Intro

Discover expert 5 Navy Federal car buying tips, including auto loan options, credit score requirements, and vehicle financing strategies to save money and navigate the car purchasing process with ease and confidence.

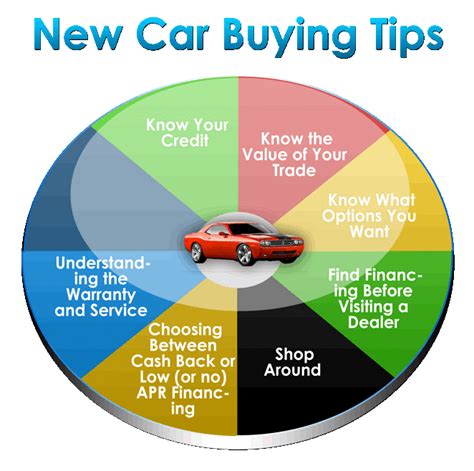

Purchasing a new vehicle can be a daunting task, especially for those who are not familiar with the process. With so many options available, it can be challenging to determine the best course of action. Fortunately, Navy Federal Credit Union provides its members with a wealth of resources and tools to help navigate the car buying process. By following these 5 Navy Federal car buying tips, individuals can ensure a smooth and successful transaction.

When it comes to buying a car, it's essential to do your research and be prepared. This includes determining your budget, checking your credit score, and researching different models and their prices. Navy Federal Credit Union offers its members a range of resources, including online tools and expert advice, to help them make informed decisions. By taking the time to prepare and do your research, you can avoid common pitfalls and find the best deal on your new vehicle.

Navy Federal Credit Union is committed to helping its members achieve their financial goals, and this includes providing them with the resources and tools they need to make smart purchasing decisions. With a long history of serving the military and their families, Navy Federal has developed a deep understanding of the unique challenges and opportunities that come with military life. By leveraging this expertise, individuals can trust that they are getting the best possible advice and guidance when it comes to buying a car.

Understanding Your Budget

Some key factors to consider when determining your budget include your income, expenses, and credit score. Your credit score can have a significant impact on the interest rate you qualify for, so it's essential to check your score and work on improving it if necessary. Navy Federal Credit Union offers its members free access to their credit scores, as well as expert advice and resources to help them improve their creditworthiness.

Researching Different Models

Some popular models to consider include the Toyota Camry, Honda Civic, and Ford F-150. These vehicles are known for their reliability, fuel efficiency, and safety features, making them popular choices among car buyers. Navy Federal Credit Union offers its members access to a range of research tools and resources, including reviews and ratings from other owners, to help them make informed decisions.

Understanding Financing Options

Some key factors to consider when financing a car include the interest rate, loan term, and monthly payment. Navy Federal Credit Union offers its members competitive interest rates and flexible loan terms to help them find a financing option that fits their budget. By taking the time to understand the different financing options available, you can ensure that you get the best possible deal and avoid financial stress.

Working with a Reputable Dealer

Some key factors to consider when working with a dealer include their reputation, pricing, and customer service. Navy Federal Credit Union offers its members a range of resources and tools to help them find a reputable dealer and negotiate the best possible price. By taking the time to research different dealers and understand the car buying process, you can ensure that you get the best possible deal and avoid financial stress.

Negotiating the Best Price

Some key factors to consider when negotiating the best price include the vehicle's market value, any trade-ins or incentives, and the dealer's profit margin. Navy Federal Credit Union offers its members expert advice and guidance to help them navigate the negotiation process and get the best possible deal. By working with a reputable dealer and understanding the car buying process, you can ensure that you negotiate the best possible price and drive away in your new vehicle with confidence.

Navy Federal Car Buying Image Gallery

What are the benefits of using Navy Federal Credit Union for car buying?

+Navy Federal Credit Union offers its members a range of benefits, including competitive interest rates, flexible loan terms, and expert advice and guidance. By using Navy Federal for car buying, individuals can ensure that they get the best possible deal and avoid financial stress.

How can I determine my budget for car buying?

+To determine your budget for car buying, consider factors such as your income, expenses, and credit score. Navy Federal Credit Union offers its members a range of tools and resources to help them determine their budget and make informed financial decisions.

What are the different financing options available for car buying?

+Navy Federal Credit Union offers its members a range of financing options, including loans and leases. By understanding the different financing options available, individuals can make informed decisions and ensure that they get the best possible deal.

How can I negotiate the best price when buying a car?

+To negotiate the best price when buying a car, research different models and their market value, consider any trade-ins or incentives, and understand the dealer's profit margin. Navy Federal Credit Union offers its members expert advice and guidance to help them navigate the negotiation process and get the best possible deal.

What are the common mistakes to avoid when buying a car?

+Common mistakes to avoid when buying a car include not researching different models, not understanding financing options, and not negotiating the best price. By taking the time to research and understand the car buying process, individuals can avoid these mistakes and ensure that they get the best possible deal.

We hope that these 5 Navy Federal car buying tips have been helpful in guiding you through the car buying process. By following these tips and using the resources and tools available through Navy Federal Credit Union, you can ensure a smooth and successful transaction. Remember to always do your research, understand your budget, and negotiate the best price to get the best possible deal on your new vehicle. If you have any further questions or would like to share your own car buying experiences, please don't hesitate to comment below.