Intro

Unlock smart mortgage planning with 5 essential calculator tips, including loan estimates, interest rates, and repayment terms, to make informed home financing decisions and avoid costly mistakes.

Purchasing a home is one of the most significant investments many people will ever make. With the numerous options available, from fixed-rate to adjustable-rate mortgages, and the various factors that influence monthly payments, such as interest rates and loan terms, navigating the mortgage landscape can be daunting. This is where a mortgage calculator comes into play, serving as an indispensable tool for potential homeowners to estimate their monthly mortgage payments and make informed decisions about their financial futures. Understanding how to effectively use a mortgage calculator can significantly impact one's ability to manage their mortgage obligations wisely.

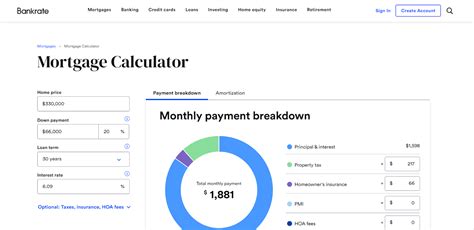

The importance of accurately calculating mortgage payments cannot be overstated. It not only helps in planning the budget but also in choosing the right mortgage product that aligns with one's financial situation and goals. For instance, a mortgage calculator can help compare the total cost of different mortgage options over their lifespan, including the principal amount borrowed, the interest paid, and other costs such as property taxes and insurance. This comparison can reveal significant differences in the long-term cost of mortgages that may seem similar at first glance.

Moreover, the process of using a mortgage calculator encourages potential homeowners to consider various scenarios, such as how changes in interest rates or the loan term might affect their monthly payments. This forward-thinking approach can protect buyers from unexpected financial burdens, ensuring that their dream of homeownership does not become a source of stress. By exploring different mortgage scenarios, individuals can identify the most affordable and sustainable option for their unique financial circumstances.

Understanding Mortgage Calculators

Mortgage calculators are designed to simplify the complex process of determining mortgage affordability and payments. They typically require several key pieces of information: the purchase price of the home, the down payment amount, the interest rate, the loan term, and sometimes additional costs like property taxes and insurance. By inputting these details, users can quickly obtain an estimate of their monthly mortgage payment. This basic functionality makes mortgage calculators an essential resource for anyone considering purchasing a home.

Key Components of Mortgage Calculators

The primary components that users need to understand when utilizing a mortgage calculator include: - **Purchase Price**: The total cost of the home. - **Down Payment**: The amount paid upfront, which reduces the amount borrowed. - **Interest Rate**: The percentage at which interest is paid on the loan. - **Loan Term**: The length of time over which the loan is repaid, typically in years. - **Property Taxes and Insurance**: Additional monthly costs associated with homeownership.Using Mortgage Calculators Effectively

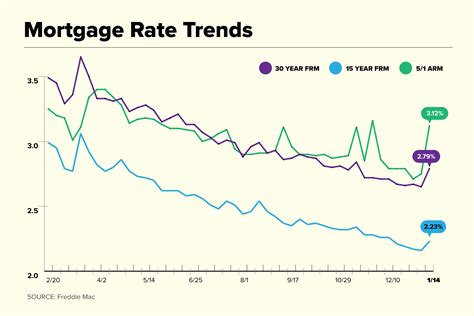

To get the most out of a mortgage calculator, it's crucial to use it in a way that reflects real-world scenarios. This involves considering not just the monthly payment, but also the total cost of the mortgage over its lifespan. For example, while a longer loan term may result in lower monthly payments, it also means paying more in interest over the life of the loan. Conversely, a shorter loan term, such as a 15-year mortgage, will have higher monthly payments but less total interest paid.

Strategies for Mortgage Calculator Use

Some strategies for effective use include: - **Comparing Loan Terms**: Evaluate how different loan terms (e.g., 15 vs. 30 years) affect monthly payments and total interest paid. - **Assessing Interest Rates**: Explore how variations in interest rates impact the mortgage. - **Calculating Affordability**: Determine the maximum home price that fits within your budget based on the calculated monthly payments.Mortgage Calculator Tips for Home Buyers

For potential home buyers, utilizing a mortgage calculator is a critical step in the home purchasing process. It allows buyers to assess their financial readiness for homeownership, explore different mortgage options, and make informed decisions about their purchase. Here are some tips specifically for home buyers:

- Start Early: Use a mortgage calculator well before beginning the home search to understand budget constraints.

- Explore Scenarios: Use the calculator to compare different mortgage products and scenarios.

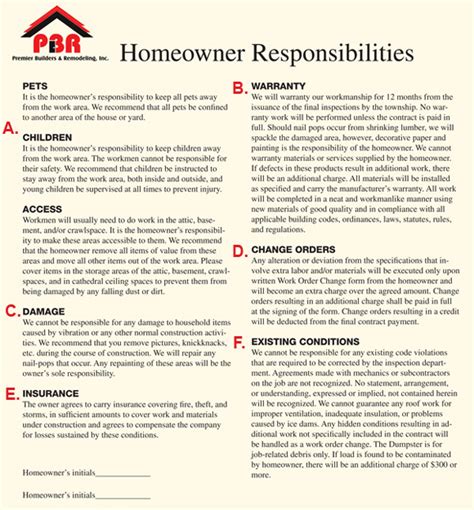

- Consider All Costs: Factor in all costs associated with homeownership, not just the mortgage payment.

Additional Costs to Consider

Beyond the mortgage payment, home buyers should also account for: - **Property Taxes**: Vary by location and can significantly impact monthly costs. - **Insurance**: Includes homeowner's insurance and possibly mortgage insurance. - **Maintenance and Repairs**: Ongoing costs of maintaining the property.Advanced Mortgage Calculator Features

Some mortgage calculators offer advanced features that can provide a more detailed analysis of mortgage options. These might include the ability to calculate payments for adjustable-rate mortgages, to factor in extra payments for paying off the mortgage early, or to compare the costs of different types of mortgages, such as FHA vs. conventional loans.

Utilizing Advanced Features

Advanced features can help in: - **Refinancing Decisions**: Determine if refinancing to a new mortgage could save money. - **Extra Payments**: Calculate how making additional payments can reduce the loan term and total interest paid. - **Mortgage Types**: Compare the benefits and drawbacks of different mortgage types, such as government-backed vs. conventional loans.Conclusion and Next Steps

In conclusion, mortgage calculators are powerful tools that can aid in the decision-making process for potential homeowners. By understanding how to use these calculators effectively and considering all the factors that influence mortgage payments, individuals can make informed choices that align with their financial goals and capabilities. Whether you're a first-time home buyer or looking to refinance an existing mortgage, leveraging the insights provided by mortgage calculators can lead to significant long-term savings and a more stable financial future.

Final Considerations

Before finalizing a mortgage, consider: - **Credit Score**: A good credit score can lead to better interest rates. - **Pre-Approval**: Get pre-approved for a mortgage to understand your budget. - **Professional Advice**: Consult with a financial advisor or mortgage broker for personalized guidance.Mortgage Calculator Image Gallery

What is the primary purpose of a mortgage calculator?

+The primary purpose of a mortgage calculator is to estimate monthly mortgage payments based on the home's purchase price, down payment, interest rate, and loan term.

How does the loan term affect mortgage payments?

+A longer loan term results in lower monthly payments but more total interest paid over the life of the loan. Conversely, a shorter loan term means higher monthly payments but less total interest paid.

What additional costs should home buyers consider beyond the mortgage payment?

+Home buyers should also consider property taxes, insurance, and maintenance and repair costs when calculating the total cost of homeownership.

We hope this comprehensive guide to mortgage calculators has provided you with valuable insights and practical tips for navigating the mortgage landscape. Whether you're a seasoned homeowner or a first-time buyer, understanding how to effectively use mortgage calculators can empower you to make informed decisions about your financial future. Feel free to share your thoughts, experiences, or questions about using mortgage calculators in the comments below. Your input can help others in their journey to homeownership.