Intro

Discover Navy Federal CD rates, terms, and benefits. Compare high-yield certificates of deposit, jumbo CDs, and special deals for maximum savings and investment growth with competitive APYs.

The world of banking and finance can be overwhelming, with numerous options and rates to consider. For those looking to save and grow their money, certificates of deposit (CDs) are a popular choice. Navy Federal Credit Union, one of the largest and most reputable credit unions in the United States, offers a range of CD options with competitive rates. In this article, we will delve into the world of Navy Federal CD rates, exploring the benefits, types, and current rates to help you make an informed decision about your savings.

Navy Federal Credit Union has been serving its members for over 80 years, providing a wide range of financial products and services. With a strong commitment to its members, Navy Federal has established itself as a trusted and reliable institution. One of the key benefits of joining Navy Federal is access to its competitive CD rates, which can help you earn a higher return on your savings. Whether you're looking to save for a short-term goal or a long-term investment, Navy Federal's CD options are worth considering.

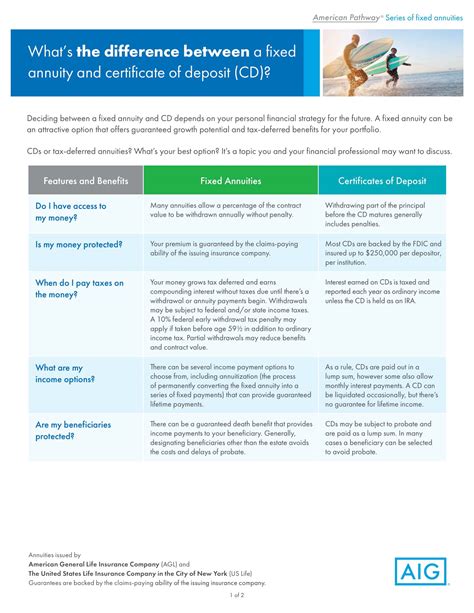

The benefits of CDs are numerous, including low risk, fixed returns, and flexibility. CDs are time deposits offered by banks and credit unions with a fixed interest rate and maturity date. They tend to be low-risk investments, making them an attractive option for those who want to avoid the volatility of the stock market. Additionally, CDs provide a fixed return, allowing you to predict your earnings with certainty. With Navy Federal's CD options, you can choose from a variety of terms, ranging from a few months to several years, to suit your financial goals and needs.

Navy Federal Cd Rates Overview

Navy Federal offers a range of CD options, each with its own unique features and benefits. The most common types of CDs include traditional CDs, jumbo CDs, and special CDs. Traditional CDs are the most basic type of CD, requiring a minimum deposit and offering a fixed interest rate for a specified term. Jumbo CDs, on the other hand, require a larger minimum deposit, typically $100,000 or more, and offer higher interest rates. Special CDs, such as step-up CDs and no-penalty CDs, offer more flexibility and unique features, such as the ability to adjust your interest rate or withdraw your money without penalty.

Types of Navy Federal CDs

Navy Federal's CD rates are competitive and vary depending on the type and term of the CD. The current rates range from 0.40% APY for a 3-month traditional CD to 4.35% APY for a 5-year jumbo CD. It's essential to note that rates are subject to change and may vary depending on your location and other factors. To get the most up-to-date information, it's best to visit Navy Federal's website or consult with a representative.

Navy Federal Cd Rates Comparison

When comparing Navy Federal's CD rates to those of other banks and credit unions, it's essential to consider the minimum deposit requirements, terms, and any potential fees. Navy Federal's rates are generally competitive, but it's crucial to shop around and compare rates from multiple institutions to find the best option for your needs. Additionally, consider the credit union's reputation, customer service, and overall benefits when making your decision.

Navy Federal Cd Rates Benefits

The benefits of Navy Federal's CD rates are numerous. With competitive rates, flexible terms, and low risk, CDs can be an attractive option for those looking to save and grow their money. Additionally, Navy Federal's CDs are insured by the National Credit Union Administration (NCUA), providing an extra layer of protection for your deposits. To maximize your earnings, consider laddering your CDs, which involves investing in multiple CDs with different terms to take advantage of higher rates and minimize risk.

Navy Federal Cd Rates Calculator

To get the most out of Navy Federal's CD rates, it's essential to understand the calculation behind the interest rates. The interest rate is typically expressed as an annual percentage yield (APY), which takes into account the compounding of interest. Navy Federal's CD rates calculator can help you determine your potential earnings based on the principal amount, interest rate, and term. By using the calculator, you can compare different CD options and make an informed decision about your investment.

Navy Federal Cd Rates Review

In conclusion, Navy Federal's CD rates are a competitive and attractive option for those looking to save and grow their money. With a range of CD options, flexible terms, and low risk, Navy Federal's CDs can help you achieve your financial goals. By understanding the benefits, types, and current rates, you can make an informed decision about your investment. Whether you're a seasoned investor or just starting to save, Navy Federal's CD rates are worth considering.

Gallery of Navy Federal Cd Rates

Navy Federal Cd Rates Image Gallery

What are the current Navy Federal CD rates?

+The current Navy Federal CD rates range from 0.40% APY for a 3-month traditional CD to 4.35% APY for a 5-year jumbo CD.

What are the benefits of Navy Federal's CD rates?

+The benefits of Navy Federal's CD rates include competitive rates, flexible terms, and low risk, making them an attractive option for those looking to save and grow their money.

How do I calculate my potential earnings with Navy Federal's CD rates?

+You can use Navy Federal's CD rates calculator to determine your potential earnings based on the principal amount, interest rate, and term.

We hope this article has provided you with a comprehensive understanding of Navy Federal's CD rates and how they can help you achieve your financial goals. Whether you're a seasoned investor or just starting to save, Navy Federal's CD rates are worth considering. Take the first step towards growing your money and securing your financial future. Share your thoughts and experiences with Navy Federal's CD rates in the comments below, and don't forget to share this article with your friends and family who may be interested in learning more about this topic.