Intro

Consolidate debt with Navy Federal loans, offering low rates and flexible terms, helping members manage credit card debt, personal loans, and bills, with benefits like simplified payments and reduced interest rates.

Debt consolidation has become a popular strategy for managing multiple debts, and financial institutions like Navy Federal Credit Union offer debt consolidation loans to help individuals simplify their financial obligations. For those struggling with multiple debts, a debt consolidation loan can provide a sense of relief and a fresh start. In this article, we will explore the importance of debt consolidation, the benefits of Navy Federal debt consolidation loans, and how they work.

Debt consolidation is a financial strategy that involves combining multiple debts into one loan with a single interest rate, monthly payment, and due date. This approach can help individuals manage their debts more efficiently, reduce stress, and save money on interest charges. With the rising costs of living and easy access to credit, many people find themselves juggling multiple debts, including credit cards, personal loans, and mortgages. Debt consolidation loans can help individuals take control of their finances, pay off high-interest debts, and achieve financial stability.

The benefits of debt consolidation are numerous, and they can have a significant impact on an individual's financial well-being. By consolidating debts, individuals can simplify their financial obligations, reduce their monthly payments, and save money on interest charges. Debt consolidation loans can also help individuals avoid late fees, penalties, and negative credit reporting. Moreover, debt consolidation can provide a sense of relief and reduce stress, as individuals only have to worry about one loan payment instead of multiple debts.

Navy Federal Debt Consolidation Loans Overview

Navy Federal Credit Union offers debt consolidation loans to its members, providing a convenient and affordable way to manage multiple debts. Navy Federal debt consolidation loans have competitive interest rates, flexible repayment terms, and no origination fees. These loans can be used to consolidate credit card debt, personal loans, and other debts, helping individuals simplify their financial obligations and achieve financial stability. With a Navy Federal debt consolidation loan, individuals can enjoy a single monthly payment, a fixed interest rate, and a clear repayment schedule.

Benefits of Navy Federal Debt Consolidation Loans

The benefits of Navy Federal debt consolidation loans are numerous, and they can have a significant impact on an individual's financial well-being. Some of the benefits include: * Competitive interest rates: Navy Federal debt consolidation loans have competitive interest rates, which can help individuals save money on interest charges. * Flexible repayment terms: Navy Federal offers flexible repayment terms, allowing individuals to choose a repayment schedule that suits their needs. * No origination fees: Navy Federal debt consolidation loans have no origination fees, which can save individuals money on upfront costs. * Single monthly payment: With a Navy Federal debt consolidation loan, individuals only have to worry about one monthly payment, making it easier to manage their finances. * Fixed interest rate: Navy Federal debt consolidation loans have a fixed interest rate, providing individuals with a clear understanding of their monthly payments and repayment schedule.How Navy Federal Debt Consolidation Loans Work

Navy Federal debt consolidation loans work by allowing individuals to combine multiple debts into one loan with a single interest rate, monthly payment, and due date. To apply for a Navy Federal debt consolidation loan, individuals must be members of the credit union, which requires military affiliation or employment with the Department of Defense. Once individuals have become members, they can apply for a debt consolidation loan online, by phone, or in person at a Navy Federal branch.

The application process typically involves providing financial information, such as income, expenses, and debt obligations. Navy Federal will review the application and provide a loan offer, which includes the interest rate, repayment terms, and monthly payment. If individuals accept the loan offer, they can use the funds to pay off their debts and simplify their financial obligations.

Eligibility Requirements

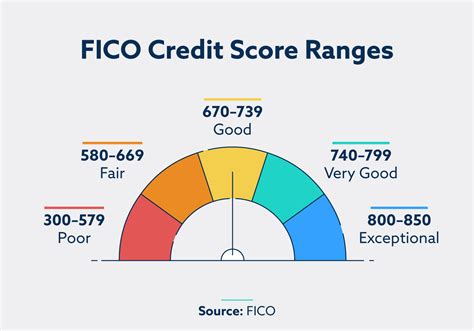

To be eligible for a Navy Federal debt consolidation loan, individuals must meet certain requirements, including: * Membership: Individuals must be members of Navy Federal Credit Union, which requires military affiliation or employment with the Department of Defense. * Credit score: Individuals must have a good credit score, which can affect the interest rate and repayment terms of the loan. * Income: Individuals must have a stable income, which can affect their ability to repay the loan. * Debt-to-income ratio: Individuals must have a manageable debt-to-income ratio, which can affect their ability to repay the loan.Types of Debt Consolidation Loans Offered by Navy Federal

Navy Federal offers several types of debt consolidation loans, including:

- Personal loans: Navy Federal personal loans can be used to consolidate debt, pay for unexpected expenses, or finance large purchases.

- Credit card consolidation loans: Navy Federal credit card consolidation loans can be used to pay off high-interest credit card debt and simplify financial obligations.

- Home equity loans: Navy Federal home equity loans can be used to consolidate debt, finance home improvements, or pay for large expenses.

Repayment Terms and Interest Rates

Navy Federal debt consolidation loans have competitive interest rates and flexible repayment terms, which can vary depending on the type of loan and individual circumstances. Some of the repayment terms and interest rates include: * Interest rates: Navy Federal debt consolidation loans have interest rates ranging from 6.99% to 18.00% APR. * Repayment terms: Navy Federal debt consolidation loans have repayment terms ranging from 12 to 60 months. * Monthly payments: Navy Federal debt consolidation loans have monthly payments that can vary depending on the interest rate, repayment term, and loan amount.Advantages and Disadvantages of Navy Federal Debt Consolidation Loans

Navy Federal debt consolidation loans have several advantages, including competitive interest rates, flexible repayment terms, and no origination fees. However, there are also some disadvantages, including:

- Credit score requirements: Navy Federal debt consolidation loans require a good credit score, which can be a challenge for individuals with poor credit.

- Income requirements: Navy Federal debt consolidation loans require a stable income, which can be a challenge for individuals with irregular income.

- Debt-to-income ratio: Navy Federal debt consolidation loans require a manageable debt-to-income ratio, which can be a challenge for individuals with high debt levels.

Alternatives to Navy Federal Debt Consolidation Loans

There are several alternatives to Navy Federal debt consolidation loans, including: * Balance transfer credit cards: Balance transfer credit cards can be used to consolidate debt and save money on interest charges. * Personal loans: Personal loans can be used to consolidate debt and simplify financial obligations. * Debt management plans: Debt management plans can be used to consolidate debt and negotiate with creditors.Conclusion and Next Steps

In conclusion, Navy Federal debt consolidation loans can be a useful tool for individuals struggling with multiple debts. With competitive interest rates, flexible repayment terms, and no origination fees, these loans can help individuals simplify their financial obligations and achieve financial stability. However, it is essential to carefully consider the advantages and disadvantages of Navy Federal debt consolidation loans and explore alternative options before making a decision.

If you are struggling with debt and considering a Navy Federal debt consolidation loan, it is essential to take the next steps:

- Check your credit score and report to ensure you meet the eligibility requirements.

- Gather financial information, such as income, expenses, and debt obligations.

- Apply for a Navy Federal debt consolidation loan online, by phone, or in person at a Navy Federal branch.

- Carefully review the loan offer and terms before accepting the loan.

Navy Federal Debt Consolidation Loans Image Gallery

What is a debt consolidation loan?

+A debt consolidation loan is a type of loan that allows individuals to combine multiple debts into one loan with a single interest rate, monthly payment, and due date.

How do I apply for a Navy Federal debt consolidation loan?

+To apply for a Navy Federal debt consolidation loan, individuals must be members of the credit union and apply online, by phone, or in person at a Navy Federal branch.

What are the benefits of a Navy Federal debt consolidation loan?

+The benefits of a Navy Federal debt consolidation loan include competitive interest rates, flexible repayment terms, and no origination fees.

Can I use a Navy Federal debt consolidation loan to consolidate credit card debt?

+Yes, Navy Federal debt consolidation loans can be used to consolidate credit card debt and simplify financial obligations.

How long does it take to repay a Navy Federal debt consolidation loan?

+The repayment term for a Navy Federal debt consolidation loan can range from 12 to 60 months, depending on the loan amount and individual circumstances.

We hope this article has provided you with a comprehensive understanding of Navy Federal debt consolidation loans and how they can help you achieve financial stability. If you have any further questions or would like to share your experiences with debt consolidation, please comment below. Additionally, if you found this article helpful, please share it with others who may be struggling with debt. Remember, taking control of your finances is the first step towards achieving financial freedom.