Intro

Discover Navy Federal Credit Unions Fayetteville NC branch, offering banking services, loans, and financial solutions with membership benefits, online banking, and investment options for military personnel and families.

The Navy Federal Credit Union is a well-established financial institution that serves the military community, including active duty personnel, veterans, and their families. With numerous branches across the United States, one of its notable locations is the Fayetteville, NC branch. This branch provides a wide range of financial services and products tailored to meet the unique needs of its members. In this article, we will delve into the details of the Navy Federal Credit Union Fayetteville, NC branch, exploring its services, benefits, and what sets it apart from other financial institutions.

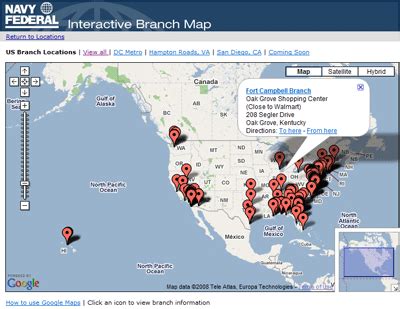

The Navy Federal Credit Union has a long history of serving the military community, dating back to 1933 when it was founded by a group of seven Navy Department employees. Over the years, it has grown to become one of the largest credit unions in the world, with over 10 million members and more than $150 billion in assets. The Fayetteville, NC branch is one of its many locations, strategically situated to serve the large military population in the area. Fayetteville is home to Fort Bragg, one of the largest military bases in the world, making the Navy Federal Credit Union a vital financial resource for the local community.

Services and Products

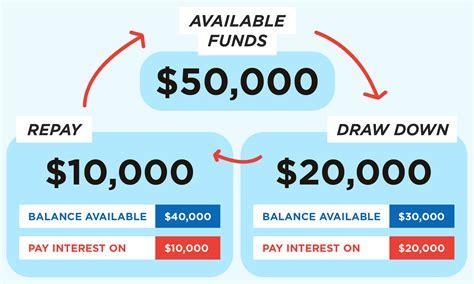

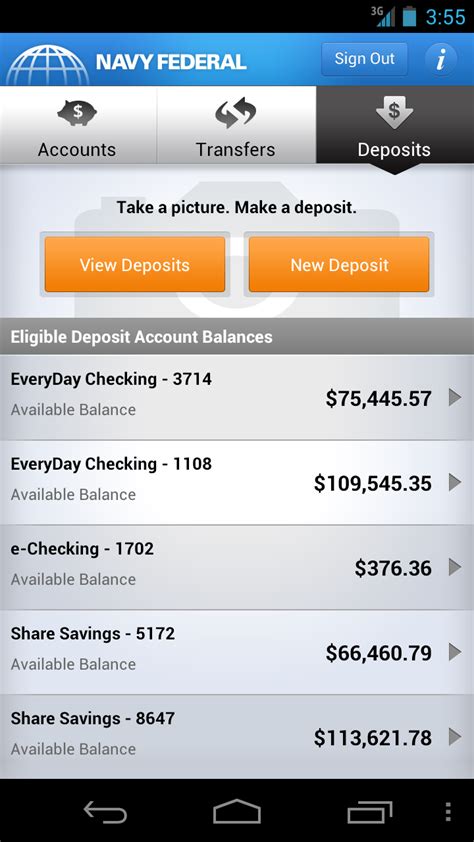

The Navy Federal Credit Union Fayetteville, NC branch offers a comprehensive range of financial services and products designed to meet the diverse needs of its members. These include checking and savings accounts, credit cards, personal loans, mortgages, and investment products. The credit union is known for its competitive rates, flexible terms, and low fees, making it an attractive option for those looking for affordable financial solutions. Additionally, the branch provides access to a network of ATMs, online banking, and mobile banking services, allowing members to manage their finances conveniently and securely.

One of the standout features of the Navy Federal Credit Union is its commitment to serving the military community. The credit union offers specialized products and services tailored to the unique needs of military personnel and their families. For example, it provides deployment loans, PCS (Permanent Change of Station) loans, and VA mortgage loans, among others. These products are designed to help members navigate the financial challenges associated with military life, such as frequent relocations and deployments.

Benefits of Membership

Membership in the Navy Federal Credit Union comes with a multitude of benefits. One of the most significant advantages is access to competitive rates and low fees. The credit union is a not-for-profit organization, which means that it returns its profits to its members in the form of better rates and lower fees. This can result in significant savings over time, especially for members with large balances or those who frequently use credit union services.

Another benefit of membership is the credit union's commitment to financial education and wellness. The Navy Federal Credit Union offers a range of resources and tools to help members manage their finances effectively, including financial counseling, budgeting workshops, and online educational materials. This focus on financial education empowers members to make informed decisions about their money and achieve their long-term financial goals.

Working Mechanisms

The Navy Federal Credit Union operates on a member-owned, not-for-profit basis. This means that the credit union is controlled by its members, who elect a board of directors to oversee the organization's operations. The board is responsible for setting the credit union's strategic direction, approving policies, and ensuring that the organization remains financially sound.

The credit union's working mechanisms are designed to promote efficiency, security, and member satisfaction. It uses advanced technology to provide secure online and mobile banking services, allowing members to access their accounts and conduct transactions from anywhere. The credit union also has a robust risk management framework in place, which includes measures to prevent fraud, protect member data, and maintain the stability of the organization.

Steps to Become a Member

Becoming a member of the Navy Federal Credit Union is a straightforward process. To be eligible for membership, individuals must meet certain criteria, such as being an active duty or retired member of the military, a veteran, or a family member of a military personnel. The membership application process typically involves the following steps:

- Check Eligibility: Determine if you are eligible for membership based on the credit union's criteria.

- Gather Required Documents: Collect the necessary documents, such as your military ID, social security number, and proof of address.

- Apply Online or In-Person: Submit your application online or visit a branch in person.

- Fund Your Account: Deposit a minimum amount into your account to activate your membership.

- Explore Services and Benefits: Familiarize yourself with the credit union's services and benefits, and start taking advantage of them.

Practical Examples and Statistical Data

The Navy Federal Credit Union has a proven track record of serving the military community effectively. According to its annual reports, the credit union has consistently delivered strong financial performance, with assets growing by over 10% annually. Additionally, member satisfaction ratings are high, with over 90% of members reporting that they are satisfied with the credit union's services.

In terms of practical examples, the Navy Federal Credit Union has helped numerous members achieve their financial goals. For instance, it has provided deployment loans to military personnel, allowing them to cover expenses related to their deployments. It has also offered VA mortgage loans to veterans, enabling them to purchase homes at competitive rates.

Gallery of Navy Federal Credit Union

Navy Federal Credit Union Image Gallery

Frequently Asked Questions

What are the eligibility criteria for joining the Navy Federal Credit Union?

+To be eligible for membership, individuals must meet certain criteria, such as being an active duty or retired member of the military, a veteran, or a family member of a military personnel.

What types of loans does the Navy Federal Credit Union offer?

+The Navy Federal Credit Union offers a range of loans, including personal loans, mortgages, auto loans, and credit card loans.

Can I access my account online or through a mobile app?

+Yes, the Navy Federal Credit Union offers online banking and a mobile app, allowing members to access their accounts and conduct transactions from anywhere.

In conclusion, the Navy Federal Credit Union Fayetteville, NC branch is a valuable resource for the military community, offering a range of financial services and products tailored to meet the unique needs of its members. With its commitment to serving the military community, competitive rates, and low fees, the credit union is an attractive option for those looking for affordable financial solutions. Whether you are an active duty personnel, veteran, or family member of a military personnel, the Navy Federal Credit Union is worth considering for your financial needs. We invite you to share your experiences with the Navy Federal Credit Union or ask questions about its services in the comments below. Additionally, if you found this article informative, please consider sharing it with others who may benefit from the credit union's services.