Intro

Discover 5 ways Navy Federal auto loans offer flexible financing, low rates, and exclusive membership benefits, including new car loans, used car loans, and refinance options with competitive terms and credit union advantages.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial products and services to its members. One of the most popular services offered by Navy Federal is its auto loan program, which provides members with competitive interest rates, flexible repayment terms, and exclusive benefits. In this article, we will explore 5 ways Navy Federal auto loans can benefit you.

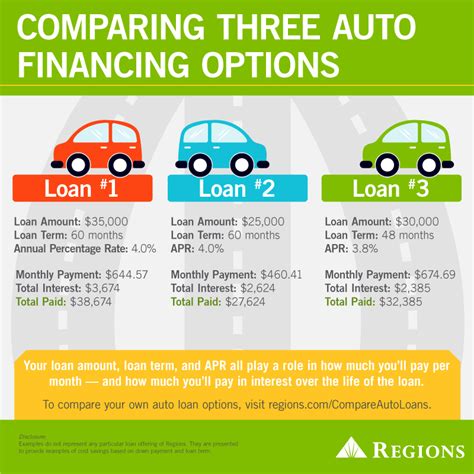

The importance of finding the right auto loan cannot be overstated. With so many lenders and loan options available, it can be overwhelming to navigate the process and find the best deal. However, by choosing Navy Federal auto loans, members can enjoy a hassle-free and cost-effective way to finance their vehicle purchases. Whether you're buying a new or used car, truck, or SUV, Navy Federal auto loans offer a range of benefits that can help you save money and achieve your financial goals.

For those who are not familiar with Navy Federal Credit Union, it's essential to understand the benefits of membership. As a member-owned cooperative, Navy Federal is committed to providing its members with the best possible rates, terms, and services. With over 10 million members worldwide, Navy Federal has established itself as a trusted and reliable financial institution. By joining Navy Federal, you can take advantage of its auto loan program and enjoy the many benefits that come with it.

Competitive Interest Rates

Flexible Repayment Terms

Exclusive Benefits for Members

Streamlined Application Process

Excellent Customer Service

Benefits of Choosing Navy Federal Auto Loans

Some of the benefits of choosing Navy Federal auto loans include: * Competitive interest rates * Flexible repayment terms * Exclusive benefits for members * Streamlined application process * Excellent customer service * Access to specialized loan programs * Discounted interest rates for members with excellent credit * Waived fees for members who set up automatic paymentsHow to Apply for a Navy Federal Auto Loan

To apply for a Navy Federal auto loan, members can follow these steps: 1. Check your eligibility: Make sure you are a member of Navy Federal Credit Union and meet the eligibility requirements for an auto loan. 2. Gather required documents: You will need to provide proof of income, employment, and identity, as well as information about the vehicle you want to purchase. 3. Apply online or by phone: You can apply for a Navy Federal auto loan online or by calling the credit union's customer service number. 4. Receive a decision: You will typically receive a decision on your loan application within 24 hours. 5. Review and sign the loan agreement: Once you are approved, you will need to review and sign the loan agreement, which will outline the terms and conditions of your loan.Navy Federal Auto Loans Image Gallery

What are the benefits of choosing Navy Federal auto loans?

+The benefits of choosing Navy Federal auto loans include competitive interest rates, flexible repayment terms, exclusive benefits for members, streamlined application process, and excellent customer service.

How do I apply for a Navy Federal auto loan?

+To apply for a Navy Federal auto loan, members can apply online, by phone, or in-person at a local branch. The application process typically takes just a few minutes, and members can receive a decision on their loan application within 24 hours.

What are the eligibility requirements for a Navy Federal auto loan?

+To be eligible for a Navy Federal auto loan, members must meet certain requirements, including being a member of Navy Federal Credit Union, having a good credit score, and providing proof of income and employment.

Can I refinance my existing auto loan with Navy Federal?

+Yes, Navy Federal offers auto loan refinancing options for existing loans. Members can refinance their loan to take advantage of lower interest rates, lower monthly payments, or to remove a co-signer from the loan.

How do I make payments on my Navy Federal auto loan?

+Members can make payments on their Navy Federal auto loan online, by phone, or by mail. Additionally, members can set up automatic payments to ensure timely payments and avoid late fees.

In summary, Navy Federal auto loans offer a range of benefits that can help members save money and achieve their financial goals. With competitive interest rates, flexible repayment terms, and exclusive benefits for members, Navy Federal auto loans are an excellent choice for anyone looking to finance a vehicle purchase. By choosing Navy Federal, members can enjoy a hassle-free and cost-effective way to finance their vehicle purchases, and take advantage of the many benefits that come with membership. We encourage you to share your experiences with Navy Federal auto loans in the comments below, and to share this article with anyone who may be in the market for a new or used vehicle.