Intro

Discover expert 5 Navy Federal Tips for managing finances, including credit score optimization, loan guidance, and investment strategies, to enhance financial stability and security.

The world of personal finance can be overwhelming, especially for those who are just starting to navigate the complexities of banking, saving, and investing. However, with the right guidance and support, anyone can take control of their financial future. For members of the military, veterans, and their families, Navy Federal Credit Union stands out as a premier financial institution dedicated to serving their unique needs. In this article, we will delve into five Navy Federal tips that can help you make the most of your membership and improve your financial well-being.

Managing finances effectively is crucial for achieving long-term stability and security. Whether you're looking to save for a big purchase, pay off debt, or build an emergency fund, having the right strategies in place can make all the difference. Navy Federal Credit Union offers a wide range of products and services designed to help its members succeed financially. From competitive savings rates to flexible loan options, the credit union is committed to providing the tools and resources needed to thrive in today's economic landscape.

For those who are new to Navy Federal or looking to optimize their current membership, understanding the available benefits and how to leverage them is key. This includes everything from maximizing savings potential to navigating the home buying process. With its member-centric approach, Navy Federal has established itself as a trusted partner for individuals seeking to enhance their financial literacy and make informed decisions about their money. By exploring the following tips and insights, you'll be better equipped to harness the full potential of your Navy Federal membership and set yourself up for long-term financial success.

Understanding Navy Federal Membership Benefits

One of the first steps in maximizing your Navy Federal experience is to understand the comprehensive suite of benefits that come with membership. This includes access to high-yield savings accounts, low-rate loans, and exclusive discounts on various financial products. Navy Federal's commitment to its members is evident in the competitive rates and terms it offers, making it an attractive option for those looking to save, borrow, or invest. By familiarizing yourself with these benefits, you can tailor your financial strategy to best take advantage of what Navy Federal has to offer.

High-Yield Savings Accounts

Navy Federal's high-yield savings accounts are designed to help members grow their savings over time. With competitive APYs (Annual Percentage Yields) and low or no monthly maintenance fees, these accounts provide an excellent vehicle for building an emergency fund, saving for a specific goal, or simply earning more on your savings. Understanding the features and benefits of these accounts, such as minimum balance requirements and interest compounding, can help you choose the right savings solution for your needs.Maximizing Savings Potential

Maximizing your savings potential is a crucial aspect of achieving financial stability. Navy Federal offers several tools and strategies to help members boost their savings. This includes setting up automatic transfers from checking to savings, taking advantage of savings challenges, and utilizing budgeting apps to track expenses and stay on top of financial goals. By implementing these strategies, you can develop healthy savings habits and make steady progress towards your financial objectives.

Automatic Savings Transfers

Setting up automatic savings transfers is a simple yet effective way to build your savings consistently. By allocating a portion of your income to savings on a regular basis, you can ensure that saving becomes a priority and a habit. Navy Federal makes it easy to set up these transfers, allowing you to choose the amount and frequency that works best for you. This approach helps in avoiding the temptation to spend impulsively and ensures that you're always moving closer to your savings goals.Navigating Loan Options

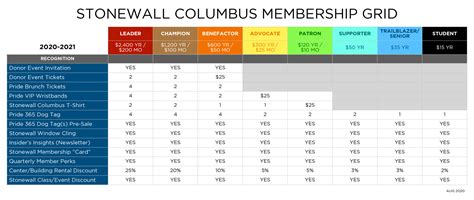

For many, borrowing is an inevitable part of achieving certain financial goals, such as purchasing a home, financing a vehicle, or covering unexpected expenses. Navy Federal offers a variety of loan products with competitive rates and flexible terms, designed to meet the diverse needs of its members. Understanding the different loan options available, including personal loans, auto loans, and mortgages, can help you make informed decisions when borrowing.

Personal Loans

Navy Federal's personal loans are a versatile financing solution for members needing to cover expenses such as debt consolidation, home improvements, or major purchases. With fixed rates and terms, these loans provide predictability and can be tailored to fit your budget. It's essential to consider factors such as interest rates, repayment terms, and any associated fees when deciding on a personal loan, ensuring that you select the option that best aligns with your financial situation and goals.Investing for the Future

Investing is a key component of long-term financial planning, offering the potential for growth and wealth accumulation over time. Navy Federal provides its members with access to investment products and services, including retirement accounts, brokerage services, and financial planning tools. Understanding the basics of investing, such as risk tolerance, diversification, and compound interest, can help you make informed investment decisions and work towards securing your financial future.

Retirement Planning

Planning for retirement is a critical aspect of financial planning, ensuring that you have the resources needed to enjoy your post-work life. Navy Federal offers various retirement accounts, such as IRAs and thrift savings plans, designed to help members save and invest for retirement. Contributing to these accounts regularly, taking advantage of any employer matching contributions, and reviewing your retirement portfolio periodically can help you stay on track to meet your retirement goals.Financial Education and Planning

Financial education and planning are fundamental to achieving financial stability and success. Navy Federal is committed to empowering its members with the knowledge and tools necessary to make informed financial decisions. This includes access to financial counseling, educational resources, and planning tools. By leveraging these resources, members can enhance their financial literacy, develop personalized financial plans, and navigate complex financial situations with confidence.

Financial Counseling

Navy Federal's financial counseling services provide members with expert guidance on managing debt, creating budgets, and achieving long-term financial goals. These services are designed to be personalized, addressing the unique financial challenges and objectives of each member. Whether you're facing financial difficulties or seeking to optimize your financial strategy, Navy Federal's financial counseling can offer valuable insights and practical advice to help you move forward.Navy Federal Image Gallery

What are the benefits of Navy Federal membership?

+Navy Federal membership offers a range of benefits, including high-yield savings accounts, low-rate loans, and exclusive discounts on various financial products. Members also have access to financial education resources, planning tools, and personalized counseling.

How can I maximize my savings with Navy Federal?

+To maximize your savings with Navy Federal, consider setting up automatic transfers from your checking to savings account, taking advantage of high-yield savings accounts, and utilizing budgeting tools to track your expenses and stay on top of your financial goals.

What loan options are available through Navy Federal?

+Navy Federal offers a variety of loan options, including personal loans, auto loans, and mortgages, all designed with competitive rates and flexible terms to meet the diverse needs of its members.

In conclusion, Navy Federal Credit Union is a powerful resource for its members, offering a comprehensive suite of financial products, services, and educational resources designed to support financial stability and success. By understanding and leveraging the benefits of membership, maximizing savings potential, navigating loan options, investing for the future, and utilizing financial education and planning tools, members can take significant steps towards achieving their financial goals. Whether you're just starting out or well into your financial journey, Navy Federal stands as a trusted partner, committed to helping you navigate the complexities of personal finance and secure a brighter financial future. We invite you to share your experiences with Navy Federal, ask questions, and explore how these tips can be applied to your unique financial situation, fostering a community of support and financial empowerment.