Intro

Discover 5 ways Navy Federal Cherry Hill enhances banking with convenient services, online tools, and personalized support, offering members easy account management, loan options, and investment guidance.

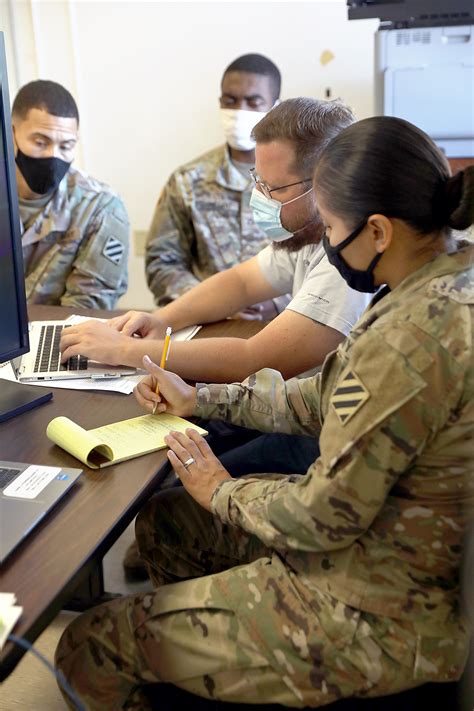

The importance of having a reliable and trustworthy financial institution cannot be overstated, especially for those serving in the military and their families. Navy Federal Credit Union has been a stalwart companion for many in this demographic, offering a wide range of financial services tailored to meet their unique needs. Among its numerous branches, the Cherry Hill location stands out for its exceptional service and commitment to the community. Understanding the benefits and services provided by Navy Federal Cherry Hill can help individuals make informed decisions about their financial futures.

For those who are part of the military community, navigating financial challenges can be particularly daunting. The unpredictable nature of military life, including deployments and relocations, can impact financial stability. It is here that institutions like Navy Federal Credit Union play a crucial role, offering not just financial products but also guidance and support. The Cherry Hill branch, with its team of experienced professionals, is well-equipped to handle the complex financial situations that military personnel and their families may face.

The decision to choose a financial institution is a significant one, as it involves entrusting one's financial well-being to the care of others. Factors such as service quality, product offerings, and community involvement are crucial in making this decision. Navy Federal Credit Union, through its Cherry Hill branch, has demonstrated a deep understanding of these factors, providing services that are both comprehensive and personalized. Whether it's opening a savings account, applying for a loan, or seeking investment advice, the staff at Navy Federal Cherry Hill are dedicated to providing the highest level of service, ensuring that every member feels valued and supported.

Introduction to Navy Federal Cherry Hill

Navy Federal Credit Union's Cherry Hill branch is part of a larger network that has been serving the military community for over 80 years. With a strong foundation built on the principles of service, integrity, and community, Navy Federal has grown to become one of the largest credit unions in the world. The Cherry Hill branch continues this legacy, offering a full spectrum of financial products and services designed to meet the diverse needs of its members.

Benefits of Choosing Navy Federal Cherry Hill

The advantages of banking with Navy Federal Cherry Hill are multifaceted, reflecting the credit union's commitment to its members' financial well-being. Some of the key benefits include: - Competitive rates on loans and deposits - Low fees compared to traditional banks - Access to a wide network of ATMs - Personalized service from experienced financial advisors - A range of financial education resources to help members make informed decisionsFinancial Products and Services

Navy Federal Cherry Hill offers an array of financial products and services, each designed to address specific needs within the military community. These include checking and savings accounts, credit cards, personal loans, mortgages, and investment services. The credit union's product lineup is notable for its flexibility and competitiveness, reflecting an understanding of the unique financial challenges faced by military personnel and their families.

Checking and Savings Accounts

Navy Federal's checking and savings accounts are designed to provide easy access to funds while earning competitive interest rates. Features such as mobile banking, direct deposit, and overdraft protection make managing finances convenient and secure. Additionally, the credit union's savings accounts offer a safe way to build wealth over time, with options for traditional savings, money market savings, and certificates.Loans and Credit Services

For members looking to finance large purchases or consolidate debt, Navy Federal Cherry Hill offers a variety of loan options. These include personal loans, auto loans, mortgages, and home equity loans, each with competitive rates and terms. The credit union also provides credit cards with rewards programs and low APRs, making them an attractive option for daily purchases and cash back.

Mortgage Services

Navy Federal's mortgage services are particularly noteworthy, given the frequent relocations that are a part of military life. The credit union offers a range of mortgage products, including VA loans, which are guaranteed by the Department of Veterans Affairs and offer favorable terms such as lower interest rates and lower or no down payments.Investment and Insurance Services

Beyond traditional banking services, Navy Federal Cherry Hill provides members with access to investment and insurance products. These services are designed to help members plan for the future, whether that involves retirement savings, education funding, or protecting loved ones through life insurance. The credit union's investment services include brokerage accounts, mutual funds, and retirement accounts, all managed by experienced financial advisors.

Financial Education and Resources

A key aspect of Navy Federal's mission is empowering its members with the knowledge and tools necessary to achieve financial stability. The credit union offers a variety of financial education resources, including workshops, webinars, and online tutorials. These resources cover topics such as budgeting, saving, investing, and managing debt, providing members with a comprehensive understanding of personal finance.

Community Involvement

Navy Federal Credit Union, through its Cherry Hill branch, is deeply committed to the local community. The credit union participates in various charitable initiatives and sponsors events that support military families and veterans. This commitment to community reflects Navy Federal's broader mission of serving those who serve, demonstrating a genuine interest in the well-being of its members beyond their financial needs.

Scholarships and Grants

As part of its community outreach, Navy Federal offers scholarships and grants to deserving students. These programs are designed to assist with education expenses, recognizing the importance of higher education in achieving long-term financial stability. By supporting the educational aspirations of its members and their families, Navy Federal Cherry Hill contributes to the development of the next generation of leaders.Membership and Eligibility

Membership in Navy Federal Credit Union is open to all branches of the military, including veterans, as well as Department of Defense civilians and contractors. Immediate family members of current members are also eligible to join, extending the benefits of credit union membership to a broader community. The eligibility criteria reflect Navy Federal's mission to serve the military community, providing a financial home for those who serve and their loved ones.

How to Join

Joining Navy Federal Cherry Hill is a straightforward process that can be completed online or in-person at the branch. Prospective members need to provide identification and proof of eligibility, after which they can open an account with as little as $5. Once a member, individuals gain access to the full range of Navy Federal's products and services, as well as its network of branches and ATMs.Conclusion and Future Outlook

As Navy Federal Credit Union continues to grow and evolve, its commitment to the military community remains unwavering. The Cherry Hill branch, with its comprehensive services and personalized approach, stands as a testament to this commitment. For those looking for a financial partner that understands the unique challenges and opportunities of military life, Navy Federal Cherry Hill is an exceptional choice. By choosing Navy Federal, members not only gain access to competitive financial products but also become part of a community dedicated to their financial well-being and success.

Navy Federal Cherry Hill Image Gallery

What are the benefits of banking with Navy Federal Cherry Hill?

+Banking with Navy Federal Cherry Hill offers competitive rates, low fees, personalized service, and access to a wide network of ATMs, among other benefits.

How do I become a member of Navy Federal Credit Union?

+Membership is open to all branches of the military, veterans, Department of Defense civilians and contractors, and their families. You can join online or in-person with a $5 initial deposit.

What types of loans does Navy Federal Cherry Hill offer?

+Navy Federal offers personal loans, auto loans, mortgages, home equity loans, and credit cards, all with competitive rates and terms tailored to the needs of military personnel and their families.

Does Navy Federal provide financial education resources?

+Yes, Navy Federal offers a variety of financial education resources, including workshops, webinars, and online tutorials, to help members manage their finances effectively and achieve their financial goals.

How does Navy Federal support the local community?

+Navy Federal Cherry Hill is involved in various community initiatives, including charitable donations, event sponsorships, and educational programs, demonstrating its commitment to the well-being of the military community and the broader local area.

In conclusion, Navy Federal Cherry Hill stands as a beacon of financial stability and support for the military community. With its comprehensive range of products and services, commitment to financial education, and deep roots in the community, it offers a unique value proposition that sets it apart from traditional banking institutions. Whether you're a service member, veteran, or part of a military family, Navy Federal Cherry Hill is an exceptional choice for all your financial needs. We invite you to explore the benefits of membership, share your experiences with others, and take the first step towards a more secure financial future. Your financial well-being is our priority, and together, we can achieve great things.