Intro

Explore Navy Federal business loan options, including term loans, lines of credit, and commercial mortgages, offering flexible financing solutions for entrepreneurs and small business owners with competitive rates and terms.

As a business owner, accessing capital is crucial for growth, expansion, and navigating unforeseen challenges. Among the numerous financial institutions offering business loans, Navy Federal Credit Union stands out for its member-centric approach and competitive terms. For businesses affiliated with the military, veterans, or the Department of Defense, Navy Federal's business loan options can be particularly appealing. This article delves into the details of Navy Federal business loans, exploring their benefits, types, application processes, and how they can support business goals.

The importance of selecting the right financial partner cannot be overstated. A loan that aligns with a business's needs can be the catalyst for success, enabling investments in new equipment, hiring additional staff, or exploring new markets. Conversely, a loan with unfavorable terms can lead to financial strain. Navy Federal Credit Union, with its not-for-profit structure, aims to provide its members with financial solutions that prioritize their success over profit maximization.

For businesses looking to grow or consolidate their operations, understanding the available loan options is the first step. Navy Federal offers a variety of business loans, each designed to meet specific needs. From lines of credit that provide flexible access to funds for ongoing expenses or unexpected costs, to term loans for larger, one-time investments, the options cater to a range of business strategies. Additionally, Navy Federal's membership eligibility, extending to veterans, active-duty military personnel, and their families, makes these loans accessible to a unique demographic that may face distinct financial challenges.

Overview of Navy Federal Business Loans

Navy Federal business loans are designed with the member in mind, offering competitive rates, flexible repayment terms, and personalized service. The application process, while thorough to ensure the loan's feasibility for the business, is streamlined for efficiency. Potential borrowers can expect a review of their business's financial health, credit history, and the purpose of the loan. This thorough assessment allows Navy Federal to provide loans that are not only affordable but also tailored to support the business's growth strategy.

Types of Business Loans Offered by Navy Federal

Navy Federal's portfolio of business loans includes: - **Business Equity Loans**: Ideal for businesses looking to leverage the equity in their commercial property to secure funds for expansion or other significant investments. - **Commercial Real Estate Loans**: Designed for the purchase, refinance, or improvement of commercial property, offering competitive terms and rates. - **Business Lines of Credit**: Providing flexible access to cash for managing day-to-day expenses, handling unexpected costs, or seizing new opportunities. - **Term Loans**: Suitable for one-time financing needs, such as purchasing equipment, consolidating debt, or financing a business expansion.Benefits of Choosing Navy Federal for Business Loans

The benefits of opting for Navy Federal business loans are multifaceted. Members can expect:

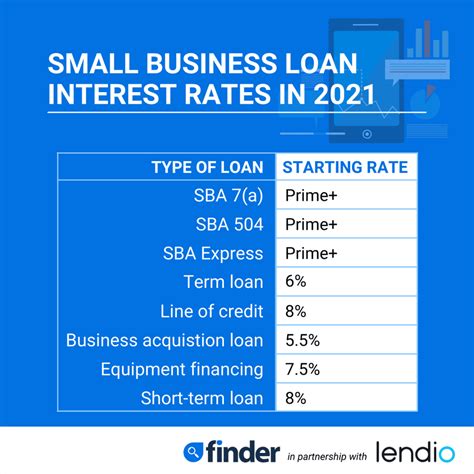

- Competitive Rates: Navy Federal, as a credit union, often offers more favorable interest rates compared to traditional banks.

- Personalized Service: The credit union's approach focuses on building long-term relationships, ensuring that members receive guidance and support tailored to their unique business needs.

- Flexible Terms: Recognizing that each business is distinct, Navy Federal works with its members to establish repayment terms that align with their cash flow and financial goals.

- Membership Perks: Beyond loan benefits, membership in Navy Federal Credit Union opens the door to a range of financial products and services designed to support overall financial well-being.

Eligibility and Application Process

To be eligible for a Navy Federal business loan, the business must meet certain criteria, including being a member of the credit union. Membership is extended to: - Active-duty military personnel - Veterans - Retired military personnel - Annuitants - Department of Defense (DoD) civilians - Contractors - Family members of the above groupsThe application process involves several steps:

- Membership Verification: Ensuring the business or its owners are eligible and members of Navy Federal.

- Loan Application: Submitting the loan application, which includes providing detailed business and personal financial information.

- Credit Review: Navy Federal conducts a thorough review of the business's creditworthiness and financial health.

- Approval and Funding: Upon approval, the loan is disbursed, and repayment terms are established.

Managing Your Business Loan

Effective management of a business loan is crucial for maintaining a healthy financial profile and ensuring the loan supports, rather than hinders, business growth. This includes:

- Regular Payments: Adhering to the repayment schedule to avoid late fees and negative impacts on credit scores.

- Budgeting: Allocating funds appropriately to meet loan repayments alongside other business expenses.

- Review and Adjustment: Periodically reviewing the loan's terms and the business's financial situation to determine if adjustments, such as refinancing, are necessary.

Common Challenges and Solutions

Businesses may encounter various challenges when managing a loan, including cash flow issues, unexpected expenses, or changes in the business environment. Solutions can include: - **Refinancing**: Exploring options to refinance the loan for better terms. - **Payment Plans**: Working with Navy Federal to establish a temporary payment plan during difficult periods. - **Financial Counseling**: Utilizing resources and expertise from Navy Federal or external financial advisors to optimize business finances.Conclusion and Next Steps

In conclusion, Navy Federal business loans offer a valuable financing solution for eligible businesses, combining competitive terms with personalized service. By understanding the types of loans available, the application process, and the benefits of choosing Navy Federal, businesses can make informed decisions about their financing needs. Whether looking to expand operations, manage cash flow, or invest in new opportunities, Navy Federal's business loans can provide the necessary support.

For those considering a Navy Federal business loan, the next steps involve exploring the credit union's website, contacting their business services team, or visiting a branch to discuss specific needs and eligibility. By taking these initial steps, businesses can embark on a path towards securing the capital they need to thrive.

Navy Federal Business Loan Image Gallery

What are the eligibility criteria for Navy Federal business loans?

+Eligibility includes being a member of Navy Federal Credit Union, which is open to active-duty military personnel, veterans, retired military personnel, annuitants, Department of Defense civilians, contractors, and their family members.

What types of business loans does Navy Federal offer?

+Navy Federal offers a range of business loans, including business equity loans, commercial real estate loans, business lines of credit, and term loans, designed to meet various business needs.

How do I apply for a Navy Federal business loan?

+The application process involves verifying membership, submitting a loan application with detailed financial information, undergoing a credit review, and, upon approval, receiving the loan funds.

In wrapping up, Navy Federal business loans present a compelling option for businesses seeking financing that understands their unique needs and challenges. By exploring these options and leveraging the guidance and resources provided by Navy Federal, businesses can navigate their financial journeys with confidence. Share your thoughts on Navy Federal business loans and how they can support business growth in the comments below.