Intro

Find Navy Federal Credit Union near me, with branch locations, ATM services, and financial solutions, offering banking, loans, and credit cards to military members and families, providing convenient and secure online banking and mobile banking services.

Finding a Navy Federal Credit Union near you can be a convenient way to manage your finances, especially if you're a member of the military or a Department of Defense employee. With numerous locations across the United States and abroad, Navy Federal Credit Union offers a wide range of financial services and products tailored to meet the unique needs of its members. In this article, we'll explore the importance of having a credit union near you, the benefits of Navy Federal Credit Union, and provide guidance on how to find a location near you.

Having a credit union near you can make a significant difference in your financial life. For one, it provides easy access to your accounts, allowing you to deposit, withdraw, and transfer funds as needed. Additionally, credit unions often offer more personalized service and better rates on loans and credit cards compared to traditional banks. Navy Federal Credit Union, in particular, is known for its exceptional service and commitment to supporting the financial well-being of its members.

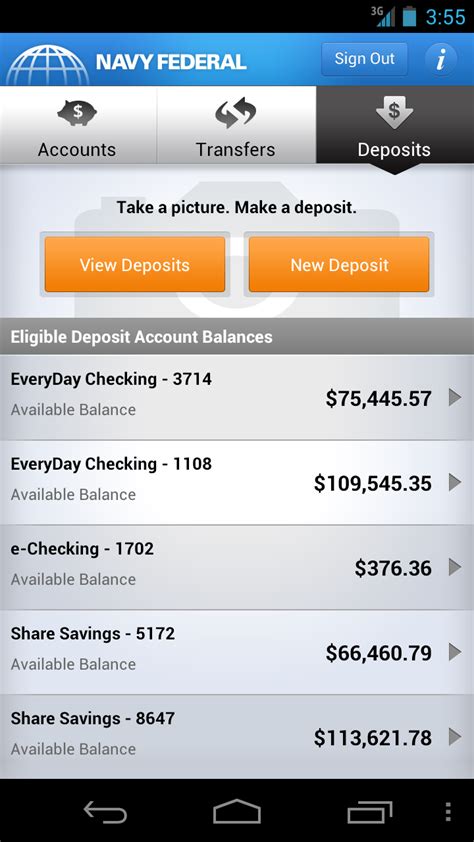

Navy Federal Credit Union has been serving the military and Department of Defense community for over 80 years, providing a wide range of financial products and services designed to meet the unique needs of its members. From checking and savings accounts to loans, credit cards, and investment services, Navy Federal Credit Union offers everything you need to manage your finances effectively. The credit union also provides online and mobile banking services, making it easy to access your accounts and conduct transactions from anywhere.

Benefits of Navy Federal Credit Union

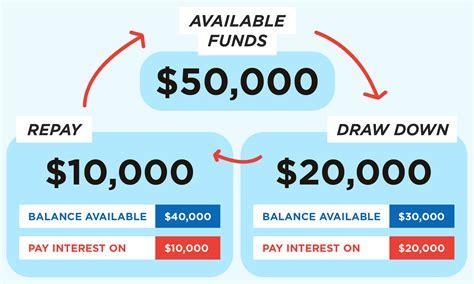

The benefits of Navy Federal Credit Union are numerous. For starters, the credit union offers competitive rates on loans and credit cards, which can help you save money on interest payments. Additionally, Navy Federal Credit Union provides a range of free services, including online and mobile banking, bill pay, and account alerts. The credit union also offers investment services, including retirement accounts and mutual funds, to help you grow your wealth over time.

Another significant benefit of Navy Federal Credit Union is its commitment to supporting the financial well-being of its members. The credit union offers financial education resources, including workshops, webinars, and online tutorials, to help you improve your financial literacy and make informed decisions about your money. Navy Federal Credit Union also provides financial counseling services, which can help you create a personalized budget and develop a plan to achieve your financial goals.

How to Find a Navy Federal Credit Union Near You

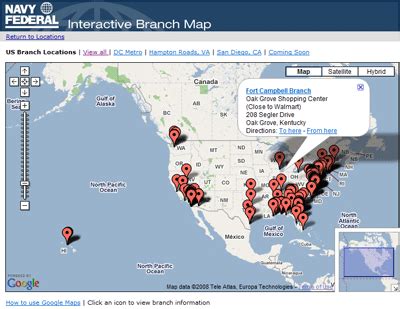

Finding a Navy Federal Credit Union near you is easy. The credit union has a large network of branches and ATMs across the United States and abroad, making it convenient to access your accounts and conduct transactions. To find a location near you, you can use the Navy Federal Credit Union website or mobile app. Simply enter your location or zip code, and you'll be shown a list of nearby branches and ATMs.

You can also use the Navy Federal Credit Union branch locator tool to find a location near you. This tool allows you to search for branches by state, city, or zip code, and provides detailed information about each location, including hours of operation, address, and phone number. Additionally, the tool allows you to filter your search results by services offered, such as ATM availability or investment services.

Navy Federal Credit Union Services

Navy Federal Credit Union offers a wide range of services designed to meet the unique needs of its members. These services include:

- Checking and savings accounts with competitive rates and low fees

- Loans, including personal loans, auto loans, and mortgages, with competitive rates and flexible terms

- Credit cards with rewards programs and low interest rates

- Investment services, including retirement accounts and mutual funds

- Online and mobile banking services, including bill pay and account alerts

- Financial education resources, including workshops, webinars, and online tutorials

- Financial counseling services to help you create a personalized budget and achieve your financial goals

Navy Federal Credit Union Membership

To become a member of Navy Federal Credit Union, you must meet certain eligibility requirements. These requirements include:

- Being a member of the military, including active duty, reserve, and retired personnel

- Being a Department of Defense employee, including civilian employees and contractors

- Being a family member of a current Navy Federal Credit Union member, including spouses, children, and parents

- Being a member of the National Guard or a veteran of the military

If you meet these eligibility requirements, you can apply for membership online or in person at a Navy Federal Credit Union branch. The application process is simple and straightforward, and you'll be required to provide certain documents, including your military ID or proof of employment.

Navy Federal Credit Union Reviews

Navy Federal Credit Union has received positive reviews from its members, with many praising the credit union's exceptional service and commitment to supporting the financial well-being of its members. Members have also praised the credit union's competitive rates on loans and credit cards, as well as its wide range of financial products and services.

However, some members have reported issues with the credit union's online and mobile banking services, including difficulties with login and transaction processing. Additionally, some members have reported long wait times at branches and on the phone, which can be frustrating for those who need to conduct transactions quickly.

Navy Federal Credit Union Fees

Navy Federal Credit Union charges fees for certain services, including overdrafts, ATM withdrawals, and loan applications. However, the credit union also offers a range of free services, including online and mobile banking, bill pay, and account alerts.

To avoid fees, it's essential to understand the credit union's fee schedule and to plan your transactions accordingly. For example, you can avoid overdraft fees by keeping a close eye on your account balance and by setting up account alerts to notify you when your balance is low.

Gallery of Navy Federal Credit Union

Navy Federal Credit Union Image Gallery

What are the benefits of Navy Federal Credit Union membership?

+The benefits of Navy Federal Credit Union membership include competitive rates on loans and credit cards, free services such as online and mobile banking, and access to financial education resources and counseling services.

How do I become a member of Navy Federal Credit Union?

+To become a member of Navy Federal Credit Union, you must meet certain eligibility requirements, including being a member of the military, a Department of Defense employee, or a family member of a current Navy Federal Credit Union member. You can apply for membership online or in person at a Navy Federal Credit Union branch.

What services does Navy Federal Credit Union offer?

+Navy Federal Credit Union offers a wide range of services, including checking and savings accounts, loans, credit cards, investment services, online and mobile banking, and financial education resources and counseling services.

In summary, Navy Federal Credit Union is a great option for those who are eligible for membership. With its competitive rates, wide range of financial products and services, and commitment to supporting the financial well-being of its members, Navy Federal Credit Union can help you achieve your financial goals. Whether you're looking to save money, invest for the future, or simply manage your day-to-day finances, Navy Federal Credit Union has the resources and expertise to help. We encourage you to share this article with others who may be interested in learning more about Navy Federal Credit Union and its services. By working together, we can help each other achieve financial success and stability.