Intro

Discover Navy Federal Checking Account benefits, featuring low fees, rewards, and mobile banking, offering members convenient financial management and exclusive perks.

The world of banking has become increasingly complex, with numerous options available to consumers. One institution that stands out from the rest is Navy Federal Credit Union, which offers a range of benefits to its members, particularly when it comes to checking accounts. For those who are part of the military community or have a connection to it, Navy Federal can provide a unique set of advantages that enhance financial management and savings. In this article, we will delve into the benefits of having a Navy Federal checking account, exploring how it can simplify your financial life and offer exclusive perks.

Navy Federal Credit Union is not just any financial institution; it is designed specifically for the military community, including active duty, veterans, and their families. This specialization allows Navy Federal to understand the unique financial challenges and opportunities that come with military service. By catering to this demographic, Navy Federal has created a suite of financial products and services that are tailored to meet the specific needs of its members. One of the cornerstone products of Navy Federal is its checking account, which is designed to be flexible, accessible, and rewarding.

The benefits of a Navy Federal checking account are multifaceted. Firstly, members can enjoy the convenience of digital banking, with mobile apps and online platforms that allow for easy account management, bill payments, and fund transfers. This level of accessibility is particularly beneficial for military personnel who may be stationed abroad or have irregular schedules. Moreover, Navy Federal checking accounts often come with no monthly service fees, which can be a significant cost savings compared to traditional banks. The absence of these fees means that members can keep more of their hard-earned money, using it for what matters most to them.

Navy Federal Checking Account Features

In addition to the basic features, Navy Federal checking accounts are packed with additional benefits. For instance, members can earn dividends on their checking account balances, which means their money can grow over time without them having to lift a finger. This feature is especially attractive in a low-interest-rate environment, where finding ways to grow your savings can be challenging. Furthermore, Navy Federal offers overdraft protection services, which can provide peace of mind for members who occasionally find themselves in a tight financial spot. By linking a savings account or credit card to the checking account, members can avoid the inconvenience and expense of overdraft fees.

Another significant advantage of Navy Federal checking accounts is the access to a large network of ATMs. With thousands of fee-free ATMs available, members can withdraw cash when they need it, without incurring extra charges. This network is particularly useful for those who travel frequently or are stationed in different parts of the country or world. The convenience of having cash on hand, combined with the cost savings of avoiding ATM fees, makes managing finances on the go much simpler.

Types of Navy Federal Checking Accounts

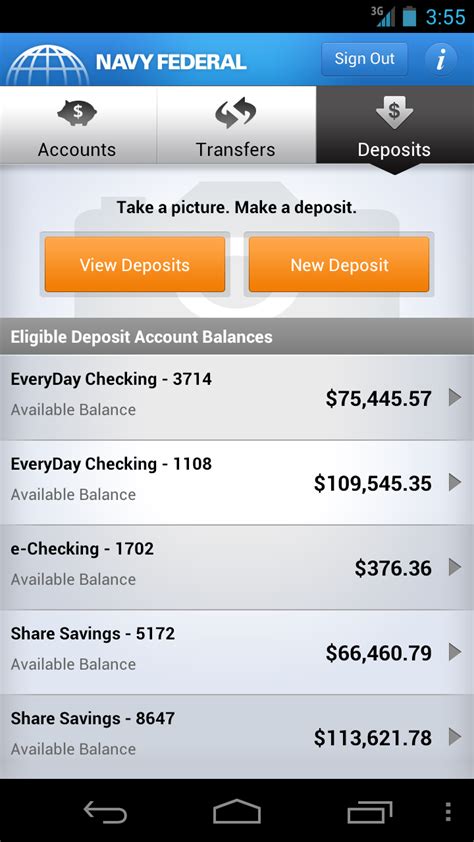

Navy Federal offers several types of checking accounts, each designed to meet the diverse needs of its members. The most basic account is the Everyday Checking, which is perfect for those who want a straightforward, no-frills checking experience. This account comes with all the standard features, including a debit card, online banking, and access to the ATM network. For members who want to earn dividends on their balance, the Free Active Duty Checking and the Free Campus Checking are excellent options. These accounts are designed for active-duty military personnel and students, respectively, offering a way to grow their savings while enjoying the convenience of a checking account.

For those who are looking for a more premium experience, Navy Federal's Flagship Checking account is the way to go. This account offers higher dividend rates, a higher ATM fee rebate, and exclusive discounts on other Navy Federal products and services. The Flagship Checking account is ideal for members who maintain higher balances and want to maximize their earnings and benefits. Regardless of which account type members choose, they can rest assured that they are getting a competitive product with features that are designed to enhance their financial well-being.

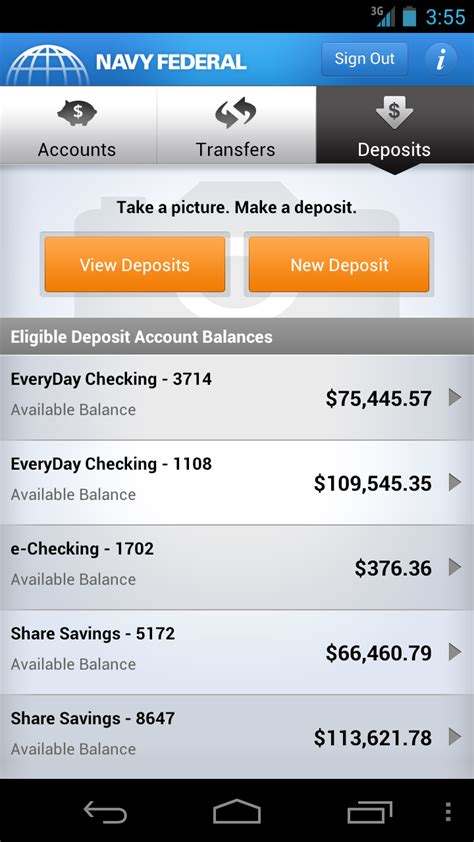

Navy Federal Mobile Banking

In today's digital age, mobile banking is an essential feature for any financial institution. Navy Federal's mobile banking app allows members to manage their accounts, pay bills, transfer funds, and even deposit checks remotely. The app is available for both iOS and Android devices, ensuring that members can stay on top of their finances wherever they go. With the mobile banking app, members can also monitor their account activity, set up alerts for large transactions, and freeze their debit card if it's lost or stolen. This level of control and accessibility provides members with peace of mind, knowing that they can manage their finances securely and efficiently.

Navy Federal Checking Account Requirements

To open a Navy Federal checking account, members must meet certain eligibility requirements. These requirements typically include being a member of the military, a veteran, or a family member of someone who is. Additionally, members must provide identification and proof of address. The application process is straightforward and can often be completed online or through the mobile app. Once the account is open, members can fund it via direct deposit, transfer from another account, or by depositing cash at a branch or ATM.

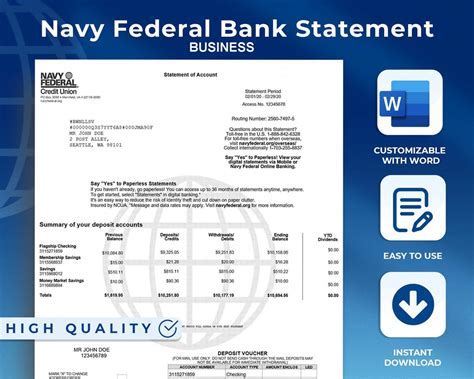

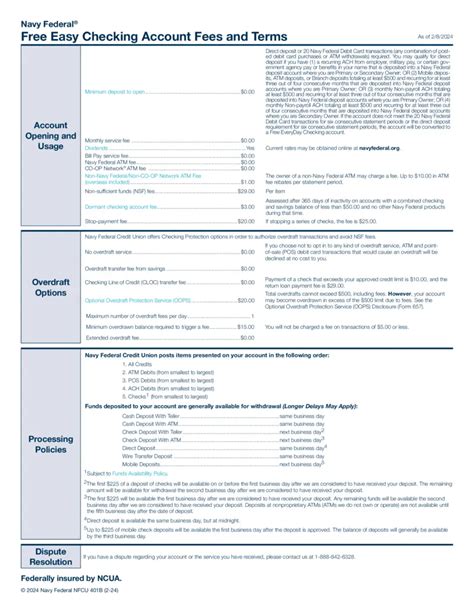

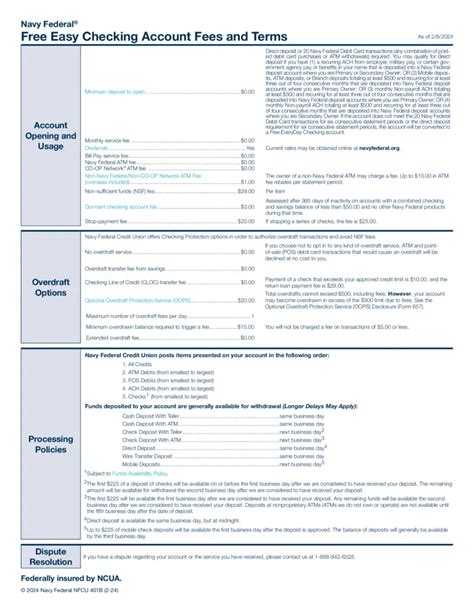

Navy Federal Checking Account Fees

One of the standout features of Navy Federal checking accounts is the lack of fees. Unlike many traditional banks, Navy Federal does not charge monthly maintenance fees, making it an attractive option for those who want to avoid extra costs. Additionally, Navy Federal offers fee-free ATM withdrawals at thousands of locations, and it reimburses up to $20 per statement cycle for ATM fees charged by other institutions. This means that members can use their debit card to withdraw cash without worrying about incurring expensive fees.

Navy Federal Checking Account Customer Service

Navy Federal is known for its exceptional customer service. Members can reach out to the credit union via phone, email, or through the mobile app. The customer service team is available 24/7, ensuring that members can get help whenever they need it. Additionally, Navy Federal has a comprehensive online resource center that provides answers to frequently asked questions, tutorials on how to use its products and services, and financial education resources. This commitment to customer service and education demonstrates Navy Federal's dedication to helping its members achieve their financial goals.

Navy Federal Checking Account Security

Security is a top priority for Navy Federal, and it takes numerous measures to protect its members' accounts and personal information. The credit union uses advanced encryption technology to secure online and mobile banking transactions, and it monitors accounts for suspicious activity. Members are also protected by zero-liability policies, which mean they are not responsible for unauthorized transactions. Furthermore, Navy Federal offers two-factor authentication and alerts for large transactions, providing an additional layer of security and peace of mind.

Gallery of Navy Federal Checking Account Benefits

Navy Federal Checking Account Image Gallery

What are the benefits of a Navy Federal checking account?

+The benefits of a Navy Federal checking account include no monthly service fees, the ability to earn dividends, overdraft protection, and access to a large network of fee-free ATMs.

How do I open a Navy Federal checking account?

+To open a Navy Federal checking account, you must meet the eligibility requirements, which typically include being a member of the military, a veteran, or a family member of someone who is. You can apply online, through the mobile app, or by visiting a branch.

What types of checking accounts does Navy Federal offer?

+Navy Federal offers several types of checking accounts, including Everyday Checking, Free Active Duty Checking, Free Campus Checking, and Flagship Checking. Each account is designed to meet the unique needs of its members, with features such as no monthly service fees, dividend earnings, and exclusive discounts.

Is Navy Federal's mobile banking app secure?

+Yes, Navy Federal's mobile banking app is secure. It uses advanced encryption technology to protect transactions and personal information. Additionally, members can enable two-factor authentication and set up alerts for large transactions to provide an extra layer of security.

How do I contact Navy Federal customer service?

+You can contact Navy Federal customer service via phone, email, or through the mobile app. The customer service team is available 24/7 to assist with any questions or concerns you may have.

In conclusion, a Navy Federal checking account offers a myriad of benefits that can simplify your financial life and provide exclusive perks. From no monthly service fees and the ability to earn dividends to overdraft protection and a large network of fee-free ATMs, Navy Federal's checking accounts are designed to meet the unique needs of the military community. Whether you're looking for a basic checking account or a more premium experience, Navy Federal has an option that's right for you. With its commitment to customer service, security, and financial education, Navy Federal is an excellent choice for anyone who wants to take control of their finances and achieve their long-term goals. If you're considering opening a checking account, we invite you to explore what Navy Federal has to offer and experience the difference for yourself. Share your thoughts on Navy Federal checking accounts in the comments below, and don't forget to share this article with anyone who might benefit from its insights.