Intro

Discover 5 ways Navy Federal Business Checking boosts financial management with cash flow control, account flexibility, and low fees, ideal for entrepreneurs and small business owners seeking reliable banking solutions.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the United States, offering a wide range of financial products and services to its members. For business owners, Navy Federal provides various checking account options designed to meet the unique needs of businesses. In this article, we will explore five ways Navy Federal Business Checking can benefit your business.

Business checking accounts are essential for managing business finances, and Navy Federal offers several options to choose from. Whether you're a small business owner, a freelancer, or a large corporation, Navy Federal has a business checking account that can help you manage your finances effectively. With Navy Federal Business Checking, you can enjoy a range of benefits, including low fees, high-yield interest rates, and excellent customer service.

Navy Federal Business Checking accounts are designed to provide businesses with the tools and resources they need to succeed. From basic checking accounts to more advanced options with additional features, Navy Federal has a business checking account that can meet your specific needs. In this article, we will delve into the details of Navy Federal Business Checking and explore the benefits it can offer your business.

Benefits of Navy Federal Business Checking

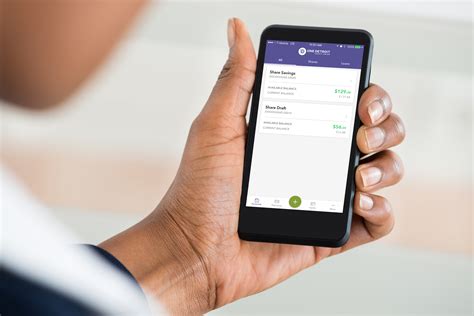

Navy Federal Business Checking offers several benefits that can help your business thrive. Some of the key benefits include low fees, high-yield interest rates, and excellent customer service. With Navy Federal Business Checking, you can enjoy a range of features, including online banking, mobile banking, and bill pay. You can also access your account information and manage your finances on the go using the Navy Federal mobile app.

In addition to these features, Navy Federal Business Checking accounts also offer a range of security features to protect your business from fraud and identity theft. With Navy Federal, you can enjoy peace of mind knowing that your business finances are secure and protected.

Low Fees and High-Yield Interest Rates

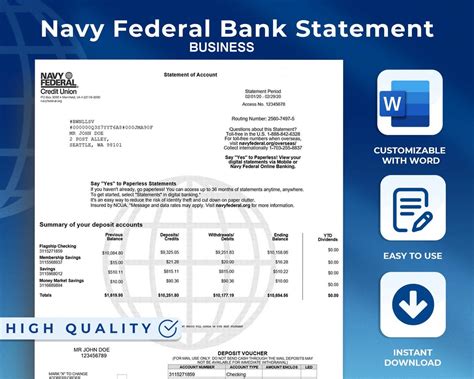

Navy Federal Business Checking accounts offer low fees and high-yield interest rates, making it an attractive option for businesses. With Navy Federal, you can enjoy low monthly maintenance fees, and you can also earn interest on your balance. This can help your business save money and earn more interest on your deposits.Types of Navy Federal Business Checking Accounts

Navy Federal offers several types of business checking accounts to choose from. Some of the most popular options include:

- Business Checking: This is a basic checking account that offers low fees and excellent customer service.

- Business Plus Checking: This account offers additional features, including higher interest rates and more free transactions.

- Business Premium Checking: This account offers the most features, including high-yield interest rates, low fees, and excellent customer service.

Each of these accounts is designed to meet the unique needs of businesses, and you can choose the one that best fits your business needs.

Features of Navy Federal Business Checking Accounts

Navy Federal Business Checking accounts offer a range of features that can help your business manage its finances effectively. Some of the key features include:- Online banking and mobile banking: You can access your account information and manage your finances online or on the go using the Navy Federal mobile app.

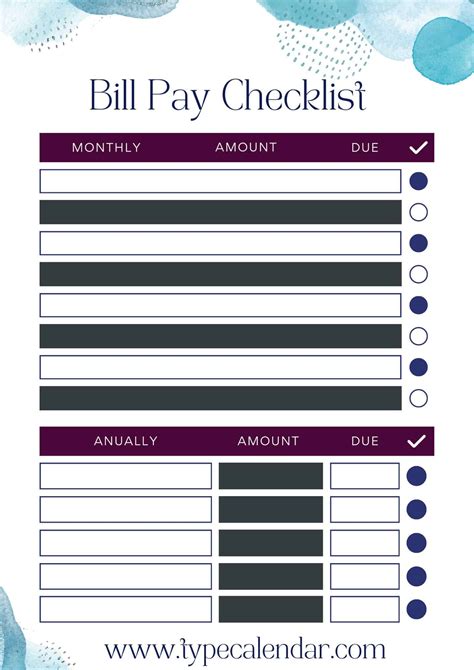

- Bill pay: You can pay your bills online or using the mobile app.

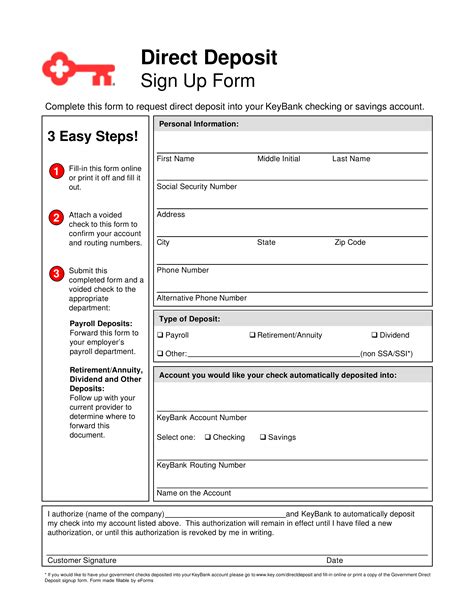

- Direct deposit: You can deposit your payroll and other payments directly into your account.

- Debit card: You can use your debit card to make purchases and withdraw cash.

These features can help your business manage its finances more efficiently and effectively.

How to Open a Navy Federal Business Checking Account

Opening a Navy Federal Business Checking account is easy and straightforward. You can apply online or visit a Navy Federal branch in person. To apply, you will need to provide some basic business information, including your business name, address, and tax ID number. You will also need to provide some personal information, including your name, address, and social security number.

Once you have applied, Navy Federal will review your application and verify your business information. If your application is approved, you can fund your account and start using it right away.

Requirements for Opening a Navy Federal Business Checking Account

To open a Navy Federal Business Checking account, you will need to meet some basic requirements. These include:- Your business must be a sole proprietorship, partnership, corporation, or limited liability company (LLC).

- You must be a member of Navy Federal Credit Union.

- You must provide some basic business information, including your business name, address, and tax ID number.

- You must provide some personal information, including your name, address, and social security number.

If you meet these requirements, you can apply for a Navy Federal Business Checking account and start managing your business finances more effectively.

Conclusion and Final Thoughts

In conclusion, Navy Federal Business Checking accounts offer a range of benefits that can help your business thrive. With low fees, high-yield interest rates, and excellent customer service, Navy Federal Business Checking is an attractive option for businesses of all sizes. Whether you're a small business owner or a large corporation, Navy Federal has a business checking account that can meet your unique needs.

By choosing Navy Federal Business Checking, you can enjoy a range of features, including online banking, mobile banking, and bill pay. You can also access your account information and manage your finances on the go using the Navy Federal mobile app.

Overall, Navy Federal Business Checking is a great option for businesses looking for a reliable and efficient way to manage their finances. With its low fees, high-yield interest rates, and excellent customer service, Navy Federal Business Checking can help your business succeed.

Additional Benefits of Navy Federal Business Checking

In addition to the benefits mentioned earlier, Navy Federal Business Checking accounts also offer a range of additional benefits. These include:

- Free online banking and mobile banking: You can access your account information and manage your finances online or on the go using the Navy Federal mobile app.

- Free bill pay: You can pay your bills online or using the mobile app.

- Free direct deposit: You can deposit your payroll and other payments directly into your account.

- Free debit card: You can use your debit card to make purchases and withdraw cash.

These additional benefits can help your business manage its finances more efficiently and effectively.

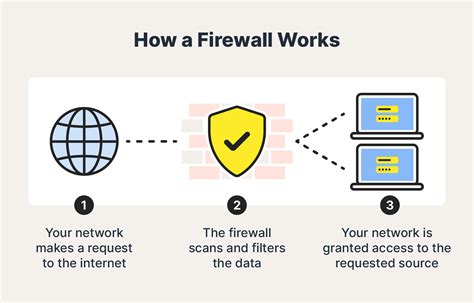

Security Features of Navy Federal Business Checking

Navy Federal Business Checking accounts also offer a range of security features to protect your business from fraud and identity theft. These include:- Encryption: Navy Federal uses encryption to protect your account information and prevent unauthorized access.

- Firewalls: Navy Federal uses firewalls to prevent unauthorized access to its systems and protect your account information.

- Monitoring: Navy Federal monitors its systems and accounts for suspicious activity and alerts you to any potential security threats.

These security features can help protect your business from fraud and identity theft.

Navy Federal Business Checking Image Gallery

What are the benefits of Navy Federal Business Checking?

+Navy Federal Business Checking offers a range of benefits, including low fees, high-yield interest rates, and excellent customer service.

How do I open a Navy Federal Business Checking account?

+You can apply online or visit a Navy Federal branch in person. You will need to provide some basic business information, including your business name, address, and tax ID number.

What are the security features of Navy Federal Business Checking?

+Navy Federal Business Checking accounts offer a range of security features, including encryption, firewalls, and monitoring.

Can I access my account information online or on the go?

+Yes, you can access your account information online or on the go using the Navy Federal mobile app.

What are the requirements for opening a Navy Federal Business Checking account?

+To open a Navy Federal Business Checking account, you must be a member of Navy Federal Credit Union, and your business must be a sole proprietorship, partnership, corporation, or limited liability company (LLC).

We hope this article has provided you with a comprehensive overview of Navy Federal Business Checking and its benefits. If you have any further questions or would like to learn more about Navy Federal Business Checking, please don't hesitate to comment below or share this article with your friends and family.