Intro

Explore 5 Navy Federal Business Loans, including term loans, lines of credit, and commercial real estate financing, with competitive rates and flexible repayment terms, ideal for small business owners and entrepreneurs seeking business funding solutions.

As a business owner, accessing capital is crucial for growth, expansion, and navigating unexpected expenses. Navy Federal Credit Union, one of the largest credit unions in the world, offers a variety of business loan options tailored to meet the diverse needs of its members. With a strong reputation for providing competitive rates and flexible terms, Navy Federal has become a go-to financial institution for businesses seeking funding. In this article, we will delve into the world of Navy Federal business loans, exploring the benefits, types of loans available, and what you need to know to make an informed decision.

Navy Federal Credit Union has been serving its members for over 80 years, providing a wide range of financial products and services. Its business loan offerings are designed to support businesses of all sizes, from small startups to large enterprises. Whether you're looking to finance new equipment, expand your operations, or manage cash flow, Navy Federal has a loan solution that can help. With its member-centric approach and commitment to providing excellent customer service, Navy Federal has built a loyal following among business owners.

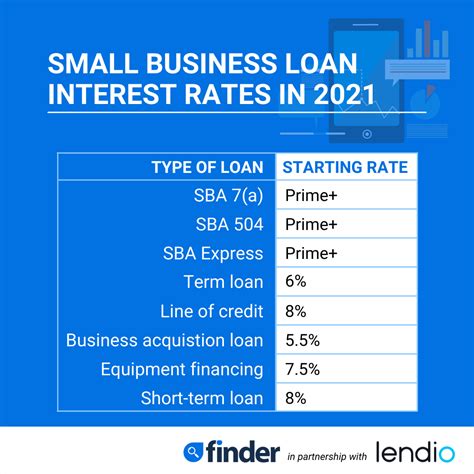

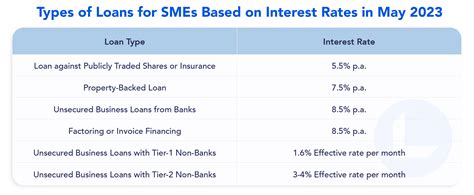

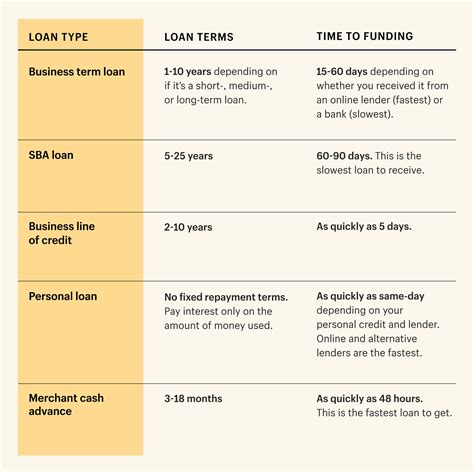

The importance of accessing the right funding at the right time cannot be overstated. It can be the difference between seizing new opportunities and missing out on potential growth. Navy Federal understands this and has structured its business loan products to be as accessible and beneficial as possible. From lines of credit to term loans, and from commercial real estate loans to equipment financing, the options are designed to fit various business needs. Moreover, with competitive interest rates and flexible repayment terms, Navy Federal aims to make borrowing as affordable and manageable as possible.

Benefits of Navy Federal Business Loans

Types of Navy Federal Business Loans

Navy Federal offers a diverse range of business loan products to cater to different business requirements. This includes lines of credit for managing cash flow and covering unexpected expenses, term loans for long-term financing needs such as expansion or equipment purchase, and commercial real estate loans for buying, refinancing, or improving property. Each type of loan is designed with the business owner in mind, aiming to provide the necessary funding while minimizing the burden of repayment.How to Apply for a Navy Federal Business Loan

Eligibility Criteria for Navy Federal Business Loans

To be eligible for a Navy Federal business loan, your business must meet certain criteria. This includes being a member of Navy Federal Credit Union, which requires having a direct relationship with the military, Department of Defense, or National Guard, among other qualifying factors. Your business financials, credit history, and the purpose of the loan are also considered in the application process. Navy Federal looks for businesses with a strong financial foundation and a clear plan for how the loan funds will be used to grow or sustain the business.Managing Your Navy Federal Business Loan

Tips for Repaying Your Navy Federal Business Loan

Repaying your business loan in a timely and efficient manner is essential for maintaining a healthy financial profile and ensuring you have access to future funding when needed. Tips for repayment include creating a budget that prioritizes loan payments, considering bi-weekly payments to reduce the principal amount faster, and keeping a close eye on interest rates and terms to potentially refinance if more favorable conditions become available. Navy Federal's customer service team is always available to provide guidance and support throughout the repayment process.Navy Federal Business Loan Rates and Terms

Common Uses of Navy Federal Business Loans

Navy Federal business loans can be used for a variety of purposes, including purchasing new equipment, expanding your business operations, refinancing existing debt, or covering seasonal cash flow needs. The flexibility in how you can use the loan funds means you can address immediate needs or invest in long-term growth strategies. Whether you're in the early stages of your business venture or are looking to take your established business to the next level, Navy Federal has a loan solution that can help.Conclusion and Next Steps

Final Thoughts on Navy Federal Business Loans

As you consider your business financing options, remember that Navy Federal is more than just a lender; it's a partner in your business's success. With its commitment to excellence, member-centric approach, and wide range of business loan products, Navy Federal is an excellent choice for businesses seeking reliable and flexible funding solutions. Take the first step towards achieving your business goals by exploring Navy Federal's business loan options today.Navy Federal Business Loan Image Gallery

What types of business loans does Navy Federal offer?

+Navy Federal offers a variety of business loans, including lines of credit, term loans, commercial real estate loans, and equipment financing, designed to meet the diverse needs of its business members.

How do I apply for a Navy Federal business loan?

+To apply for a Navy Federal business loan, you can start the application process online, visit a branch, or speak with a business services representative. You will need to provide required documents, including business and personal financial statements, tax returns, and business registration documents.

What are the benefits of choosing Navy Federal for my business loan needs?

+Choosing Navy Federal for your business loan needs offers several benefits, including competitive rates, flexible terms, personalized service, and access to financial counseling and planning services. As a member-centric institution, Navy Federal reinvests its profits to benefit its members, often resulting in better loan terms.

We invite you to share your experiences or ask questions about Navy Federal business loans in the comments below. Whether you're a current business owner or just starting out, understanding your financing options is a crucial step in achieving your goals. By choosing the right loan and financial partner, you can set your business up for success and navigate the challenges of the business world with confidence.