Intro

Discover expert 5 Navy Federal Student Loans Tips, including repayment options, interest rates, and consolidation, to manage your education debt effectively and make informed financial decisions.

Navy Federal student loans are an attractive option for students and parents looking to finance their education. As one of the largest credit unions in the world, Navy Federal Credit Union offers a range of student loan products with competitive rates and flexible repayment terms. In this article, we will explore five tips to help you navigate Navy Federal student loans and make the most of their benefits.

The importance of understanding student loans cannot be overstated. With the rising cost of tuition and living expenses, many students and families rely on loans to finance their education. However, navigating the complex world of student loans can be daunting, especially for those who are new to borrowing. By understanding the ins and outs of Navy Federal student loans, you can make informed decisions about your financial aid and set yourself up for long-term success.

For those who are considering Navy Federal student loans, it's essential to do your research and understand the different options available. From undergraduate to graduate loans, Navy Federal offers a range of products designed to meet the unique needs of students and families. Whether you're looking for a low-interest rate, flexible repayment terms, or a loan with no origination fees, Navy Federal has a solution that can help. In the following sections, we will delve deeper into the world of Navy Federal student loans and explore five tips to help you get the most out of their products.

Understanding Navy Federal Student Loan Options

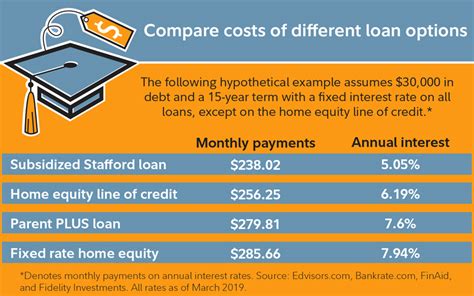

Some key features of Navy Federal student loans include competitive interest rates, flexible repayment terms, and no origination fees. Their loans also offer a range of repayment options, including deferred payment, interest-only payment, and full payment. This flexibility can be especially helpful for students who are just starting their careers or who may be experiencing financial difficulties. Additionally, Navy Federal offers a range of benefits, including a 0.25% interest rate reduction for borrowers who make automatic payments.

Benefits of Navy Federal Student Loans

The benefits of Navy Federal student loans are numerous. For one, their competitive interest rates can help you save money over the life of the loan. Additionally, their flexible repayment terms can provide you with the flexibility you need to manage your debt. Navy Federal also offers a range of repayment options, including income-driven repayment plans, which can help you avoid default and stay on track with your payments.Some other benefits of Navy Federal student loans include their lack of origination fees, which can save you money upfront. They also offer a range of discounts, including a 0.25% interest rate reduction for borrowers who make automatic payments. This can help you save even more money over the life of the loan. Furthermore, Navy Federal's customer service is top-notch, with a range of online resources and support available to help you manage your loan.

Applying for Navy Federal Student Loans

It's also a good idea to have a copy of your credit report and your financial aid award letter handy, as you may need to provide this information as part of the application process. Additionally, you may need to provide documentation, such as pay stubs or tax returns, to verify your income and employment status. Once you've submitted your application, Navy Federal will review your creditworthiness and determine your eligibility for a loan.

Managing Your Navy Federal Student Loan

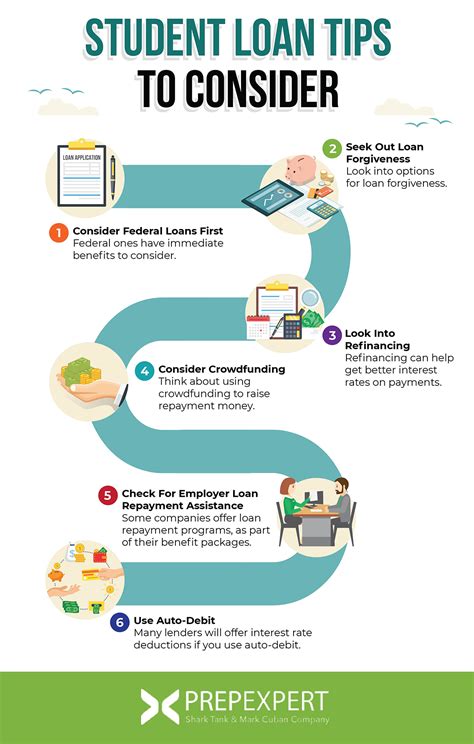

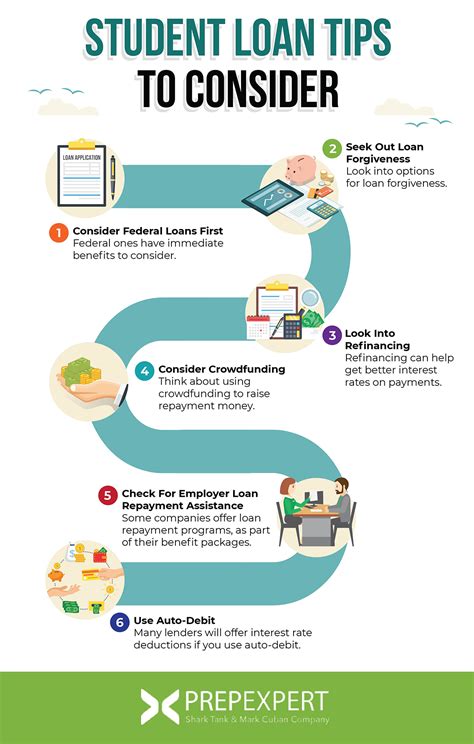

Managing your Navy Federal student loan is crucial to avoiding default and staying on track with your payments. One of the most important things you can do is to make your payments on time, every time. You can set up automatic payments to ensure that you never miss a payment, and you can also take advantage of Navy Federal's online resources and support to help you manage your loan.It's also a good idea to keep track of your loan balance and interest rate, as well as your repayment term and any fees associated with your loan. You can use Navy Federal's online tools to view your loan information and make payments, and you can also contact their customer service team if you have any questions or concerns. Additionally, you may want to consider consolidating your loans or refinancing your loan to take advantage of a lower interest rate or more favorable repayment terms.

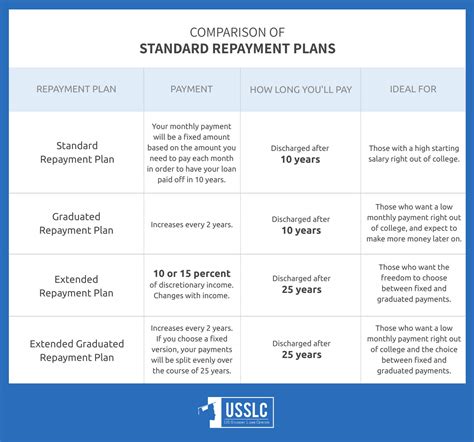

Navy Federal Student Loan Repayment Options

Additionally, Navy Federal offers income-driven repayment plans, which can help you avoid default and stay on track with your payments. These plans require you to make payments based on your income and family size, and they can be a good option for borrowers who are experiencing financial difficulties. You may also want to consider consolidating your loans or refinancing your loan to take advantage of a lower interest rate or more favorable repayment terms.

Navy Federal Student Loan Forgiveness Options

Navy Federal also offers loan forgiveness options for borrowers who are working in public service or who are experiencing financial difficulties. Their public service loan forgiveness program, for example, allows borrowers to have their loans forgiven after making 120 qualifying payments while working full-time for a qualifying employer. They also offer a loan forgiveness program for borrowers who are experiencing financial difficulties, such as unemployment or economic hardship.To be eligible for loan forgiveness, you'll need to meet certain requirements, such as making qualifying payments and working for a qualifying employer. You'll also need to submit an application and provide documentation to support your eligibility. Navy Federal's customer service team can help you navigate the application process and determine your eligibility for loan forgiveness.

Navy Federal Student Loan Customer Service

Their customer service team can help you with everything from applying for a loan to managing your payments and exploring repayment options. They can also help you navigate the loan forgiveness process and determine your eligibility for forgiveness. Additionally, they offer a range of online tools and resources to help you manage your loan and stay on track with your payments.

Navy Federal Student Loan Online Resources

Navy Federal's online resources are designed to help you manage your loan and stay on track with your payments. Their website offers a range of tools and resources, including a loan calculator, a repayment estimator, and a loan forgiveness calculator. You can also use their online platform to view your loan information, make payments, and communicate with their customer service team.Their online resources are available 24/7, and they can be accessed from anywhere with an internet connection. This makes it easy to manage your loan and stay on top of your payments, even when you're on the go. Additionally, their online resources are secure and reliable, so you can trust that your personal and financial information is safe.

Navy Federal Student Loan Image Gallery

What are the benefits of Navy Federal student loans?

+The benefits of Navy Federal student loans include competitive interest rates, flexible repayment terms, and no origination fees. They also offer a range of repayment options, including income-driven repayment plans, and loan forgiveness programs for borrowers who are working in public service or experiencing financial difficulties.

How do I apply for a Navy Federal student loan?

+To apply for a Navy Federal student loan, you'll need to be a member of Navy Federal Credit Union, which requires you to have a military connection or be a family member of someone who does. You can apply online or by phone, and you'll need to provide some basic information, including your name, address, and social security number, as well as information about your school and your expected enrollment status.

What are my repayment options for Navy Federal student loans?

+Navy Federal offers a range of repayment options, including standard repayment, extended repayment, and income-driven repayment plans. They also offer loan forgiveness programs for borrowers who are working in public service or experiencing financial difficulties. You can choose the repayment option that best fits your needs and financial situation.

Can I consolidate or refinance my Navy Federal student loan?

+Yes, you may be able to consolidate or refinance your Navy Federal student loan to take advantage of a lower interest rate or more favorable repayment terms. However, this may not always be the best option, and you should carefully consider the pros and cons before making a decision. Navy Federal's customer service team can help you explore your options and determine the best course of action for your situation.

How do I contact Navy Federal's customer service team?

+You can contact Navy Federal's customer service team by phone or email, or through their online platform. They are available to help you with any questions or concerns you may have about your student loan, and they can provide you with personalized guidance and support to help you manage your debt and achieve your financial goals.

In summary, Navy Federal student loans offer a range of benefits and repayment options for students and families. By understanding the different loan products available and carefully considering your options, you can make informed decisions about your financial aid and set yourself up for long-term success. Whether you're looking for a low-interest rate, flexible repayment terms, or a loan with no origination fees, Navy Federal has a solution that can help. We encourage you to share this article with others who may be considering Navy Federal student loans, and to comment below with any questions or concerns you may have. By working together, we can help each other navigate the complex world of student loans and achieve our financial goals.