Intro

Get the Navy Federal Direct Deposit Form to set up automatic payroll deposits, ensuring timely and secure transactions with Navy Federal Credit Unions direct deposit services and benefits.

The Navy Federal Direct Deposit Form is a crucial document for members of Navy Federal Credit Union who want to set up direct deposit for their accounts. Direct deposit is a convenient and secure way to receive payments, such as paychecks, government benefits, or tax refunds, directly into one's account. In this article, we will delve into the importance of the Navy Federal Direct Deposit Form, its benefits, and the steps to fill it out correctly.

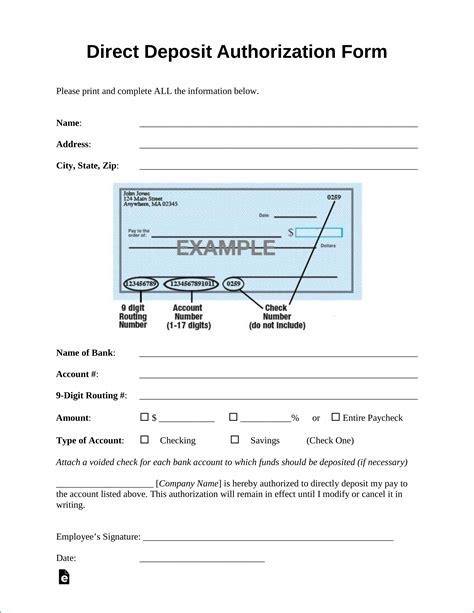

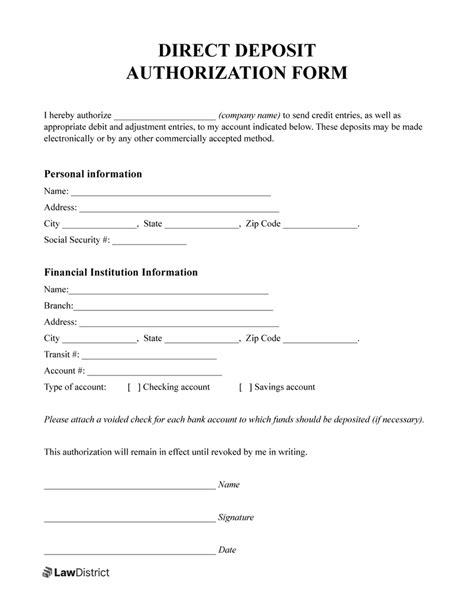

Setting up direct deposit can save time and reduce the risk of lost or stolen checks. It also helps to avoid delays in receiving payments, as the funds are deposited directly into the account on the payment date. Moreover, direct deposit is an environmentally friendly option, as it reduces the need for paper checks and mailing. The Navy Federal Direct Deposit Form is a simple and straightforward document that requires basic information, such as the account holder's name, account number, and routing number.

Benefits of Direct Deposit

How to Fill Out the Navy Federal Direct Deposit Form

Types of Accounts Eligible for Direct Deposit

Common Uses of Direct Deposit

Troubleshooting Common Issues

Security and Fraud Protection

Conclusion and Next Steps

Direct Deposit Image Gallery

What is the Navy Federal Direct Deposit Form used for?

+The Navy Federal Direct Deposit Form is used to set up direct deposit for Navy Federal Credit Union accounts, allowing members to receive payments directly into their accounts.

How do I fill out the Navy Federal Direct Deposit Form?

+To fill out the form, download it from the Navy Federal Credit Union website or obtain it from a local branch, and provide the required information, including account holder's name, account number, and routing number.

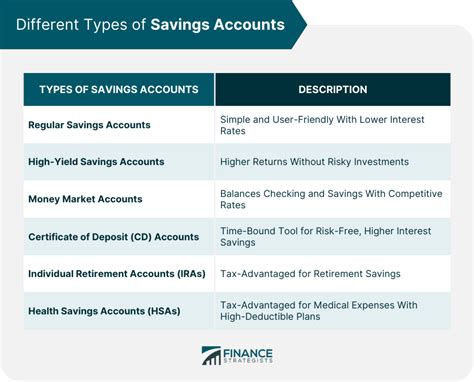

What types of accounts are eligible for direct deposit?

+Most types of accounts are eligible for direct deposit, including checking accounts, savings accounts, money market accounts, certificates of deposit (CDs), and individual retirement accounts (IRAs).

We hope this article has provided you with a comprehensive understanding of the Navy Federal Direct Deposit Form and its benefits. If you have any further questions or would like to share your experiences with direct deposit, please comment below. Additionally, feel free to share this article with others who may benefit from this information.