Intro

Boost credit with 5 Navy Federal Secured tips, including credit builder loans, secured cards, and smart financial management strategies for secured credit.

Building credit is an essential part of financial health, and for those who are just starting out or looking to repair their credit, a secured credit card can be a valuable tool. Navy Federal Credit Union, one of the largest and most reputable credit unions in the world, offers a range of financial products, including secured credit cards designed to help members build or rebuild their credit. Here are five Navy Federal secured tips to consider when using a secured credit card to improve your credit score.

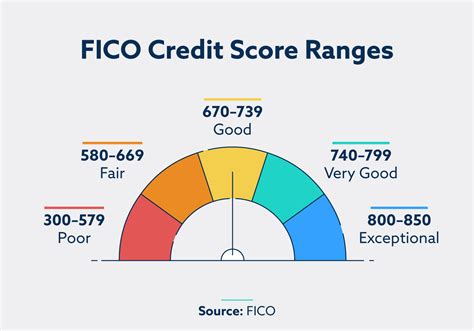

The importance of credit scores cannot be overstated. They play a crucial role in determining the interest rates you qualify for, whether you're approved for a loan or credit card, and even affect the deposits required for utilities and rentals. A good credit score can save you thousands of dollars in interest payments over the life of a loan and provide access to better financial products. On the other hand, a poor credit score can limit your financial options and increase the costs associated with borrowing.

Understanding how credit scores are calculated is key to improving them. The most widely used credit scores are FICO scores, which are calculated based on payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. By focusing on these areas, individuals can take proactive steps to enhance their credit profiles. For instance, making timely payments and keeping credit utilization ratios low are fundamental strategies for maintaining a healthy credit score.

Introduction to Navy Federal Secured Credit Cards

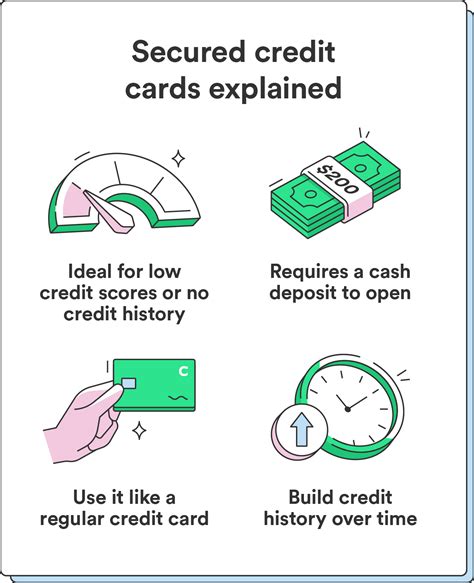

Navy Federal Credit Union offers its members a secured credit card option that can be particularly beneficial for those looking to establish or reestablish their credit. The Navy Federal Credit Union nRewards Secured Credit Card, for example, provides an opportunity for members to earn rewards while they work on building their credit. This card, like other secured credit cards, requires a security deposit, which becomes the credit limit, thereby reducing the risk for the lender and making it more accessible to individuals who might not qualify for a traditional credit card.

Benefits of Using a Secured Credit Card

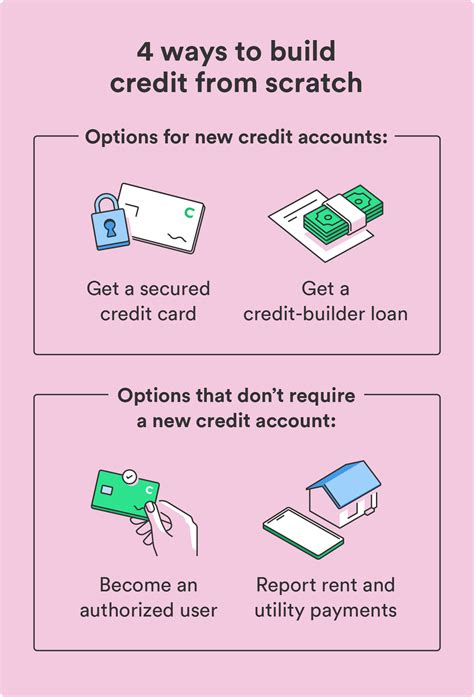

Using a secured credit card from Navy Federal or any other reputable lender can offer several benefits, especially for those with limited or damaged credit histories. One of the primary advantages is the opportunity to build or rebuild credit. By making regular payments and keeping credit utilization low, individuals can demonstrate responsible credit behavior, which is reflected in their credit scores over time. Additionally, secured credit cards can provide a sense of security for both the lender and the borrower, as the credit limit is backed by a cash deposit, reducing the risk of default.

Another significant benefit of secured credit cards is their accessibility. They are often easier to qualify for than unsecured credit cards, making them a viable option for individuals who are new to credit or have experienced credit difficulties in the past. Furthermore, many secured credit cards, including those offered by Navy Federal, come with competitive interest rates and terms, as well as rewards programs that can help cardholders save money or earn benefits on their purchases.

Steps to Apply for a Navy Federal Secured Credit Card

Applying for a Navy Federal secured credit card involves several steps:

- Membership Eligibility: First, ensure you are eligible for Navy Federal membership. This typically includes active duty, retired, or veteran members of the U.S. armed forces, as well as their families.

- Choose Your Card: Select the secured credit card that best fits your needs. Navy Federal offers various options, so it's essential to compare features such as interest rates, fees, and rewards.

- Apply Online or In-Person: You can apply for a Navy Federal secured credit card online through their website or in person at a branch. The application will require personal and financial information.

- Security Deposit: Once approved, you will need to make a security deposit to open your account. This deposit will serve as your credit limit.

- Responsible Use: Start using your card responsibly by making purchases, paying your bill on time, and keeping your credit utilization ratio low.

Managing Your Secured Credit Card

Effective management of your secured credit card is crucial for achieving your credit-building goals. Here are some tips to consider:

- Make Timely Payments: Paying your bill on time is essential for building credit. Late payments can negatively affect your credit score, so set up payment reminders or automate your payments.

- Keep Utilization Low: Aim to use less than 30% of your available credit limit. High credit utilization can harm your credit score, so keep your balances low compared to your credit limit.

- Monitor Your Credit Report: Regularly check your credit report to ensure it's accurate and up-to-date. You can request a free credit report from each of the three major credit reporting bureaus once a year.

- Avoid Applying for Too Much Credit: Applying for multiple credit cards in a short period can negatively affect your credit score. Only apply for credit when necessary, and space out your applications if you need to apply for multiple lines of credit.

Common Mistakes to Avoid

When using a secured credit card, there are several common mistakes to avoid:

- Missing Payments: Failing to make payments on time can lead to late fees, interest charges, and damage to your credit score.

- High Credit Utilization: Using too much of your available credit can indicate to lenders that you may be overspending or unable to manage your debt effectively.

- Applying for Too Many Cards: While having some credit can be beneficial, applying for too many credit cards in a short period can raise concerns about your creditworthiness.

- Not Monitoring Credit Reports: Failing to check your credit reports regularly can mean missing errors or signs of identity theft that could affect your credit score.

Converting to an Unsecured Card

After using a secured credit card responsibly for a period, you may become eligible to convert to an unsecured credit card. This typically involves a review of your credit history and payment behavior with the lender. Converting to an unsecured card can be a significant milestone, as it indicates an improvement in your creditworthiness and can provide more flexible credit terms, such as higher credit limits and lower interest rates.

To increase your chances of being approved for an unsecured card, focus on demonstrating responsible credit behavior, such as making all payments on time, keeping credit utilization low, and avoiding new credit inquiries unless necessary. Over time, as your credit score improves, you may find that you qualify for better credit card offers, including those with rewards, lower interest rates, and no annual fees.

Gallery of Secured Credit Card Options

Secured Credit Card Image Gallery

Frequently Asked Questions

What is a secured credit card?

+A secured credit card is a type of credit card that requires a security deposit, which becomes the credit limit, to open an account. It's designed for individuals who are building or rebuilding their credit.

How do I apply for a Navy Federal secured credit card?

+To apply, you must be a Navy Federal member. You can apply online or in-person at a branch. The application process requires personal and financial information, and once approved, you'll need to make a security deposit to open your account.

Can I convert my secured credit card to an unsecured card?

+Yes, after demonstrating responsible credit behavior, such as making timely payments and keeping credit utilization low, you may be eligible to convert your secured credit card to an unsecured card. This typically involves a review of your credit history and payment behavior with the lender.

How long does it take to build credit with a secured credit card?

+Building credit with a secured credit card can take several months to a few years, depending on your credit history and how responsibly you use the card. Making timely payments, keeping credit utilization low, and avoiding new credit inquiries can help improve your credit score over time.

What are the benefits of using a secured credit card?

+The benefits include the opportunity to build or rebuild credit, accessibility for those with limited or damaged credit histories, and the potential to convert to an unsecured card after demonstrating responsible credit behavior. Additionally, many secured credit cards offer competitive terms and rewards programs.

In conclusion, using a Navy Federal secured credit card can be a strategic step towards building or rebuilding your credit. By understanding the benefits, applying responsibly, and managing your card effectively, you can improve your credit score and gain access to better financial products. Remember, building credit takes time and patience, but with the right tools and strategies, you can achieve your financial goals. If you have any further questions or would like to share your experiences with secured credit cards, please don't hesitate to comment below. Sharing this article with others who may benefit from the information can also help spread financial literacy and support community growth.