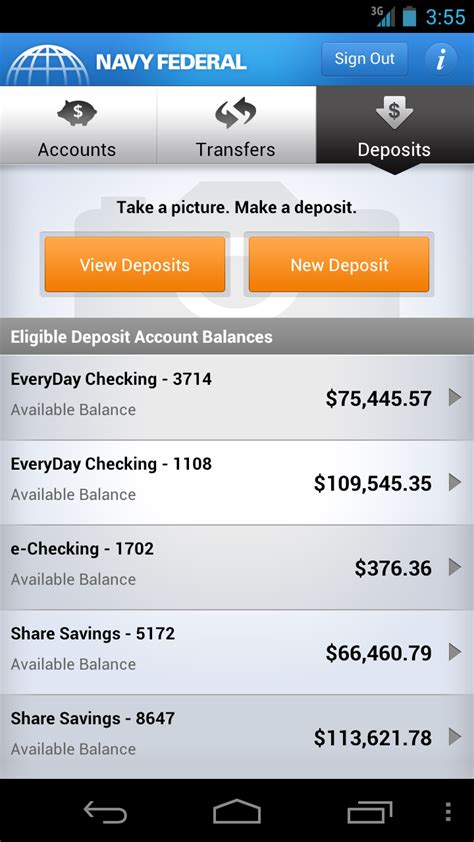

Navy Federal Business Account Online Banking and Mobile Banking

Navy Federal Business Account Credit Cards and Loans

Navy Federal Business Account Solutions for Small Businesses

Navy Federal Business Account Solutions for Large Businesses

Navy Federal Business Account Image Gallery

What are the benefits of Navy Federal Business Account Solutions?

+Navy Federal Business Account Solutions offer a range of benefits, including low fees, high-yield savings rates, and access to a network of branches and ATMs. They also offer online banking and mobile banking, allowing you to access your account information, transfer funds, and pay bills from anywhere.

How do I apply for a Navy Federal Business Account?

+To apply for a Navy Federal Business Account, you can visit their website, call their customer service number, or visit one of their branches. You will need to provide documentation, such as your business license, tax ID number, and identification.

What are the fees associated with Navy Federal Business Accounts?

+Navy Federal Business Accounts have low fees, including a monthly maintenance fee of $5, which can be waived if you maintain a minimum balance of $1,500. They also offer a range of free services, including online banking, mobile banking, and bill pay.

Can I use Navy Federal Business Account Solutions for my small business?

+Yes, Navy Federal Business Account Solutions are designed to meet the unique needs of small businesses. They offer a range of features and benefits, including low fees, high-yield savings rates, and access to a network of branches and ATMs.

How do I contact Navy Federal customer service?

+You can contact Navy Federal customer service by calling their customer service number, visiting their website, or visiting one of their branches. They are available 24/7 to answer your questions and provide assistance with your account.

In conclusion, Navy Federal Business Account Solutions are a great option for businesses of all sizes. They offer a range of features and benefits, including low fees, high-yield savings rates, and access to a network of branches and ATMs. With Navy Federal, you can enjoy online banking and mobile banking, allowing you to access your account information, transfer funds, and pay bills from anywhere. Their customer service team is available 24/7 to answer your questions and provide assistance with your account. Whether you are just starting out or are an established business, Navy Federal has the expertise and solutions to help you achieve your financial goals. We encourage you to share your experiences with Navy Federal Business Account Solutions in the comments below, and to share this article with your friends and colleagues who may be interested in learning more about Navy Federal's business account solutions.