Intro

Unlock smart borrowing with 5 Navy Federal Loan Tips, including loan options, interest rates, and repayment terms, to make informed decisions on personal loans, credit cards, and mortgage loans.

Navy Federal Credit Union is one of the largest and most reputable financial institutions in the world, offering a wide range of financial products and services to its members. One of the most popular services offered by Navy Federal is its loan program, which provides members with access to affordable and flexible financing options. Whether you're looking to purchase a new home, refinance an existing loan, or cover unexpected expenses, Navy Federal loans can be a great option. In this article, we'll provide you with 5 Navy Federal loan tips to help you make the most of their loan program.

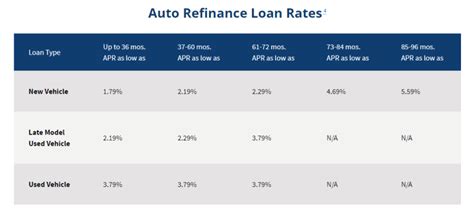

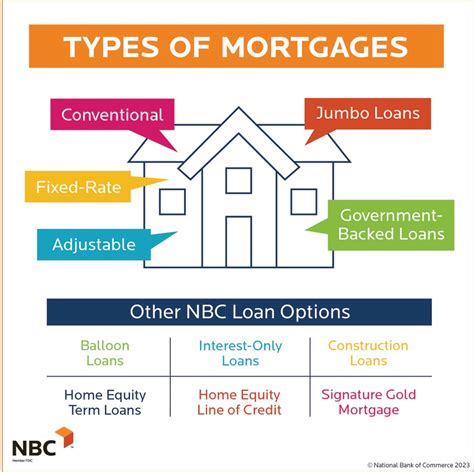

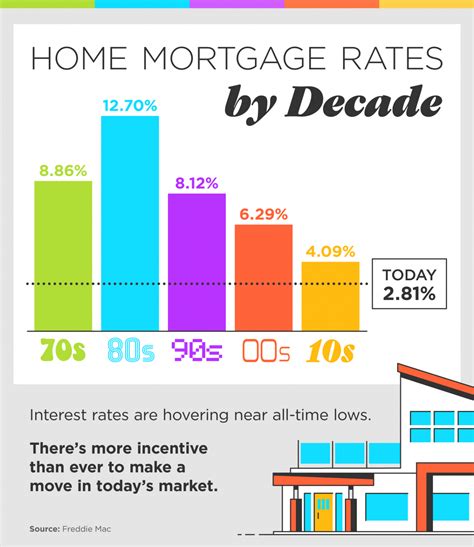

When it comes to borrowing money, it's essential to do your research and understand the terms and conditions of the loan. Navy Federal offers a variety of loan options, including personal loans, auto loans, mortgages, and credit cards. Each type of loan has its own set of benefits and drawbacks, and it's crucial to choose the one that best fits your financial needs and goals. By understanding the different types of loans available and their corresponding interest rates, fees, and repayment terms, you can make an informed decision and avoid costly mistakes.

Navy Federal loans are known for their competitive interest rates and flexible repayment terms. However, to qualify for the best rates and terms, you'll need to have a good credit score and a stable financial history. If you're not sure about your credit score or have concerns about your financial situation, it's a good idea to check your credit report and work on improving your credit score before applying for a loan. Additionally, Navy Federal offers a range of financial tools and resources to help you manage your debt and improve your financial health.

Understanding Navy Federal Loan Options

Benefits of Navy Federal Loans

Some of the benefits of Navy Federal loans include competitive interest rates, flexible repayment terms, and low fees. Navy Federal also offers a range of financial tools and resources to help you manage your debt and improve your financial health. Additionally, Navy Federal loans are often more affordable than loans from other financial institutions, making them a great option for those who need to borrow money.How to Apply for a Navy Federal Loan

Navy Federal Loan Requirements

To qualify for a Navy Federal loan, you'll need to meet certain requirements, such as having a good credit score and a stable financial history. You'll also need to be a member of Navy Federal Credit Union, which requires you to have a military connection or be a family member of someone who is. Additionally, you'll need to provide some basic information, such as your income, employment history, and credit score, and you may need to provide additional documentation, such as pay stubs or tax returns.Navy Federal Loan Rates and Terms

Navy Federal Loan Repayment Options

Navy Federal offers a range of repayment options to help you manage your debt and make timely payments. You can choose to make monthly payments, bi-weekly payments, or even pay off your loan early to save on interest. Additionally, Navy Federal offers a range of financial tools and resources to help you manage your debt and improve your financial health.Navy Federal Loan Tips and Tricks

Navy Federal Loan Customer Service

Navy Federal is known for its excellent customer service, which is available 24/7 to help you with any questions or concerns you may have. You can contact Navy Federal by phone, email, or online chat, and they also have a range of online resources and tools to help you manage your account and make payments.Navy Federal Loan FAQs

Navy Federal Loan Gallery

Navy Federal Loan Image Gallery

Navy Federal Loan FAQs Section

What are the requirements for applying for a Navy Federal loan?

+To apply for a Navy Federal loan, you'll need to be a member of Navy Federal Credit Union, which requires you to have a military connection or be a family member of someone who is. You'll also need to provide some basic information, such as your income, employment history, and credit score, and you may need to provide additional documentation, such as pay stubs or tax returns.

How do I check my credit score and improve my financial health?

+You can check your credit score for free on the Navy Federal website or by contacting their customer service department. To improve your financial health, you can take advantage of Navy Federal's financial tools and resources, such as their budgeting and savings calculators, and their financial counseling services.

What are the benefits of consolidating debt or refinancing an existing loan?

+Consolidating debt or refinancing an existing loan can help you save on interest, reduce your monthly payments, and simplify your finances. Navy Federal offers a range of loan options and financial tools to help you achieve your financial goals.

We hope this article has provided you with a comprehensive overview of Navy Federal loans and helped you make an informed decision about your financial options. Remember to always read the fine print, make timely payments, and take advantage of Navy Federal's financial tools and resources to help you manage your debt and improve your financial health. If you have any further questions or concerns, don't hesitate to contact Navy Federal's customer service department or visit their website for more information. Share this article with friends and family who may be interested in learning more about Navy Federal loans, and don't forget to comment below with any questions or feedback you may have.