Intro

Discover 5 ways to refinance auto loans, lowering interest rates and monthly payments with auto refinance options, refinancing cars, and vehicle loan refinancing strategies.

Refinancing an auto loan can be a great way to save money, lower monthly payments, and improve overall financial stability. With the current economic climate, many individuals are looking for ways to reduce their expenses and free up more money in their budgets. Refinancing an auto loan is a viable option that can provide significant benefits. In this article, we will explore the importance of refinancing an auto loan and provide guidance on how to do it effectively.

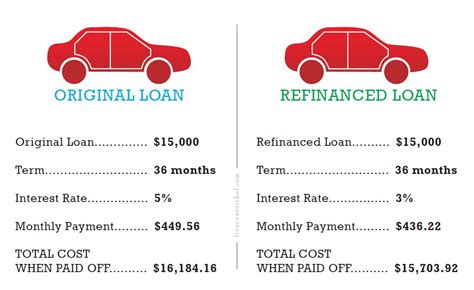

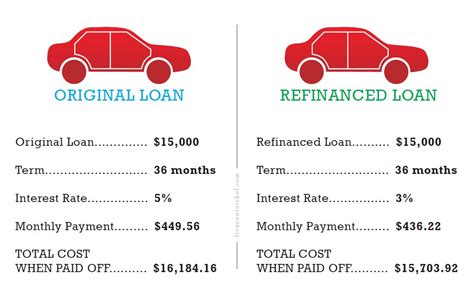

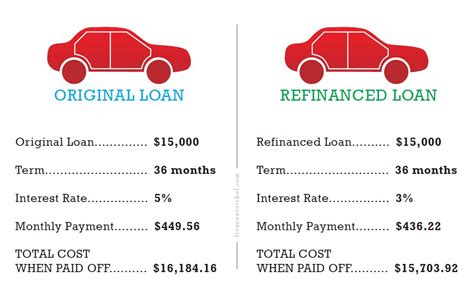

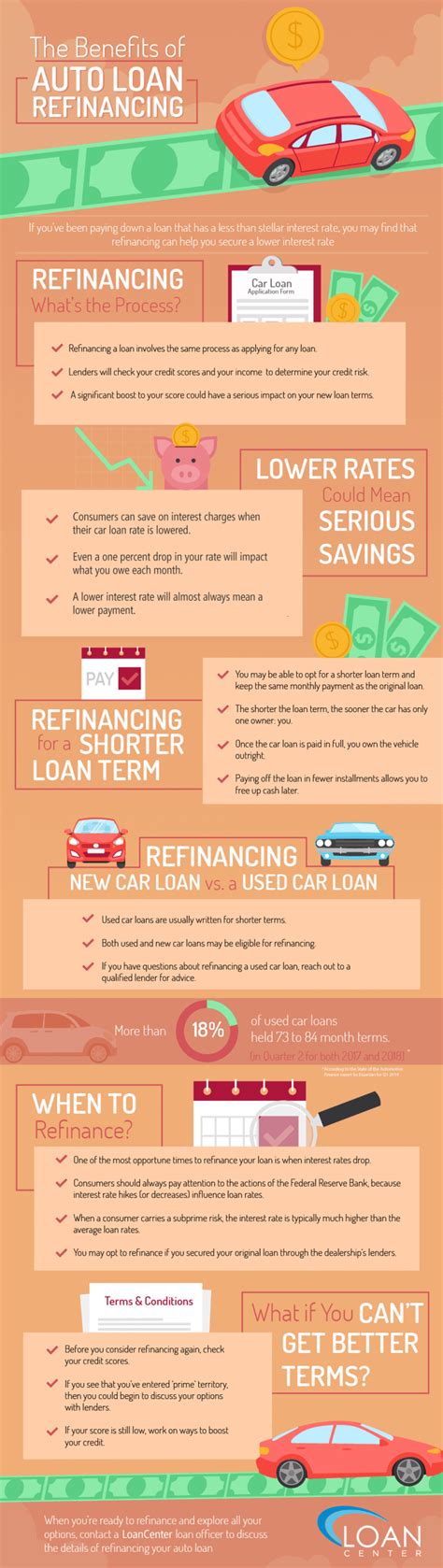

Refinancing an auto loan involves replacing an existing loan with a new one, typically with a lower interest rate, lower monthly payments, or a shorter loan term. This can be a great option for individuals who have improved their credit score since taking out the original loan or for those who want to take advantage of current low interest rates. Additionally, refinancing an auto loan can help individuals who are struggling to make monthly payments, as it can provide a more manageable and affordable payment plan.

The process of refinancing an auto loan is relatively straightforward. Individuals can start by checking their credit score and history to determine their eligibility for refinancing. They can then shop around for lenders and compare rates, terms, and conditions to find the best deal. Once a lender is chosen, the individual will need to provide documentation, such as proof of income, employment, and insurance, to complete the refinancing process. With the right guidance and support, refinancing an auto loan can be a simple and effective way to improve financial stability and reduce expenses.

Understanding Refinance Auto Loans

Refinance auto loans are designed to help individuals manage their debt and improve their financial situation. These loans can provide a range of benefits, including lower interest rates, lower monthly payments, and a shorter loan term. Refinance auto loans can also help individuals who are struggling to make monthly payments, as they can provide a more manageable and affordable payment plan. Additionally, refinance auto loans can be used to consolidate debt, reduce expenses, and improve overall financial stability.

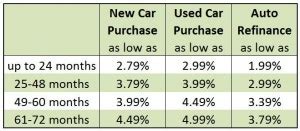

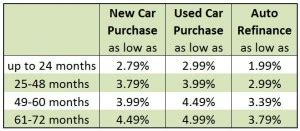

To qualify for a refinance auto loan, individuals will typically need to meet certain eligibility criteria, such as having a good credit score, a stable income, and a reliable vehicle. Lenders may also consider factors such as the individual's debt-to-income ratio, employment history, and credit history. By understanding the eligibility criteria and requirements for refinance auto loans, individuals can make informed decisions and choose the best option for their needs.

Benefits of Refinance Auto Loans

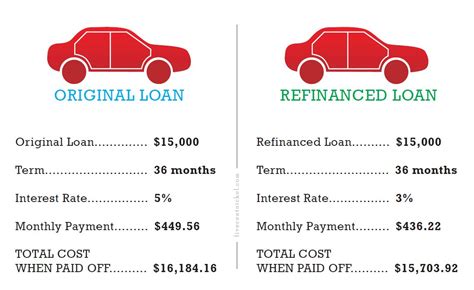

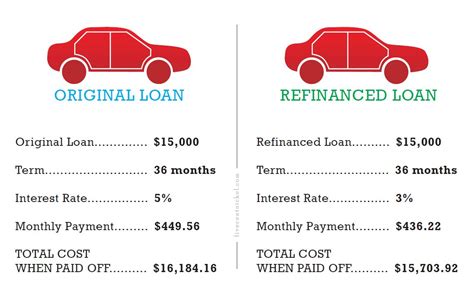

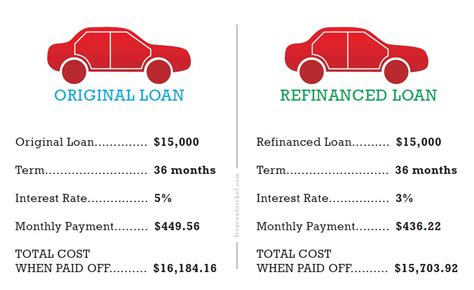

Refinance auto loans offer a range of benefits, including: * Lower interest rates: Refinance auto loans can provide lower interest rates, which can help reduce monthly payments and save money over the life of the loan. * Lower monthly payments: Refinance auto loans can provide lower monthly payments, which can help individuals manage their debt and improve their financial stability. * Shorter loan term: Refinance auto loans can provide a shorter loan term, which can help individuals pay off their debt faster and save money on interest. * Consolidation of debt: Refinance auto loans can be used to consolidate debt, reduce expenses, and improve overall financial stability. * Improved credit score: Refinance auto loans can help individuals improve their credit score by making timely payments and reducing debt.5 Ways to Refinance Auto Loans

There are several ways to refinance auto loans, including:

- Traditional Refinance: This involves replacing an existing loan with a new one, typically with a lower interest rate, lower monthly payments, or a shorter loan term.

- Online Refinance: This involves using online lenders to refinance an auto loan, which can provide a range of benefits, including lower interest rates, lower monthly payments, and a shorter loan term.

- Bank Refinance: This involves using a bank to refinance an auto loan, which can provide a range of benefits, including lower interest rates, lower monthly payments, and a shorter loan term.

- Credit Union Refinance: This involves using a credit union to refinance an auto loan, which can provide a range of benefits, including lower interest rates, lower monthly payments, and a shorter loan term.

- Dealership Refinance: This involves using a dealership to refinance an auto loan, which can provide a range of benefits, including lower interest rates, lower monthly payments, and a shorter loan term.

Steps to Refinance Auto Loans

To refinance an auto loan, individuals will need to follow these steps: * Check credit score and history to determine eligibility for refinancing * Shop around for lenders and compare rates, terms, and conditions * Choose a lender and provide documentation, such as proof of income, employment, and insurance * Complete the refinancing process and review the terms and conditions of the new loanRefinance Auto Loan Options

There are several refinance auto loan options available, including:

- Fixed-Rate Refinance: This involves replacing an existing loan with a new one with a fixed interest rate, which can provide a range of benefits, including lower monthly payments and a shorter loan term.

- Variable-Rate Refinance: This involves replacing an existing loan with a new one with a variable interest rate, which can provide a range of benefits, including lower monthly payments and a shorter loan term.

- Lease Refinance: This involves replacing an existing lease with a new one, which can provide a range of benefits, including lower monthly payments and a shorter loan term.

- Title Refinance: This involves using the title of the vehicle as collateral to secure a new loan, which can provide a range of benefits, including lower monthly payments and a shorter loan term.

Refinance Auto Loan Requirements

To qualify for a refinance auto loan, individuals will typically need to meet certain eligibility criteria, such as: * Having a good credit score * Having a stable income * Having a reliable vehicle * Meeting the lender's debt-to-income ratio requirements * Meeting the lender's employment history requirements * Meeting the lender's credit history requirementsRefinance Auto Loan Tips

Here are some tips to consider when refinancing an auto loan:

- Shop around for lenders and compare rates, terms, and conditions

- Check credit score and history to determine eligibility for refinancing

- Choose a lender that offers flexible repayment terms

- Consider a shorter loan term to save money on interest

- Make timely payments to improve credit score and reduce debt

Refinance Auto Loan Mistakes to Avoid

Here are some common mistakes to avoid when refinancing an auto loan: * Not checking credit score and history before applying for refinancing * Not shopping around for lenders and comparing rates, terms, and conditions * Not choosing a lender that offers flexible repayment terms * Not considering a shorter loan term to save money on interest * Not making timely payments to improve credit score and reduce debtRefinance Auto Loan Gallery

Refinance Auto Loan Image Gallery

Refinance Auto Loan FAQs

What is refinance auto loan?

+A refinance auto loan is a new loan that replaces an existing auto loan, typically with a lower interest rate, lower monthly payments, or a shorter loan term.

How do I qualify for a refinance auto loan?

+To qualify for a refinance auto loan, you will typically need to meet certain eligibility criteria, such as having a good credit score, a stable income, and a reliable vehicle.

What are the benefits of refinancing an auto loan?

+The benefits of refinancing an auto loan include lower interest rates, lower monthly payments, and a shorter loan term, which can help you save money and improve your financial stability.

How do I apply for a refinance auto loan?

+To apply for a refinance auto loan, you will need to shop around for lenders and compare rates, terms, and conditions, and then choose a lender that offers the best deal for your needs.

What are the common mistakes to avoid when refinancing an auto loan?

+The common mistakes to avoid when refinancing an auto loan include not checking credit score and history before applying for refinancing, not shopping around for lenders and comparing rates, terms, and conditions, and not choosing a lender that offers flexible repayment terms.

In conclusion, refinancing an auto loan can be a great way to save money, lower monthly payments, and improve overall financial stability. By understanding the benefits, requirements, and options available, individuals can make informed decisions and choose the best refinance auto loan for their needs. Whether you're looking to reduce your expenses, improve your credit score, or simply want to take advantage of current low interest rates, refinancing an auto loan can be a simple and effective way to achieve your financial goals. We encourage you to share your thoughts and experiences with refinancing an auto loan in the comments below, and don't forget to share this article with others who may benefit from this information.