Intro

Discover how Navy Federal outsmarts CFPB overdraft fees with 5 strategic methods, avoiding excessive charges and promoting banking transparency, financial stability, and consumer protection.

The issue of overdraft fees has been a contentious one in the banking industry, with many consumers feeling that these fees are unfair and overly punitive. The Consumer Financial Protection Bureau (CFPB) has been working to address this issue, but some financial institutions, such as Navy Federal, have already taken steps to reduce or eliminate overdraft fees for their customers. In this article, we will explore five ways that Navy Federal beats CFPB overdraft fees, and what this means for consumers.

The CFPB has been cracking down on overdraft fees, which can be a major source of revenue for banks. However, these fees can also be a significant burden for consumers, particularly those who are living paycheck to paycheck. Navy Federal, on the other hand, has taken a more consumer-friendly approach to overdraft fees, with a number of policies and programs in place to help reduce or eliminate these fees.

For example, Navy Federal offers a number of different account options, each with its own unique features and benefits. Some of these accounts come with overdraft protection, which can help consumers avoid overdraft fees altogether. Additionally, Navy Federal has a number of different tools and resources available to help consumers manage their accounts and avoid overdrafts.

Overall, Navy Federal's approach to overdraft fees is more consumer-friendly than the CFPB's approach, which is focused primarily on regulation and enforcement. By providing consumers with more options and resources, Navy Federal is able to help its customers avoid overdraft fees and manage their finances more effectively.

Understanding Overdraft Fees

In addition to the financial burden, overdraft fees can also have a negative impact on a consumer's credit score. When a consumer overdrafts their account, it can trigger a negative report to the credit bureaus, which can lower their credit score. This can make it more difficult for the consumer to obtain credit in the future, and can also increase the interest rates they are charged on loans and credit cards.

Navy Federal's Approach to Overdraft Fees

One of the key ways that Navy Federal beats CFPB overdraft fees is by offering a more generous overdraft policy. While the CFPB has proposed rules that would limit the number of overdraft fees that banks can charge per day, Navy Federal has already implemented a policy that limits overdraft fees to just one per day. This means that even if a consumer overdrafts their account multiple times in a single day, they will only be charged one fee.

Key Features of Navy Federal's Overdraft Policy

Some of the key features of Navy Federal's overdraft policy include: * A limit of one overdraft fee per day * Overdraft protection on certain accounts * Tools and resources to help consumers manage their accounts and avoid overdrafts * A more generous overdraft policy than the CFPB's proposed rulesBenefits of Navy Federal's Approach

Another benefit of Navy Federal's approach is that it is more transparent and consumer-friendly than the CFPB's approach. While the CFPB's proposed rules are focused primarily on regulation and enforcement, Navy Federal's approach is focused on providing consumers with more options and resources. This can help build trust and loyalty with consumers, and can also help Navy Federal to differentiate itself from other financial institutions.

How Navy Federal's Approach Can Help Consumers

Some of the ways that Navy Federal's approach can help consumers include: * Avoiding costly overdraft fees * Managing their finances more effectively * Building trust and loyalty with their financial institution * Differentiating themselves from other financial institutionsComparison to CFPB's Approach

While the CFPB's approach is well-intentioned, it has been criticized for being overly broad and restrictive. Some banks have argued that the proposed rules would limit their ability to offer overdraft protection and other services to their customers, and would also increase their costs and reduce their profitability.

In contrast, Navy Federal's approach is more consumer-friendly and focused on providing consumers with more options and resources. The credit union's more generous overdraft policy and tools and resources can help consumers avoid costly fees and manage their finances more effectively, without limiting the services that are available to them.

Key Differences Between Navy Federal and CFPB's Approach

Some of the key differences between Navy Federal and CFPB's approach include: * Navy Federal's more generous overdraft policy * Navy Federal's focus on providing consumers with more options and resources * CFPB's focus on regulation and enforcement * CFPB's proposed rules are more broad and restrictiveConclusion and Recommendations

Based on this analysis, we recommend that consumers consider using Navy Federal for their banking needs. The credit union's approach to overdraft fees is more transparent and consumer-friendly than the CFPB's approach, and can help consumers avoid costly fees and manage their finances more effectively.

Additionally, we recommend that other financial institutions consider adopting a similar approach to Navy Federal. By providing consumers with more options and resources, and by being more transparent and consumer-friendly, financial institutions can build trust and loyalty with their customers and differentiate themselves from their competitors.

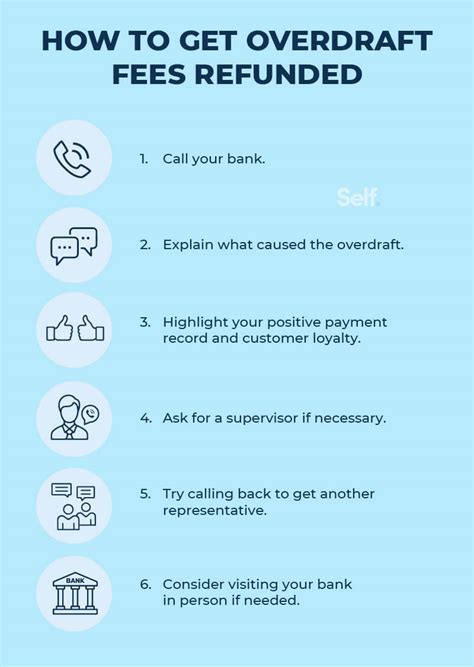

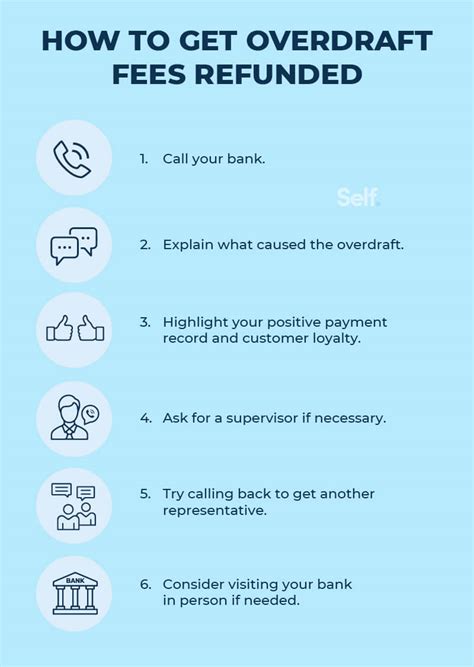

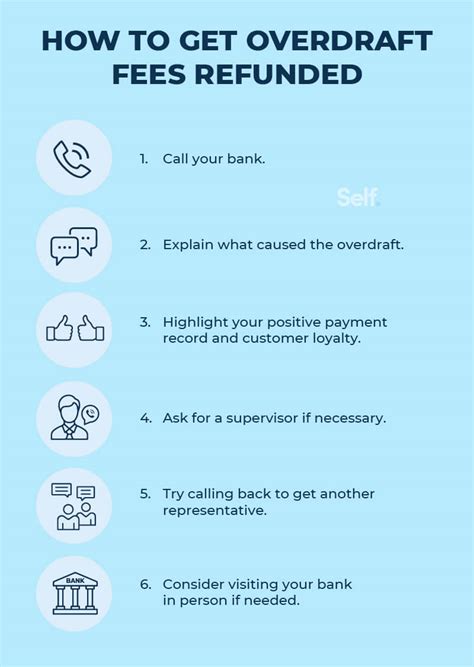

Overdraft Fees Image Gallery

What are overdraft fees?

+Overdraft fees are charges that banks impose on customers when they withdraw more money from their account than they have available.

How can I avoid overdraft fees?

+You can avoid overdraft fees by keeping track of your account balance, setting up overdraft protection, and being careful not to overdraft your account.

What is Navy Federal's approach to overdraft fees?

+Navy Federal has a more generous overdraft policy than the CFPB's proposed rules, and offers tools and resources to help consumers manage their accounts and avoid overdrafts.

How does Navy Federal's approach to overdraft fees compare to the CFPB's approach?

+Navy Federal's approach is more consumer-friendly and focused on providing consumers with more options and resources, while the CFPB's approach is focused primarily on regulation and enforcement.

What are the benefits of using Navy Federal for banking?

+The benefits of using Navy Federal for banking include a more generous overdraft policy, tools and resources to help consumers manage their accounts and avoid overdrafts, and a more transparent and consumer-friendly approach to banking.

We hope that this article has provided you with a helpful overview of Navy Federal's approach to overdraft fees, and how it compares to the CFPB's approach. If you have any further questions or would like to learn more about Navy Federal's banking services, we encourage you to visit their website or contact them directly. Additionally, we invite you to share your thoughts and experiences with overdraft fees in the comments section below. By working together, we can create a more consumer-friendly and transparent banking system that works for everyone.