Intro

Discover Navy Federal personal loan options, including unsecured loans, debt consolidation, and home improvement loans with competitive rates and flexible terms.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial products and services to its members. One of the most popular products offered by Navy Federal is personal loans, which can be used for various purposes such as consolidating debt, financing a large purchase, or covering unexpected expenses. In this article, we will delve into the world of Navy Federal personal loan options, exploring the benefits, features, and requirements of these loans.

Personal loans are a type of unsecured loan, meaning that they do not require collateral to secure the loan. This makes them a popular choice for individuals who do not have valuable assets to pledge as collateral or who prefer not to risk losing their assets in case of default. Navy Federal personal loans are designed to provide members with flexible and affordable financing options, allowing them to achieve their financial goals without breaking the bank.

Navy Federal offers several types of personal loans, each with its own unique features and benefits. For example, the credit union offers personal loans with fixed interest rates, which can provide borrowers with predictable monthly payments and a sense of security. Additionally, Navy Federal offers personal lines of credit, which allow borrowers to access a revolving line of credit and borrow funds as needed.

Types of Navy Federal Personal Loans

Navy Federal offers several types of personal loans, including:

- Personal loans with fixed interest rates

- Personal lines of credit

- Debt consolidation loans

- Home improvement loans

- Vacation loans Each of these loan options has its own unique features and benefits, and borrowers can choose the one that best fits their needs and financial situation.

Personal Loans with Fixed Interest Rates

Personal loans with fixed interest rates are a popular choice among borrowers who prefer predictable monthly payments and a sense of security. These loans offer a fixed interest rate, which means that the interest rate remains the same throughout the life of the loan. This can provide borrowers with a sense of stability and security, as they know exactly how much they will be paying each month.Benefits of Navy Federal Personal Loans

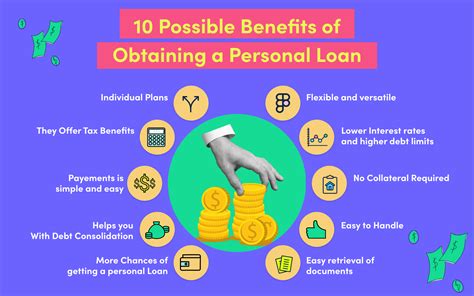

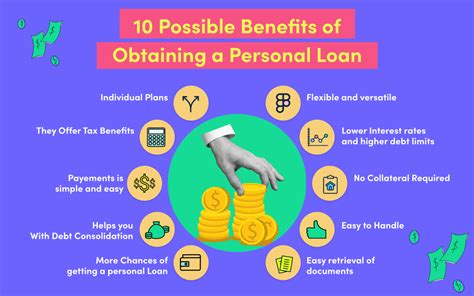

Navy Federal personal loans offer several benefits, including:

- Competitive interest rates

- Flexible repayment terms

- No collateral required

- Fast and easy application process

- Personalized service from experienced loan officers

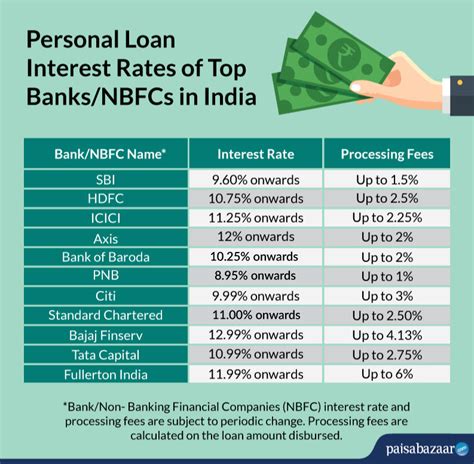

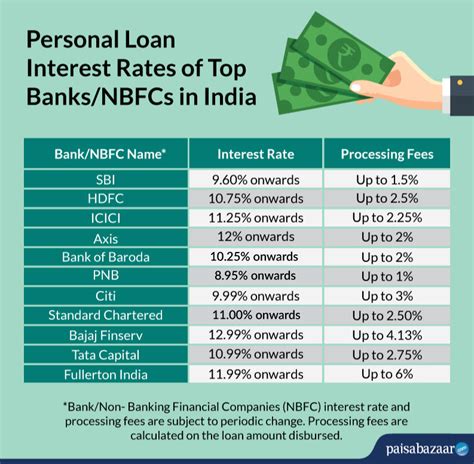

Competitive Interest Rates

Navy Federal offers competitive interest rates on its personal loans, which can help borrowers save money on interest payments. The credit union's interest rates are often lower than those offered by traditional banks and lenders, making it a popular choice among borrowers who are looking for affordable financing options.How to Apply for a Navy Federal Personal Loan

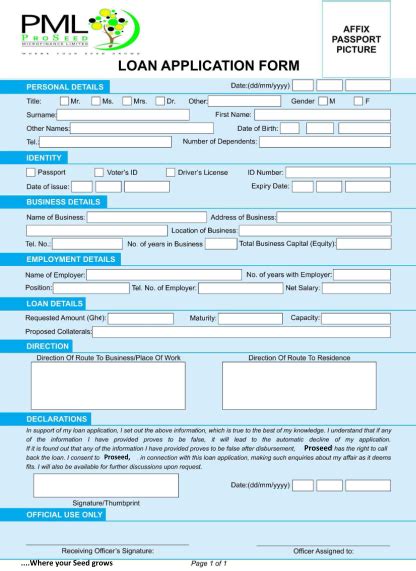

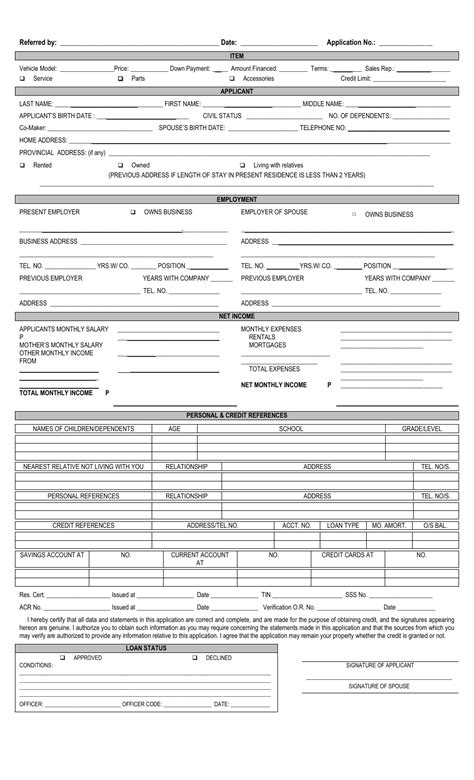

Applying for a Navy Federal personal loan is a fast and easy process. Borrowers can apply online, by phone, or in person at a Navy Federal branch. To apply, borrowers will need to provide some basic information, such as their income, employment history, and credit score. They will also need to specify the amount they wish to borrow and the purpose of the loan.

Required Documents

To apply for a Navy Federal personal loan, borrowers will need to provide some basic documents, such as: * Identification (driver's license, passport, etc.) * Proof of income (pay stub, W-2 form, etc.) * Proof of employment (letter from employer, etc.) * Credit report (if applicable)Navy Federal Personal Loan Requirements

To be eligible for a Navy Federal personal loan, borrowers must meet certain requirements, such as:

- Being a member of Navy Federal Credit Union

- Having a good credit score

- Having a stable income

- Being at least 18 years old

- Being a U.S. citizen or permanent resident

Membership Requirements

To be eligible for a Navy Federal personal loan, borrowers must be members of the credit union. Membership is open to active duty and retired military personnel, as well as their families and household members. Borrowers can join Navy Federal by opening a savings account or applying for a loan.Navy Federal Personal Loan Repayment Terms

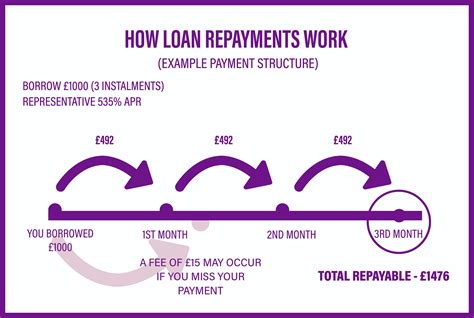

Navy Federal personal loans offer flexible repayment terms, which can help borrowers manage their debt and make timely payments. The credit union offers repayment terms ranging from 12 to 60 months, depending on the loan amount and borrower's financial situation.

Repayment Options

Navy Federal offers several repayment options, including: * Monthly payments * Bi-weekly payments * Automatic payments * Online paymentsGallery of Navy Federal Personal Loan Options

Navy Federal Personal Loan Image Gallery

Frequently Asked Questions

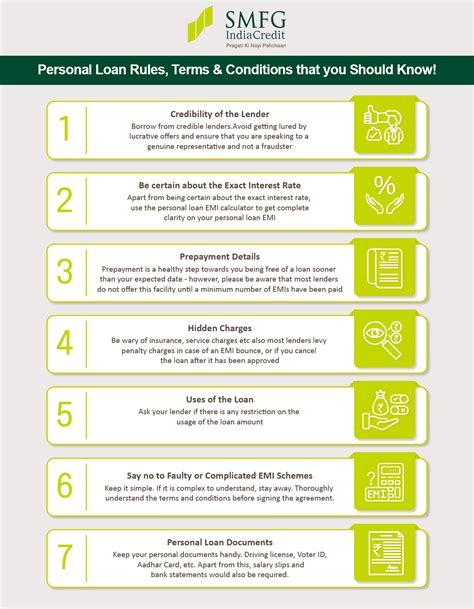

What are the benefits of a Navy Federal personal loan?

+Navy Federal personal loans offer competitive interest rates, flexible repayment terms, and no collateral requirements. They also provide fast and easy application processes and personalized service from experienced loan officers.

How do I apply for a Navy Federal personal loan?

+To apply for a Navy Federal personal loan, borrowers can apply online, by phone, or in person at a Navy Federal branch. They will need to provide some basic information, such as their income, employment history, and credit score, as well as specify the amount they wish to borrow and the purpose of the loan.

What are the requirements for a Navy Federal personal loan?

+To be eligible for a Navy Federal personal loan, borrowers must be members of the credit union, have a good credit score, have a stable income, and be at least 18 years old. They must also be U.S. citizens or permanent residents.

In conclusion, Navy Federal personal loan options offer a range of benefits and features that can help borrowers achieve their financial goals. With competitive interest rates, flexible repayment terms, and no collateral requirements, these loans are a popular choice among individuals who are looking for affordable and convenient financing options. By understanding the different types of Navy Federal personal loans, their benefits, and requirements, borrowers can make informed decisions and choose the loan that best fits their needs and financial situation. We encourage readers to share their experiences with Navy Federal personal loans and provide feedback on how these loans have helped them achieve their financial goals.