Intro

Unlock 5 Navy Federal Insurance Tips for secure coverage, including auto, home, and life insurance options, to make informed decisions and maximize benefits with Navy Federal Credit Unions insurance services and policies.

As a member of the military community, it's essential to have the right insurance coverage to protect yourself and your loved ones. Navy Federal Insurance offers a range of products and services designed to meet the unique needs of military personnel and their families. In this article, we'll explore five valuable tips to help you get the most out of your Navy Federal Insurance coverage.

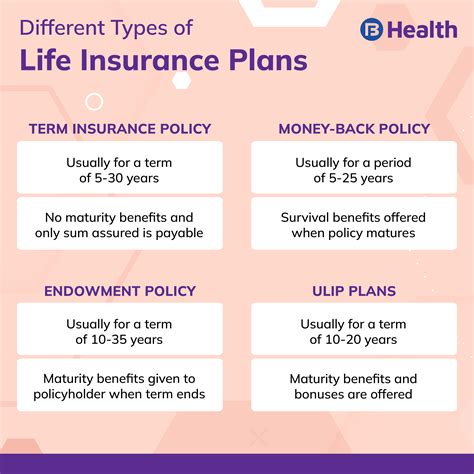

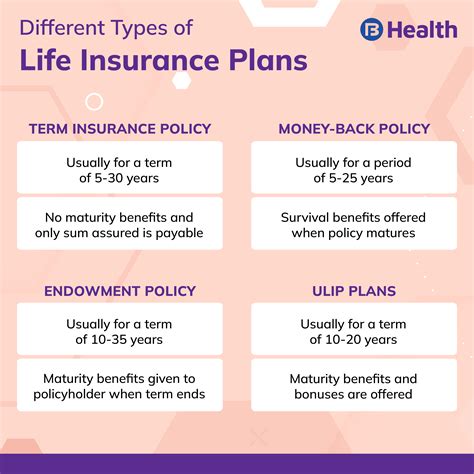

When it comes to insurance, it's crucial to understand what you're getting and how it can benefit you. Navy Federal Insurance provides a variety of insurance products, including life insurance, disability insurance, and long-term care insurance. By taking the time to learn about each type of insurance and how it can help you, you can make informed decisions about your coverage.

Navy Federal Insurance is a trusted provider of insurance products for the military community. With a long history of serving military personnel and their families, they have a deep understanding of the unique challenges and risks that come with military life. By choosing Navy Federal Insurance, you can rest assured that you're getting coverage that's tailored to your specific needs.

Navy Federal Insurance Overview

Tip 1: Understand Your Insurance Options

Some key things to consider when evaluating your insurance options include the type of coverage you need, the amount of coverage you require, and the cost of premiums. You should also consider any additional features or riders that may be available, such as waiver of premium or accidental death benefit.

Tip 2: Assess Your Insurance Needs

Some key factors to consider when assessing your insurance needs include your income, your expenses, and your debt. You should also consider any dependents you may have, such as a spouse or children, and how they would be affected if something were to happen to you.

Tip 3: Choose the Right Insurance Products

Some popular insurance products offered by Navy Federal Insurance include term life insurance, whole life insurance, and disability insurance. Term life insurance provides coverage for a specified period, while whole life insurance provides coverage for your entire lifetime. Disability insurance, on the other hand, helps replace your income if you become unable to work due to illness or injury.

Tip 4: Consider Additional Features and Riders

Waiver of premium, for example, waives your premium payments if you become disabled or critically ill. Accidental death benefit, on the other hand, provides an additional payout if you die as a result of an accident.

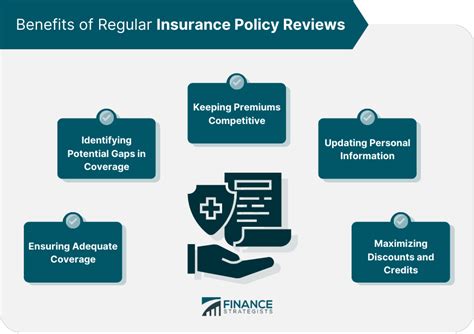

Tip 5: Review and Update Your Coverage Regularly

Some key things to consider when reviewing your coverage include changes to your income, expenses, or dependents. You should also consider any changes to your risk profile, such as a new job or a move to a new location.

Navy Federal Insurance Image Gallery

What types of insurance products does Navy Federal Insurance offer?

+Navy Federal Insurance offers a range of insurance products, including life insurance, disability insurance, and long-term care insurance.

How do I choose the right insurance products for my needs?

+To choose the right insurance products, consider your income, expenses, and dependents, as well as your overall risk profile. You may also want to consult with a licensed insurance professional.

Can I customize my insurance coverage with additional features and riders?

+Yes, Navy Federal Insurance offers a range of additional features and riders, such as waiver of premium and accidental death benefit. These can provide extra protection and benefits, but may also increase your premium payments.

How often should I review and update my insurance coverage?

+Can I get a quote for Navy Federal Insurance online?

+Yes, you can get a quote for Navy Federal Insurance online by visiting their website and using their online quote tool. You can also contact a licensed insurance professional for a personalized quote.

In conclusion, Navy Federal Insurance offers a range of valuable insurance products and services designed to meet the unique needs of military personnel and their families. By following these five tips, you can get the most out of your coverage and ensure that you and your loved ones are protected. Remember to review and update your coverage regularly, and don't hesitate to reach out to a licensed insurance professional if you have any questions or concerns. Share your thoughts and experiences with Navy Federal Insurance in the comments below, and don't forget to share this article with your friends and family who may benefit from this valuable information.