Intro

Unlock smart borrowing with 5 Navy Federal Loan Tips, including loan options, interest rates, and repayment terms, to make informed decisions on personal loans, credit cards, and mortgage loans.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial services to its members, including loans. If you're a member of Navy Federal or considering becoming one, it's essential to understand the loan options available to you and how to make the most of them. In this article, we'll provide you with five valuable Navy Federal loan tips to help you navigate the loan process and make informed decisions about your financial future.

The importance of understanding loan options cannot be overstated. With so many different types of loans available, each with its own set of terms and conditions, it's crucial to do your research and choose the loan that best fits your needs. Whether you're looking to purchase a new home, finance a car, or consolidate debt, Navy Federal has a loan option that can help. By following these five tips, you'll be well on your way to securing the loan you need and achieving your financial goals.

Navy Federal's loan options are designed to be flexible and affordable, with competitive interest rates and repayment terms that can be tailored to your individual circumstances. From personal loans and credit cards to mortgages and home equity loans, Navy Federal offers a wide range of loan products that can help you achieve your financial goals. With these five tips, you'll be able to navigate the loan process with confidence and make the most of the loan options available to you.

Navy Federal Loan Options

Personal Loans

Personal loans are a popular option for Navy Federal members, offering a flexible and affordable way to borrow money. With a personal loan, you can borrow up to $50,000 and repay it over a period of up to 60 months. Personal loans are unsecured, meaning you don't need to put up collateral to secure the loan, and they often have lower interest rates than credit cards. To qualify for a personal loan, you'll need to meet Navy Federal's creditworthiness requirements, which take into account your credit score, income, and debt-to-income ratio.Applying for a Navy Federal Loan

Required Documentation

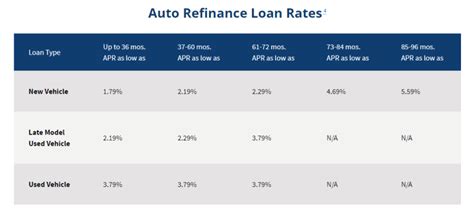

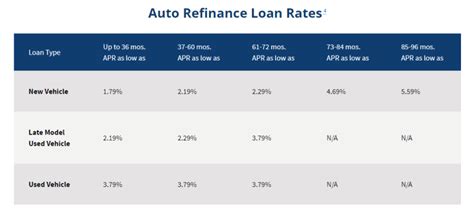

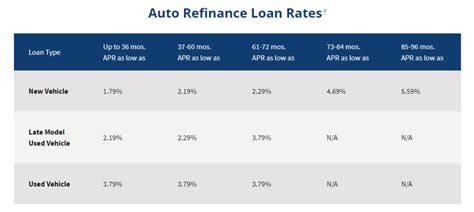

The documentation required to apply for a Navy Federal loan will vary depending on the type of loan you're applying for and your individual circumstances. In general, you'll need to provide: * Identification, such as a driver's license or passport * Proof of income, such as pay stubs or tax returns * Proof of employment, such as a letter from your employer * Bank statements or other financial documentsNavy Federal Loan Rates and Terms

Repayment Options

Navy Federal offers a range of repayment options to help you manage your loan payments and stay on track. These include: * Automatic payments, which can be set up to deduct payments from your checking or savings account * Online payments, which can be made through Navy Federal's online banking platform * Phone payments, which can be made by calling Navy Federal's customer service number * In-person payments, which can be made at a Navy Federal branchNavy Federal Loan Benefits

Member Benefits

As a Navy Federal member, you're eligible for a range of benefits, including: * Competitive loan rates and terms * No origination fees on most loans * Flexible repayment options * Access to online banking and mobile banking * Discounts on other financial products and servicesNavy Federal Loan Tips

Additional Tips

Here are a few additional tips to keep in mind when applying for a Navy Federal loan: * **Apply online**: Applying online is a convenient and efficient way to apply for a loan. * **Have all required documentation ready**: Make sure you have all the required documentation ready before applying for a loan. * **Ask questions**: If you have any questions or concerns, don't hesitate to ask.Navy Federal Loan Image Gallery

What are the benefits of a Navy Federal loan?

+Navy Federal loans offer a range of benefits, including competitive interest rates, flexible repayment terms, and no origination fees.

How do I apply for a Navy Federal loan?

+You can apply for a Navy Federal loan online, by phone, or in person at a Navy Federal branch.

What are the repayment options for a Navy Federal loan?

+Navy Federal offers a range of repayment options, including automatic payments, online payments, phone payments, and in-person payments.

Can I make extra payments on my Navy Federal loan?

+Yes, you can make extra payments on your Navy Federal loan, which can help you pay off the loan faster and save money on interest.

How do I check my credit score before applying for a Navy Federal loan?

+You can check your credit score for free through various online services, such as Credit Karma or Credit Sesame.

In conclusion, Navy Federal loans offer a range of benefits and options for members, from competitive interest rates and flexible repayment terms to no origination fees and flexible repayment options. By following these five valuable Navy Federal loan tips and understanding the loan options available to you, you can make informed decisions about your financial future and achieve your goals. We encourage you to share your experiences with Navy Federal loans in the comments below and to reach out to us if you have any further questions or concerns. Additionally, if you found this article helpful, please share it with others who may be interested in learning more about Navy Federal loans.