Intro

Unlock smart mortgage planning with 5 essential calculator tips, including loan estimates, interest rates, and repayment terms, to make informed home financing decisions and avoid costly mistakes.

Mortgage calculators have become an essential tool for homebuyers, providing them with a clear understanding of their financial obligations when purchasing a property. With the numerous mortgage calculators available online, it can be overwhelming to choose the right one and use it effectively. However, by following some simple tips, homebuyers can maximize the benefits of mortgage calculators and make informed decisions about their mortgage. In this article, we will explore five mortgage calculator tips that can help homebuyers navigate the complex world of mortgages.

The importance of mortgage calculators cannot be overstated. They provide homebuyers with a detailed breakdown of their monthly payments, allowing them to plan their finances accordingly. Moreover, mortgage calculators can help homebuyers determine how much they can afford to borrow, taking into account factors such as interest rates, loan terms, and credit scores. By using a mortgage calculator, homebuyers can avoid the risk of overborrowing and ensure that they are comfortable with their monthly payments.

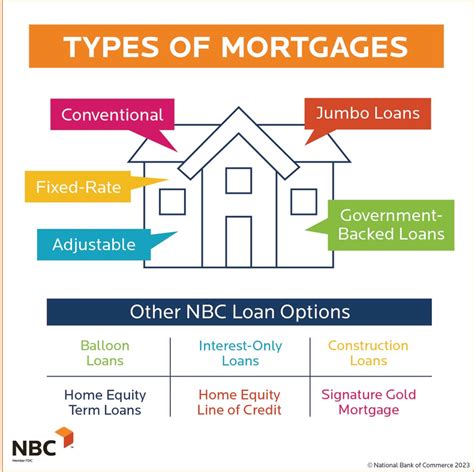

In addition to providing a clear understanding of monthly payments, mortgage calculators can also help homebuyers compare different mortgage options. With the numerous mortgage products available in the market, it can be challenging to choose the right one. However, by using a mortgage calculator, homebuyers can compare the costs of different mortgages, including fixed-rate and adjustable-rate loans, and determine which one is best for their financial situation. This can help homebuyers save thousands of dollars in interest payments over the life of the loan.

Understanding Mortgage Calculator Basics

Key Factors to Consider

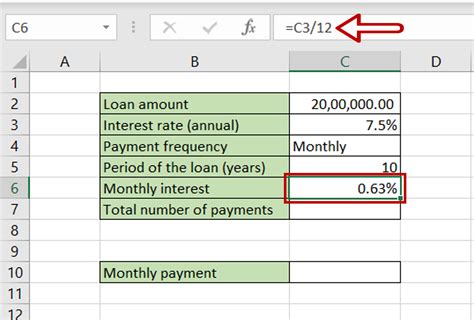

When using a mortgage calculator, there are several key factors to consider. These include the loan amount, interest rate, loan term, and credit score. The loan amount refers to the amount of money that the homebuyer is borrowing, while the interest rate refers to the rate at which the lender charges interest on the loan. The loan term, on the other hand, refers to the length of time that the homebuyer has to repay the loan. By considering these factors, homebuyers can use a mortgage calculator to determine their monthly payments and make informed decisions about their mortgage.Using a Mortgage Calculator to Compare Mortgage Options

Fixed-Rate vs. Adjustable-Rate Loans

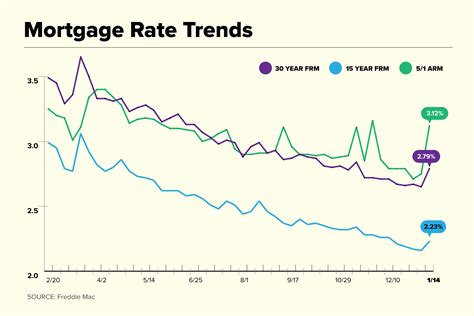

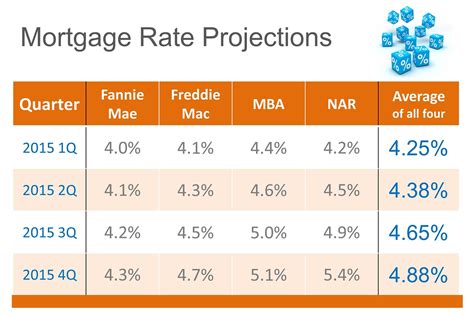

When comparing mortgage options, homebuyers often have to choose between fixed-rate and adjustable-rate loans. Fixed-rate loans offer a fixed interest rate over the life of the loan, while adjustable-rate loans offer a variable interest rate that can change over time. By using a mortgage calculator, homebuyers can compare the costs of these two types of loans and determine which one is best for their financial situation. For example, if interest rates are expected to rise in the future, a fixed-rate loan may be a better option. On the other hand, if interest rates are expected to fall, an adjustable-rate loan may be a better option.Calculating Monthly Payments

Factors That Affect Monthly Payments

There are several factors that can affect monthly payments, including the loan amount, interest rate, loan term, and credit score. By understanding these factors, homebuyers can use a mortgage calculator to determine their monthly payments and make informed decisions about their mortgage. For example, a higher interest rate can result in higher monthly payments, while a longer loan term can result in lower monthly payments.Considering Additional Costs

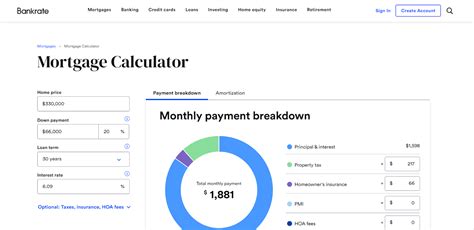

Property Taxes and Insurance

Property taxes and insurance are two of the most significant additional costs associated with homeownership. Property taxes refer to the taxes that homeowners pay on their property, while insurance refers to the insurance premiums that homeowners pay to protect their property against damage or loss. By considering these costs, homebuyers can use a mortgage calculator to determine their total monthly payments and make informed decisions about their mortgage.Using a Mortgage Calculator to Determine Affordability

Factors That Affect Affordability

There are several factors that can affect affordability, including income, expenses, credit score, and debt-to-income ratio. By understanding these factors, homebuyers can use a mortgage calculator to determine their affordability and make informed decisions about their mortgage. For example, a higher income can result in a higher affordability, while a higher debt-to-income ratio can result in a lower affordability.Mortgage Calculator Image Gallery

What is a mortgage calculator and how does it work?

+A mortgage calculator is a tool that helps homebuyers calculate their monthly payments and determine how much they can afford to borrow. It works by inputting the loan amount, interest rate, loan term, and other relevant details, and then calculating the monthly payment based on these factors.

What are the benefits of using a mortgage calculator?

+The benefits of using a mortgage calculator include determining monthly payments, comparing mortgage options, and determining affordability. It can also help homebuyers avoid the risk of overborrowing and ensure that they are comfortable with their monthly payments.

How do I choose the right mortgage calculator?

+When choosing a mortgage calculator, consider the factors that are most important to you, such as the loan amount, interest rate, and loan term. You should also consider the reputation of the lender or financial institution providing the calculator, as well as the level of customer support and resources available.

Can I use a mortgage calculator to compare mortgage rates?

+Yes, you can use a mortgage calculator to compare mortgage rates. By inputting the loan amount, interest rate, and loan term, you can calculate the monthly payment and compare the costs of different mortgages. This can help you determine which mortgage is best for your financial situation.

How often should I use a mortgage calculator?

+You should use a mortgage calculator as often as needed to determine your monthly payments and compare mortgage options. This can be especially helpful when you are first considering purchasing a home, or when you are trying to decide between different mortgage products.

In conclusion, mortgage calculators are a valuable tool for homebuyers, providing them with a clear understanding of their financial obligations when purchasing a property. By following the five mortgage calculator tips outlined in this article, homebuyers can maximize the benefits of mortgage calculators and make informed decisions about their mortgage. Whether you are a first-time homebuyer or an experienced homeowner, using a mortgage calculator can help you navigate the complex world of mortgages and ensure that you are comfortable with your monthly payments. We invite you to share your thoughts and experiences with mortgage calculators in the comments below, and to share this article with anyone who may be considering purchasing a home.