Intro

Discover Navy Federal Business Account Options, including business loans, credit cards, and banking solutions, tailored for entrepreneurs and small business owners, offering flexible financing, cash management, and investment services.

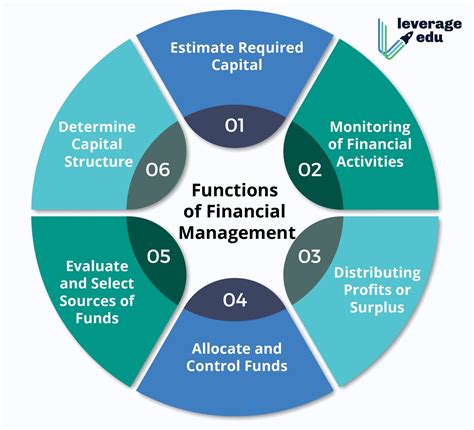

As a business owner, managing your finances effectively is crucial for the success and growth of your company. One of the key aspects of financial management is choosing the right business account that meets your specific needs. Navy Federal Credit Union, one of the largest and most reputable credit unions in the world, offers a range of business account options designed to help you manage your finances efficiently. In this article, we will delve into the various Navy Federal business account options, their features, benefits, and how they can help your business thrive.

Navy Federal Credit Union has been serving its members for over 80 years, providing a wide range of financial products and services tailored to meet the unique needs of its members. With a strong commitment to excellence and a deep understanding of the financial needs of businesses, Navy Federal has developed a suite of business account options that cater to different types of businesses, from small startups to large corporations. Whether you are just starting out or looking to expand your operations, Navy Federal has a business account that can help you achieve your financial goals.

The importance of choosing the right business account cannot be overstated. A business account that meets your needs can help you manage your cash flow, reduce costs, and increase efficiency. It can also provide you with the necessary tools and resources to make informed financial decisions, helping you to stay ahead of the competition. With Navy Federal's business account options, you can enjoy a range of benefits, including low fees, high-yield interest rates, and personalized service.

Navy Federal Business Checking Accounts

Navy Federal offers several business checking account options, each designed to meet the unique needs of different types of businesses. The Business Checking account is the most popular option, offering a low monthly maintenance fee, unlimited transactions, and a debit card with no annual fee. The Business Checking account is ideal for small to medium-sized businesses that need to manage their cash flow and make frequent transactions.

The Business Plus Checking account is another option, offering a higher interest rate and a higher transaction limit. This account is suitable for larger businesses that need to manage a high volume of transactions and want to earn a higher interest rate on their balances. The Business Plus Checking account also comes with a debit card, online banking, and mobile banking, making it easy to manage your finances on the go.

Navy Federal Business Savings Accounts

In addition to business checking accounts, Navy Federal also offers business savings accounts that can help you save for the future and earn a higher interest rate on your deposits. The Business Savings account is a basic savings account that offers a low minimum balance requirement, a competitive interest rate, and easy access to your funds. This account is ideal for businesses that want to save for short-term goals, such as expanding their operations or purchasing new equipment.

The Business Money Market Savings account is another option, offering a higher interest rate and limited check-writing privileges. This account is suitable for businesses that want to earn a higher interest rate on their deposits and need to make occasional withdrawals. The Business Money Market Savings account also comes with a debit card, online banking, and mobile banking, making it easy to manage your finances and access your funds when you need them.

Navy Federal Business Loans and Credit Products

Navy Federal also offers a range of business loans and credit products that can help you finance your business operations, expand your business, or purchase new equipment. The Business Loan is a popular option, offering a competitive interest rate, flexible repayment terms, and a quick application process. This loan is ideal for businesses that need to finance their operations, expand their business, or purchase new equipment.

The Business Line of Credit is another option, offering a revolving line of credit that can be used to finance your business operations, manage cash flow, or take advantage of new business opportunities. This loan is suitable for businesses that need to manage their cash flow, finance their operations, or take advantage of new business opportunities. The Business Line of Credit also comes with a competitive interest rate, flexible repayment terms, and a quick application process.

Navy Federal Business Credit Cards

Navy Federal also offers business credit cards that can help you manage your business expenses, earn rewards, and build credit. The Business Credit Card is a popular option, offering a competitive interest rate, no annual fee, and rewards on purchases. This card is ideal for businesses that want to manage their expenses, earn rewards, and build credit.

The Business Rewards Credit Card is another option, offering a higher rewards rate, no annual fee, and a competitive interest rate. This card is suitable for businesses that want to earn rewards on their purchases, manage their expenses, and build credit. The Business Rewards Credit Card also comes with a range of benefits, including travel insurance, purchase protection, and concierge service.

Navy Federal Business Online Banking and Mobile Banking

Navy Federal also offers business online banking and mobile banking services that can help you manage your finances, pay bills, and transfer funds on the go. The Business Online Banking service offers a range of features, including account management, bill pay, and fund transfer. This service is ideal for businesses that want to manage their finances, pay bills, and transfer funds online.

The Business Mobile Banking service is another option, offering a range of features, including account management, bill pay, and fund transfer. This service is suitable for businesses that want to manage their finances, pay bills, and transfer funds on the go. The Business Mobile Banking service also comes with a range of benefits, including mobile deposit, mobile payment, and mobile alerts.

Navy Federal Business Account Benefits

Navy Federal business accounts offer a range of benefits that can help your business thrive. Some of the benefits include:

- Low fees: Navy Federal business accounts offer low fees, including low monthly maintenance fees, low overdraft fees, and low ATM fees.

- High-yield interest rates: Navy Federal business accounts offer high-yield interest rates, including high-yield checking accounts, high-yield savings accounts, and high-yield money market accounts.

- Personalized service: Navy Federal business accounts offer personalized service, including dedicated business bankers, online banking, and mobile banking.

- Convenient banking: Navy Federal business accounts offer convenient banking, including online banking, mobile banking, and a network of branches and ATMs.

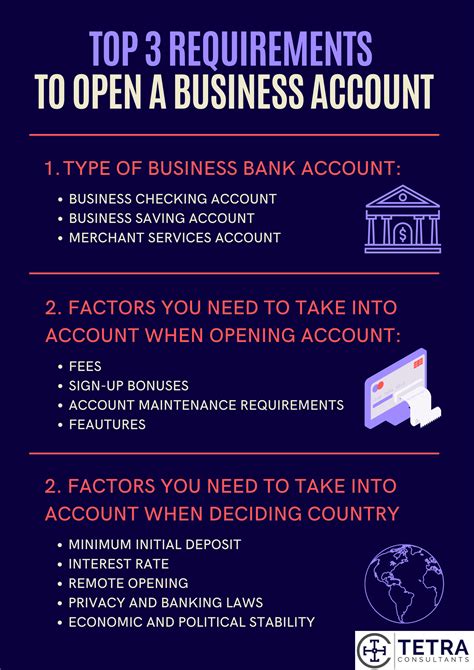

Navy Federal Business Account Requirements

To open a Navy Federal business account, you will need to meet certain requirements. Some of the requirements include:

- Business registration: You will need to register your business and obtain a federal tax ID number.

- Business license: You will need to obtain a business license and any other necessary permits.

- Identification: You will need to provide identification, including a driver's license, passport, or state ID.

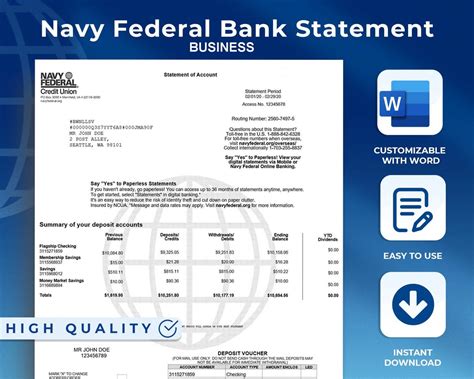

- Financial information: You will need to provide financial information, including financial statements, tax returns, and bank statements.

Gallery of Navy Federal Business Account Options

Navy Federal Business Account Options Image Gallery

What are the benefits of opening a Navy Federal business account?

+The benefits of opening a Navy Federal business account include low fees, high-yield interest rates, personalized service, and convenient banking.

What are the requirements for opening a Navy Federal business account?

+The requirements for opening a Navy Federal business account include business registration, business license, identification, and financial information.

What types of business accounts does Navy Federal offer?

+Navy Federal offers a range of business accounts, including business checking accounts, business savings accounts, business loans, and business credit cards.

How do I apply for a Navy Federal business account?

+You can apply for a Navy Federal business account online, by phone, or in person at a Navy Federal branch.

What is the minimum balance requirement for a Navy Federal business account?

+The minimum balance requirement for a Navy Federal business account varies depending on the type of account and the branch location.

In conclusion, Navy Federal business account options are designed to help businesses manage their finances effectively, reduce costs, and increase efficiency. With a range of account options, including business checking accounts, business savings accounts, business loans, and business credit cards, Navy Federal has something to offer every type of business. Whether you are just starting out or looking to expand your operations, Navy Federal's business account options can help you achieve your financial goals. We invite you to share your thoughts and experiences with Navy Federal business account options in the comments below. If you found this article helpful, please share it with your friends and colleagues who may be interested in learning more about Navy Federal business account options.