Intro

Boost financial management with 5 Navy Federal Checks tips, including check ordering, endorsement, and deposit methods, to optimize banking and account security.

Navy Federal Credit Union is one of the largest and most respected credit unions in the world, serving over 10 million members. As a member of Navy Federal, you have access to a wide range of financial products and services, including checking accounts. When it comes to managing your finances, understanding how to use Navy Federal checks effectively is crucial. In this article, we will delve into the world of Navy Federal checks, exploring their benefits, how they work, and providing valuable tips on how to get the most out of them.

The importance of checks in modern banking cannot be overstated. Despite the rise of digital payments, checks remain a reliable and secure way to make payments, especially for large transactions or when dealing with entities that do not accept digital payments. Navy Federal checks are designed to provide members with a convenient, secure, and cost-effective way to manage their finances. Whether you are a long-time member or just joining the Navy Federal family, understanding how to use checks can help you navigate the banking system more efficiently.

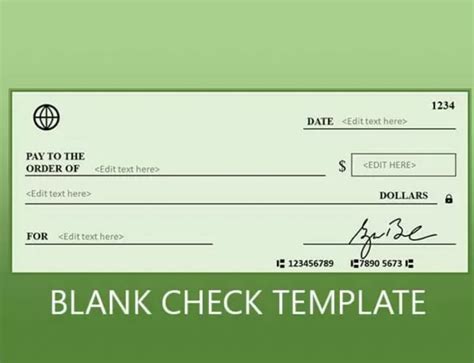

For those who are new to using checks or are looking to maximize their banking experience, it's essential to start with the basics. A check is essentially a written order to pay a specific amount of money from your account to the person or business named on the check. Navy Federal checks are personalized with your account information, making it easy to keep track of your transactions. Moreover, with the advancement in banking technology, you can now order checks online, making the process more convenient than ever.

Benefits of Using Navy Federal Checks

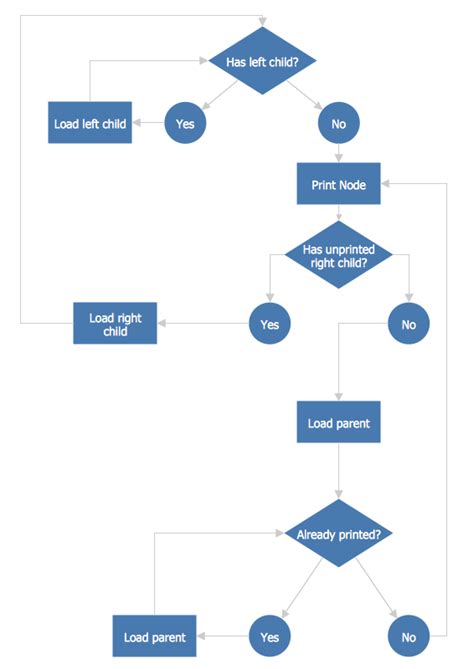

How Navy Federal Checks Work

Steps to Write a Navy Federal Check

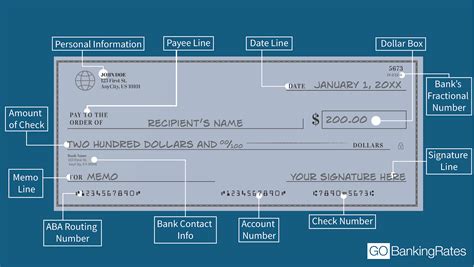

To write a Navy Federal check, follow these steps: - Date the check in the top right corner. - Write the recipient's name on the line that says "Pay to the order of." - Enter the amount of the payment in both numbers (in the box on the right side) and words (on the line below the recipient's name). - Sign your name in the bottom right corner. - Include a memo (optional) to describe the purpose of the payment.Tips for Using Navy Federal Checks Effectively

Common Mistakes to Avoid

When using Navy Federal checks, there are several common mistakes to avoid: - Writing a check without sufficient funds in your account. - Not signing the check. - Not filling out the check correctly (e.g., missing date, incorrect amount). - Losing your checkbook or having it stolen.Ordering Navy Federal Checks Online

Security Features of Navy Federal Checks

Navy Federal checks come with several security features to protect against fraud. These include: - **Watermark:** A watermark that is visible when held up to light. - **Security Thread:** A thread that glows under UV light. - **Microprinting:** Small print that is difficult to reproduce with a copier. - **Chemical Sensitive Paper:** Paper that reacts to chemical alteration attempts.Managing Your Navy Federal Checks

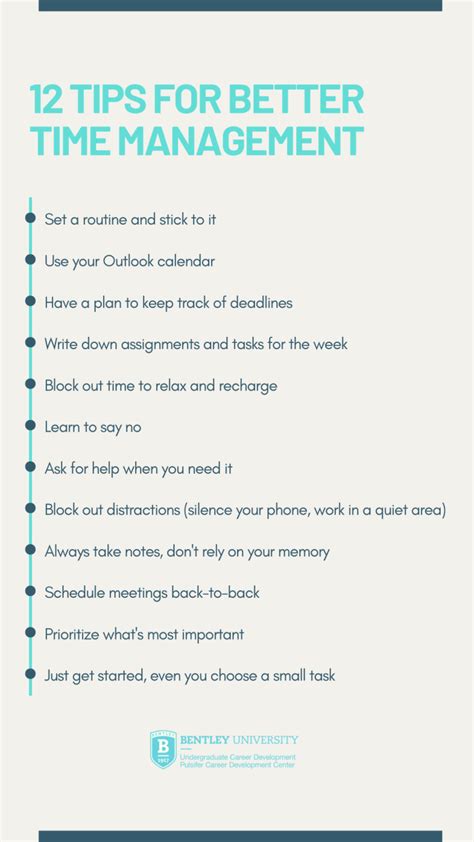

Benefits of Online Banking for Check Management

Online banking offers several benefits for managing your checks, including: - The ability to view check images online. - Real-time account updates. - Alerts for low account balances or suspicious activity. - The ability to transfer funds between accounts.Conclusion and Next Steps

Navy Federal Checks Image Gallery

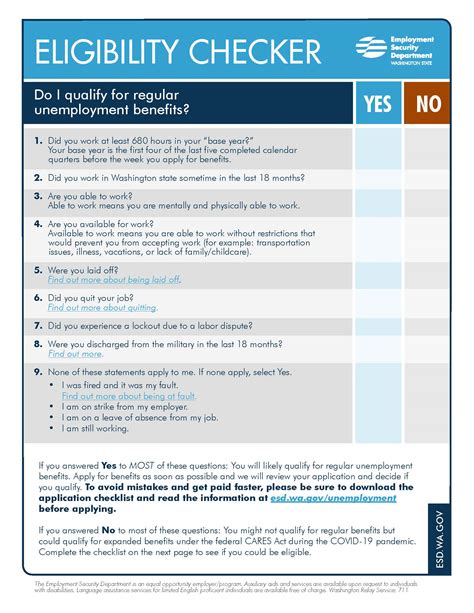

How do I order Navy Federal checks online?

+To order Navy Federal checks online, log into your online banking account, navigate to the check ordering section, and follow the prompts.

What security features do Navy Federal checks have?

+Navy Federal checks come with several security features, including watermarks, security threads, microprinting, and chemical-sensitive paper.

How can I avoid overdrafts when using Navy Federal checks?

+To avoid overdrafts, ensure you have sufficient funds in your account before writing a check, and regularly monitor your account balance.

As you continue on your financial journey with Navy Federal, remember that understanding and effectively using the tools at your disposal, such as checks, is key to managing your finances wisely. Whether you have questions about checks, online banking, or any other aspect of your Navy Federal account, don't hesitate to reach out. Share your experiences and tips with others, and consider consulting with financial advisors for personalized advice tailored to your financial goals. Together, let's navigate the world of personal finance with confidence and clarity.