Intro

Boost business finances with Navy Federal Business Credit Card, offering rewards, cashback, and low APR, ideal for business owners seeking credit card solutions with flexible payment terms and robust benefits.

The Navy Federal Business Credit Card is a valuable financial tool designed specifically for business owners who are members of the Navy Federal Credit Union. This credit card offers a range of benefits, including cashback rewards, low interest rates, and exclusive discounts. For entrepreneurs and small business owners, managing finances effectively is crucial for growth and sustainability. The Navy Federal Business Credit Card is tailored to meet the unique needs of businesses, providing a convenient and rewarding way to manage expenses.

As a business owner, it's essential to separate personal and business finances to maintain clarity and organization. The Navy Federal Business Credit Card helps achieve this by offering a dedicated credit line for business expenses. This separation not only simplifies accounting and tax filing but also helps in building business credit, which is vital for future loans and credit applications. Moreover, the card's rewards program is designed to benefit businesses directly, offering cashback on common business expenses such as office supplies, travel, and dining.

The application process for the Navy Federal Business Credit Card is straightforward, requiring basic business and personal financial information. Once approved, cardholders can enjoy a generous credit limit, flexible payment terms, and no foreign transaction fees, making it an excellent choice for businesses with international dealings. The credit union's commitment to its members is evident in the card's competitive interest rates and lack of hidden fees, ensuring that businesses can focus on growth rather than unexpected charges.

Navy Federal Business Credit Card Benefits

The Navy Federal Business Credit Card offers numerous benefits that cater to the diverse needs of business owners. One of the most attractive features is the cashback rewards program, which provides a percentage of cashback on certain purchases. This can lead to significant savings over time, especially for businesses with high volumes of eligible purchases. Additionally, the card often comes with introductory APR offers, allowing businesses to save on interest during the initial period. The lack of annual fees for the first year, and sometimes thereafter, is another incentive, making the card a cost-effective option for managing business expenses.

Key Features of the Navy Federal Business Credit Card

The key features of the Navy Federal Business Credit Card include: - Competitive interest rates to keep costs low - Cashback rewards on business purchases - No foreign transaction fees for international transactions - Introductory APR offers for new cardholders - Dedicated customer service for business members - Online account management for easy tracking and paymentsHow to Apply for the Navy Federal Business Credit Card

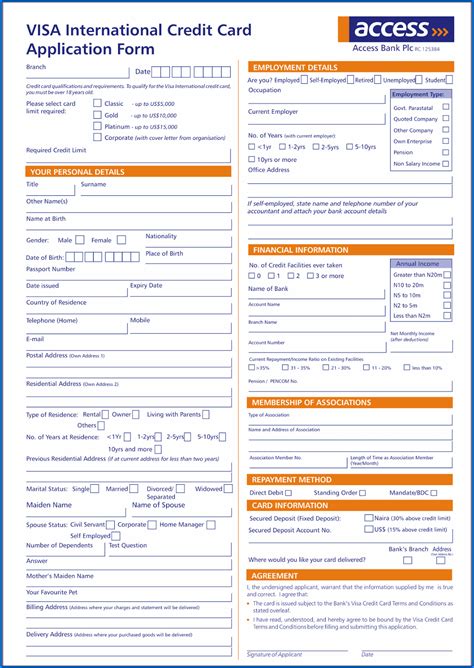

Applying for the Navy Federal Business Credit Card involves several steps, starting with ensuring eligibility for Navy Federal Credit Union membership. This typically includes being a member of the armed forces, a Department of Defense civilian, or a family member of someone who is. Once membership eligibility is confirmed, applicants can proceed to gather the necessary documents, which may include business tax returns, financial statements, and personal identification.

The application itself can usually be completed online through the Navy Federal Credit Union website or by visiting a local branch. Applicants will need to provide detailed information about their business, including its structure, annual revenue, and years in operation, as well as personal financial information. After submitting the application, Navy Federal will review the creditworthiness of the business and the personal credit of the applicant, and a decision will be made regarding approval and the credit limit.

Tips for Approval

To increase the chances of approval for the Navy Federal Business Credit Card, consider the following tips: - Ensure a good personal and business credit score - Provide accurate and complete application information - Demonstrate a stable business income - Keep debt-to-income ratios low - Consider a secured credit card option if approval is difficultNavy Federal Business Credit Card Rewards and Benefits

The rewards program associated with the Navy Federal Business Credit Card is designed to maximize savings for businesses. Cardholders can earn a certain percentage of cashback on common business expenses, which can be redeemed for statement credits, direct deposits, or other rewards. The program's structure is straightforward, with no rotating categories or spending limits on rewards, making it simple for businesses to earn and redeem rewards.

In addition to the cashback rewards, the Navy Federal Business Credit Card offers other benefits tailored to business needs. These may include travel insurance, purchase protection, and extended warranties on business purchases. The card also provides access to exclusive business events and workshops, offering valuable networking opportunities and insights into business management and growth strategies.

Maximizing Rewards

To maximize the rewards earned from the Navy Federal Business Credit Card: - Use the card for all eligible business purchases - Take advantage of promotional offers and bonuses - Redeem rewards regularly to avoid expiration - Consider adding employee cards to increase earningsNavy Federal Business Credit Card Security and Support

The security and support offered by the Navy Federal Business Credit Card are comprehensive, ensuring that businesses can use the card with confidence. The card features advanced security measures, including chip technology and zero-liability protection, which means businesses are not responsible for unauthorized transactions.

Customer support is another area where Navy Federal excels, offering dedicated business customer service available 24/7. This support can help with everything from account inquiries and transaction disputes to applying for additional credit lines or cards for employees. The online account management platform is also user-friendly, allowing businesses to track expenses, pay bills, and monitor account activity easily.

Security Measures

Key security measures include: - Chip card technology for secure transactions - Zero-liability protection against unauthorized use - Regular account monitoring for suspicious activity - Secure online account access with two-factor authenticationNavy Federal Business Credit Card Fees and Interest Rates

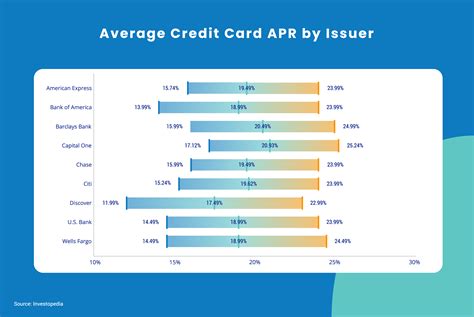

Understanding the fees and interest rates associated with the Navy Federal Business Credit Card is essential for managing business finances effectively. The card typically comes with competitive interest rates, which can vary based on the business's creditworthiness and market conditions. There are also fees to consider, such as late payment fees, foreign transaction fees (although these are often waived), and potential fees for balance transfers or cash advances.

It's crucial for businesses to review the terms and conditions carefully to understand all potential fees and how to avoid them. For example, making timely payments can prevent late fees, and using the card for business purchases rather than cash advances can help avoid higher interest rates and fees associated with cash advances.

Avoiding Fees

To minimize fees: - Make payments on time to avoid late fees - Use the card for purchases rather than cash advances - Avoid going over the credit limit to prevent over-limit fees - Review statements regularly to catch and dispute any incorrect chargesNavy Federal Business Credit Card Image Gallery

What are the benefits of the Navy Federal Business Credit Card?

+The Navy Federal Business Credit Card offers cashback rewards, low interest rates, and exclusive discounts, along with no foreign transaction fees and dedicated customer service.

How do I apply for the Navy Federal Business Credit Card?

+To apply, ensure you are eligible for Navy Federal Credit Union membership, gather necessary business and personal financial documents, and submit your application online or at a local branch.

What are the rewards and benefits of using the Navy Federal Business Credit Card?

+The card offers a cashback rewards program, travel insurance, purchase protection, and extended warranties, along with access to exclusive business events and workshops.

In summary, the Navy Federal Business Credit Card is a valuable tool for business owners looking to manage their finances effectively, earn rewards, and enjoy exclusive benefits. With its competitive interest rates, lack of foreign transaction fees, and dedicated customer service, this card is designed to support the growth and success of businesses. Whether you're a small business owner or an entrepreneur, the Navy Federal Business Credit Card can help you achieve your financial goals. We invite you to share your experiences with the Navy Federal Business Credit Card, ask questions, or explore how this card can benefit your business. Together, let's navigate the world of business finance with confidence and clarity.