Intro

Discover Navy Federal Business Checking Account benefits, features, and requirements, including business banking, account management, and financial tools, tailored for entrepreneurs and small business owners.

As a business owner, managing your company's finances is crucial for its success. One of the essential tools for achieving this is a business checking account. Among the numerous options available, Navy Federal Business Checking Account stands out for its unique features and benefits. In this article, we will delve into the details of this account, exploring its advantages, requirements, and how it can support your business's financial health.

The importance of a business checking account cannot be overstated. It provides a centralized location for managing your company's income and expenses, allowing for easier tracking and analysis of financial transactions. Moreover, it helps in maintaining a clear separation between personal and business finances, which is vital for tax purposes and financial organization. Navy Federal Credit Union, with its long history of serving military personnel, veterans, and their families, offers a range of financial products, including the Navy Federal Business Checking Account, designed to cater to the diverse needs of businesses.

For businesses looking to streamline their financial operations and take advantage of competitive banking services, the Navy Federal Business Checking Account is an attractive option. This account is tailored to meet the needs of small to medium-sized businesses, offering features such as low monthly maintenance fees, unlimited transactions, and access to a network of ATMs and branches. Additionally, the account comes with digital banking tools, enabling business owners to manage their finances efficiently, whether in the office or on the go.

Benefits of Navy Federal Business Checking Account

Features and Requirements

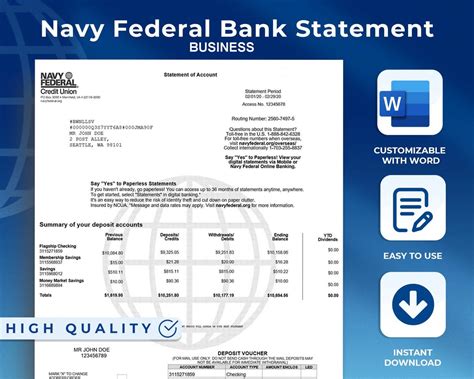

To open a Navy Federal Business Checking Account, businesses must meet certain eligibility criteria. These include being a member of Navy Federal Credit Union, which requires a connection to the military, either through service, family ties, or employment with the Department of Defense. The application process involves providing business documentation, such as articles of incorporation or a business license, and personal identification for all business owners. Once the account is opened, businesses can take advantage of features like debit cards, checks, and online bill pay, making it easier to manage daily financial operations.Managing Your Business Finances

Security and Support

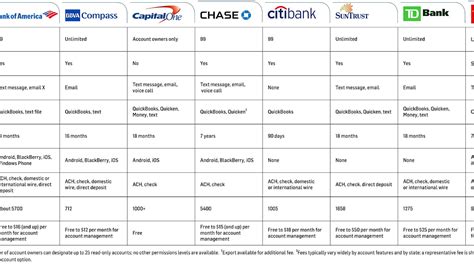

Security is a top priority for any business, and Navy Federal Credit Union takes extensive measures to protect its members' accounts. The Navy Federal Business Checking Account comes with advanced security features, including fraud monitoring, encryption, and secure login processes. In case of any issues or queries, businesses have access to dedicated customer support, available through phone, email, or in-person at a branch. This support ensures that any problems are resolved promptly, minimizing downtime and allowing businesses to focus on their operations.Comparing Business Checking Accounts

Conclusion and Recommendations

In conclusion, the Navy Federal Business Checking Account offers a compelling package of benefits, features, and support tailored to the needs of small to medium-sized businesses. With its low fees, unlimited transactions, and robust digital banking platform, it provides a solid foundation for managing business finances. For businesses eligible for Navy Federal Credit Union membership, this account is certainly worth considering. As with any financial decision, it's crucial to evaluate the account's terms, benefits, and how they align with your business's unique situation and goals.Gallery of Business Checking Accounts

Business Checking Account Image Gallery

What are the eligibility criteria for opening a Navy Federal Business Checking Account?

+To be eligible, your business must be a member of Navy Federal Credit Union, which requires a connection to the military, and you must provide necessary business and personal documentation.

What are the benefits of using the Navy Federal Business Checking Account for my business?

+The benefits include low monthly maintenance fees, unlimited transactions, access to a wide network of ATMs and branches, and a comprehensive digital banking platform for easy financial management.

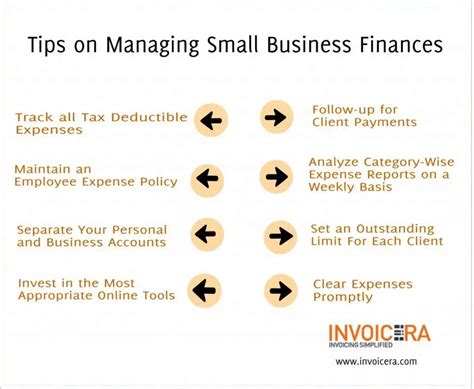

How do I manage my business finances effectively using the Navy Federal Business Checking Account?

+You can manage your finances effectively by utilizing the account's budgeting tools, tracking income and expenses through the online platform, and taking advantage of loans and credit lines for business expansion or investment.

We invite you to share your experiences or ask questions about the Navy Federal Business Checking Account in the comments below. Whether you're a small business owner or an entrepreneur looking to expand, understanding the options available for managing your finances is crucial. By exploring the features and benefits of business checking accounts like the one offered by Navy Federal, you can make informed decisions that support the growth and success of your business. Don't hesitate to reach out or share this article with others who might find it helpful in their financial journey.