Intro

Unlock smart borrowing with 5 HELOC tips, including home equity management, loan options, and interest rate strategies, to maximize your line of credit and minimize debt.

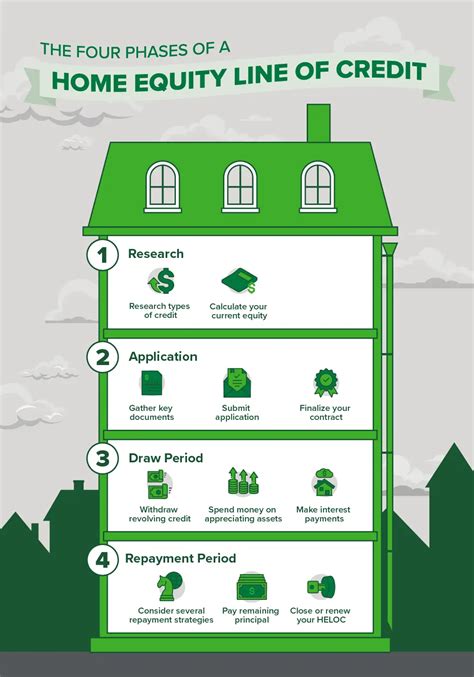

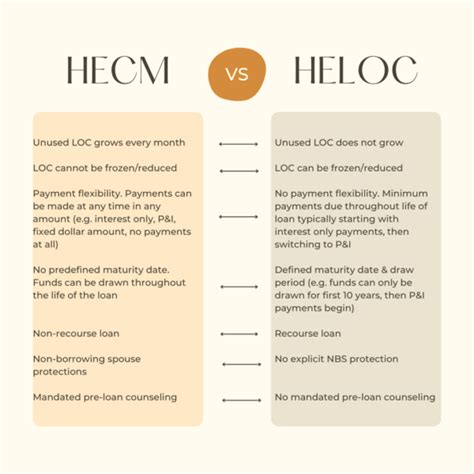

Home equity lines of credit, commonly referred to as HELOCs, have become a popular financial tool for homeowners looking to tap into the value of their property. With a HELOC, homeowners can borrow money using the equity in their home as collateral, often at a lower interest rate than other types of loans. However, navigating the world of HELOCs can be complex, and it's essential to understand the ins and outs before making a decision. In this article, we'll delve into the world of HELOCs, exploring their benefits, drawbacks, and providing valuable tips for those considering this financial option.

For many homeowners, a HELOC can be a lifeline, providing access to much-needed funds for home renovations, debt consolidation, or unexpected expenses. However, it's crucial to approach HELOCs with caution, as they can also lead to financial pitfalls if not managed properly. With the right knowledge and strategy, homeowners can harness the power of a HELOC to achieve their financial goals. Whether you're looking to upgrade your home, pay off high-interest debt, or simply have a financial safety net, a HELOC can be a valuable tool in your financial arsenal.

As we explore the world of HELOCs, it's essential to consider the potential risks and benefits. On one hand, HELOCs offer flexibility and convenience, allowing homeowners to borrow and repay funds as needed. On the other hand, HELOCs can be complex, with variable interest rates, fees, and repayment terms that can be difficult to navigate. By understanding the intricacies of HELOCs and following expert tips, homeowners can make informed decisions and avoid common pitfalls. In the following sections, we'll dive deeper into the world of HELOCs, providing actionable advice and insights to help homeowners make the most of this financial tool.

Understanding HELOCs

Benefits of HELOCs

Some of the benefits of HELOCs include: * Flexibility: HELOCs allow homeowners to borrow and repay funds as needed, making them ideal for ongoing expenses or projects. * Low interest rates: HELOCs often have lower interest rates than other types of loans, such as personal loans or credit cards. * Tax benefits: The interest on a HELOC may be tax-deductible, making it a more attractive option for homeowners. * Large credit limits: HELOCs can provide access to large amounts of credit, making them ideal for major expenses or projects.HELOC Tips and Strategies

Common HELOC Mistakes

Some common mistakes to avoid when using a HELOC include: * Borrowing too much: Borrowing more than you need can lead to unnecessary debt and interest payments. * Not understanding the terms: Failing to understand the terms and conditions of the HELOC can lead to surprises down the road. * Not making timely payments: Failing to make payments on time can lead to late fees and negative credit reporting. * Using the HELOC for non-essential expenses: Using the HELOC for non-essential expenses, such as vacations or luxury items, can lead to financial trouble.HELOC Alternatives

HELOC FAQs

Here are some frequently asked questions about HELOCs: * What is a HELOC? * How do I qualify for a HELOC? * What are the benefits of a HELOC? * What are the risks of a HELOC?HELOC Best Practices

HELOC and Credit Score

Here are some tips for maintaining a good credit score while using a HELOC: * Make timely payments: Making payments on time can help improve your credit score. * Keep credit utilization low: Keeping credit utilization low can help improve your credit score. * Monitor your credit report: Monitoring your credit report can help you identify errors or inaccuracies. * Avoid applying for too much credit: Avoid applying for too much credit, as this can negatively impact your credit score.HELOC and Tax Implications

HELOC and Foreclosure

Here are some tips for avoiding foreclosure when using a HELOC: * Make timely payments: Making payments on time can help avoid foreclosure. * Keep track of your expenses: Keeping track of your expenses can help ensure you're not overspending. * Review your budget: Reviewing your budget regularly can help ensure you're using the HELOC responsibly. * Seek professional help: Seeking professional help, such as a financial advisor, can help you navigate the complexities of a HELOC.HELOC Image Gallery

What is a HELOC?

+A HELOC is a type of revolving credit that allows homeowners to borrow and repay funds as needed, using the equity in their home as collateral.

How do I qualify for a HELOC?

+To qualify for a HELOC, you'll typically need to have a good credit score, a stable income, and sufficient equity in your home.

What are the benefits of a HELOC?

+The benefits of a HELOC include flexibility, low interest rates, and tax benefits, making it a popular financial tool for homeowners.

In conclusion, HELOCs can be a valuable financial tool for homeowners, offering flexibility, low interest rates, and tax benefits. However, it's essential to approach HELOCs with caution, understanding the potential risks and benefits, and following expert tips and strategies to get the most out of this financial option. By doing so, homeowners can harness the power of a HELOC to achieve their financial goals, whether it's upgrading their home, paying off high-interest debt, or simply having a financial safety net. We invite you to share your thoughts and experiences with HELOCs in the comments below, and don't forget to share this article with anyone who may benefit from this valuable information.