Intro

Discover 5 Navy Federal Certificates with competitive rates, flexible terms, and low risks, offering high-yield savings, certificate dividends, and investment options for members.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial products and services to its members. One of the most popular investment options offered by Navy Federal is its certificates, which provide a safe and secure way to earn a fixed rate of return on your savings. In this article, we will explore the 5 Navy Federal Certificates, their benefits, and how they can help you achieve your financial goals.

The importance of saving and investing cannot be overstated. With the rising cost of living and uncertainty in the economy, it's essential to have a solid financial foundation to fall back on. Navy Federal Certificates offer a low-risk investment option that can help you grow your savings over time. Whether you're looking to save for a short-term goal, such as a vacation or a down payment on a house, or a long-term goal, such as retirement, Navy Federal Certificates can provide a safe and secure way to earn a fixed rate of return.

Navy Federal Certificates are similar to traditional bank CDs, but they offer more flexible terms and higher interest rates. With a Navy Federal Certificate, you can choose from a variety of terms, ranging from a few months to several years, and earn a fixed rate of return that's guaranteed for the life of the certificate. This makes them an attractive option for those who want to earn a higher interest rate than a traditional savings account, but don't want to take on the risk of investing in the stock market.

Benefits of Navy Federal Certificates

Another benefit of Navy Federal Certificates is that they are easy to open and manage. You can open a certificate online, by phone, or in person at a Navy Federal branch. You can also manage your certificate online, including checking your balance, viewing your interest rate, and making changes to your account. This makes it easy to keep track of your investment and make adjustments as needed.

Types of Navy Federal Certificates

Each of these certificates offers a unique set of benefits and features, and can be tailored to meet your individual financial needs. For example, the EasyStart Certificate is a great option for those who are just starting to save, as it requires a low minimum deposit and offers flexible terms. On the other hand, the Jumbo Certificate is a good option for those who have a large sum of money to invest, as it offers a higher interest rate and a longer term.

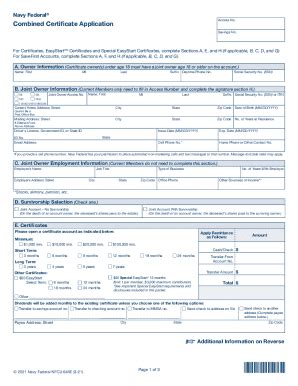

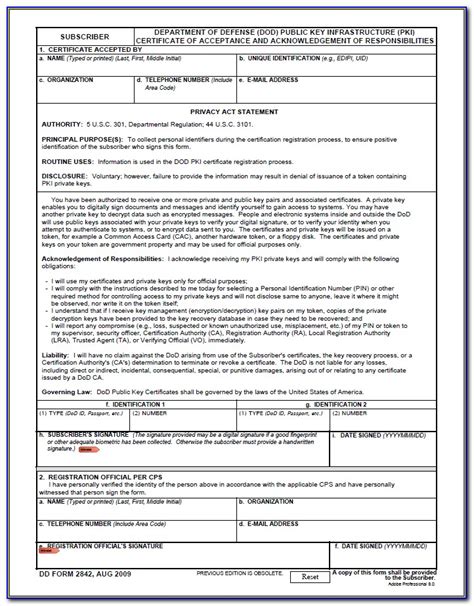

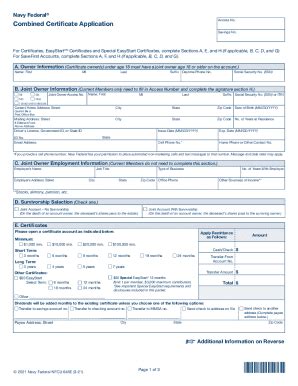

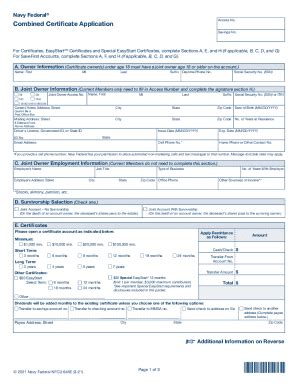

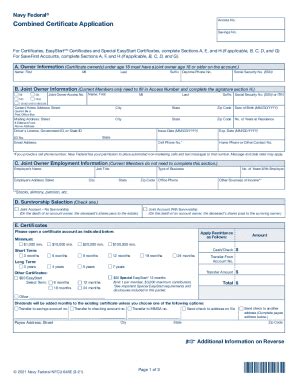

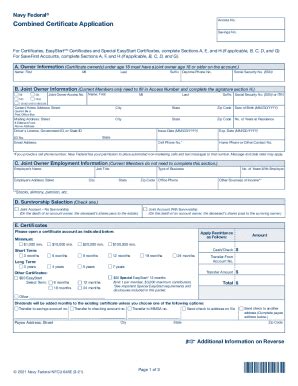

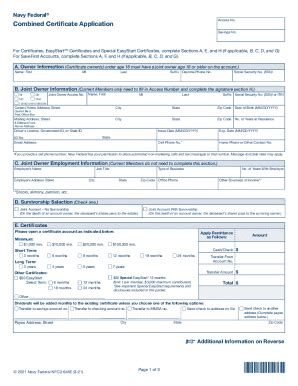

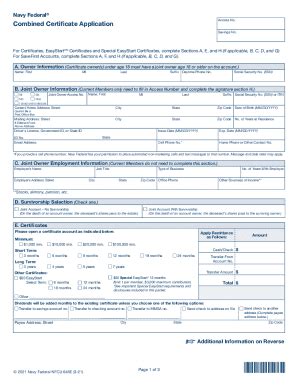

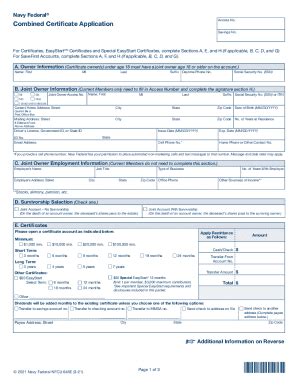

How to Open a Navy Federal Certificate

Opening a Navy Federal Certificate is a straightforward process that can be completed online, by phone, or in person at a Navy Federal branch. To open a certificate, you will need to provide some basic information, such as your name, address, and social security number. You will also need to fund your certificate with the minimum required deposit.Once you have opened your certificate, you can manage it online, including checking your balance, viewing your interest rate, and making changes to your account. You can also set up automatic transfers from your checking or savings account to your certificate, making it easy to save regularly.

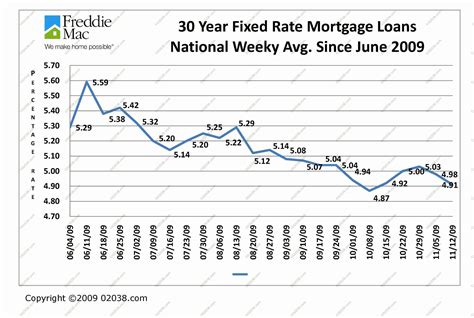

Interest Rates and Terms

It's also worth noting that Navy Federal Certificates offer a fixed rate of return, which means that your interest rate is guaranteed for the life of the certificate. This can provide a sense of security and stability, as you know exactly how much you will earn on your investment.

Tax Benefits

Navy Federal Certificates also offer tax benefits, as the interest earned on your certificate is generally exempt from state and local taxes. This can help you keep more of your hard-earned money, as you won't have to pay taxes on the interest you earn.Additionally, Navy Federal Certificates are insured by the NCUA, which means that your deposits are protected up to $250,000. This provides an added layer of security and protection, as you know that your investment is safe and secure.

Conclusion and Next Steps

If you're interested in opening a Navy Federal Certificate, you can do so online, by phone, or in person at a Navy Federal branch. You can also contact a Navy Federal representative for more information and to discuss your individual financial needs.

Summary of Benefits

To summarize, the benefits of Navy Federal Certificates include: * Safe and secure way to earn a fixed rate of return on your savings * Flexible terms, ranging from a few months to several years * Competitive interest rates, which can help you earn a higher return on your investment * Tax benefits, as the interest earned on your certificate is generally exempt from state and local taxes * Insured by the NCUA, which means that your deposits are protected up to $250,000Overall, Navy Federal Certificates are a great option for those who want to grow their savings over time, while also enjoying a sense of security and stability.

Navy Federal Certificates Image Gallery

What is a Navy Federal Certificate?

+A Navy Federal Certificate is a type of savings account that offers a fixed rate of return for a specified term.

How do I open a Navy Federal Certificate?

+You can open a Navy Federal Certificate online, by phone, or in person at a Navy Federal branch.

What are the benefits of a Navy Federal Certificate?

+The benefits of a Navy Federal Certificate include a safe and secure way to earn a fixed rate of return, flexible terms, and competitive interest rates.

Are Navy Federal Certificates insured?

+Yes, Navy Federal Certificates are insured by the National Credit Union Administration (NCUA), which means that your deposits are protected up to $250,000.

Can I withdraw my money from a Navy Federal Certificate at any time?

+No, you cannot withdraw your money from a Navy Federal Certificate at any time. You will need to wait until the end of the term to withdraw your money without penalty.

We hope this article has provided you with a comprehensive overview of the 5 Navy Federal Certificates and their benefits. If you have any further questions or would like to learn more, please don't hesitate to contact us. We're always here to help. Additionally, we invite you to share your thoughts and experiences with Navy Federal Certificates in the comments below. Your feedback is valuable to us and can help others make informed decisions about their financial investments. Thank you for reading!