Intro

Find Navy Federal Credit Union near me, with branch locations, ATM services, and financial solutions, offering banking, loans, and credit cards to military members and families, providing convenient and secure online banking and mobile banking services.

Finding a Navy Federal Credit Union near you can be a great way to manage your finances, especially if you're affiliated with the military or a Department of Defense employee. With numerous locations across the United States and abroad, Navy Federal Credit Union offers a range of financial services, from savings and checking accounts to loans and investment products. Whether you're looking to open a new account, apply for a credit card, or simply conduct everyday banking, having a branch nearby can be incredibly convenient.

The importance of having a financial institution that understands the unique needs of military personnel and their families cannot be overstated. Navy Federal Credit Union has built its reputation on providing tailored services and benefits that cater to this demographic, including more favorable loan terms, higher savings rates, and access to exclusive discounts. By locating a Navy Federal Credit Union near you, you can take advantage of these benefits and work towards achieving your financial goals, whether that's saving for a home, planning for retirement, or simply managing your day-to-day expenses more effectively.

For those who are new to the area or have recently become eligible to join Navy Federal Credit Union, finding a local branch is the first step in accessing these benefits. The credit union's extensive network means that you're likely to find a location near your home, workplace, or military base. Moreover, with the advancement in digital banking, you can also manage your accounts, pay bills, and transfer funds online or through the mobile app, making it easier than ever to stay on top of your finances, even when you're on the move.

Benefits of Navy Federal Credit Union

Being a member of Navy Federal Credit Union comes with a multitude of benefits. One of the most significant advantages is the competitive rates offered on savings accounts, certificates, and loans. Members can earn higher interest on their savings, which can help their money grow over time. Additionally, the credit union provides lower interest rates on loans, making it more affordable to borrow money for significant purchases like cars or homes. There are also fewer fees associated with Navy Federal Credit Union accounts compared to traditional banks, which can save members a considerable amount of money in the long run.

Another benefit is the wide range of financial products and services available. From basic checking and savings accounts to more complex investment products and insurance services, Navy Federal Credit Union offers a one-stop solution for all financial needs. The credit union also provides financial education and planning tools to help members make informed decisions about their money. Whether you're a seasoned investor or just starting to build your financial foundation, the resources available can be invaluable in achieving your financial objectives.

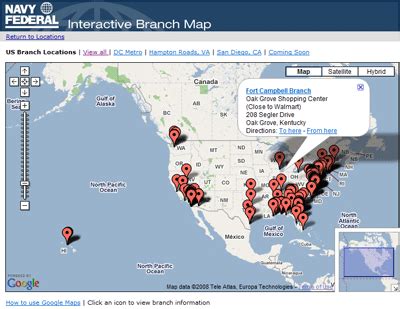

How to Find a Navy Federal Credit Union Near You

Finding a Navy Federal Credit Union near your location is relatively straightforward. The credit union provides an online locator tool on its website that allows you to search for branches and ATMs by zip code, city, or state. You can also filter your search by the services you need, such as deposit-taking ATMs or branches with drive-thru services. This tool is especially useful for those who are always on the move, as it helps you find the nearest location wherever you are in the country or abroad.Services Offered by Navy Federal Credit Union

Navy Federal Credit Union offers a broad spectrum of services designed to meet the diverse financial needs of its members. For everyday banking, members can choose from various checking and savings accounts, each with its own set of benefits and features. The credit union also provides a range of loan options, including auto loans, personal loans, mortgages, and home equity loans, all designed to help members achieve their financial goals, whether that's purchasing a new vehicle, consolidating debt, or buying a dream home.

In addition to these core services, Navy Federal Credit Union offers investment products and retirement accounts for those looking to grow their wealth over time. Members can choose from a variety of investment options, including mutual funds, stocks, and bonds, and can also open IRA accounts to plan for retirement. The credit union's financial advisors are available to provide guidance and help members create a personalized investment strategy that aligns with their financial objectives and risk tolerance.

Eligibility and Membership

To join Navy Federal Credit Union, you must be affiliated with the military, Department of Defense, or National Guard. This includes active duty, retired, and veteran members of the armed forces, as well as civilians and contractors working for the Department of Defense. Family members of eligible personnel are also eligible to join, which means spouses, children, and household members can benefit from the credit union's services as well.The membership process is relatively simple and can be completed online or in-person at a local branch. You'll need to provide identification and proof of eligibility, and you'll also need to open a savings account with a minimum deposit, which is typically $5. Once you're a member, you can take advantage of all the services and benefits Navy Federal Credit Union has to offer, from banking and lending to investment and insurance services.

Online Banking and Mobile App

In today's digital age, having access to online banking and a mobile app can greatly enhance your banking experience. Navy Federal Credit Union's online platform and mobile app allow members to manage their accounts, pay bills, transfer funds, and deposit checks remotely. The mobile app is available for both iOS and Android devices and offers a range of features, including account monitoring, transaction history, and budgeting tools.

One of the standout features of Navy Federal Credit Union's digital banking is the ease of use. The website and app are designed to be user-friendly, making it simple for members to navigate and find what they need. Additionally, the credit union offers robust security measures to protect member accounts, including two-factor authentication and encryption, giving members peace of mind when banking online or through the app.

Customer Service

Navy Federal Credit Union is known for its excellent customer service. Members can reach the credit union's customer service team 24/7 by phone, and there are also online chat services available during business hours. The credit union's website is also a valuable resource, with a comprehensive FAQ section and educational materials on various financial topics.For more complex issues or for those who prefer face-to-face interaction, visiting a local branch can be beneficial. Branch staff are knowledgeable and can provide personalized advice and assistance with everything from account opening to loan applications. The credit union's commitment to customer service reflects its mission to serve the financial needs of its members and provide them with the support they need to achieve their financial goals.

Community Involvement

Navy Federal Credit Union is deeply involved in the communities it serves. The credit union participates in various charitable initiatives and sponsors local events, particularly those that support military families and veterans. This community involvement not only reflects the credit union's values but also demonstrates its commitment to giving back and making a positive impact on the lives of its members and the broader community.

Through its charitable foundation, Navy Federal Credit Union supports a range of causes, from education and healthcare to disaster relief and military support. The credit union also encourages its employees to volunteer and engage in community service, fostering a culture of philanthropy and social responsibility. By supporting local communities, Navy Federal Credit Union helps to build stronger, more resilient neighborhoods, which is essential for the well-being of its members and the success of the credit union as a whole.

Financial Education

Financial education is a critical component of Navy Federal Credit Union's mission. The credit union offers a variety of resources and tools designed to help members improve their financial literacy and make informed decisions about their money. These resources include workshops, webinars, and online tutorials, covering topics such as budgeting, saving, investing, and managing debt.The credit union's financial advisors are also available to provide personalized advice and guidance, helping members to create a financial plan that meets their unique needs and goals. Whether you're looking to buy your first home, plan for retirement, or simply manage your finances more effectively, Navy Federal Credit Union's financial education resources can provide valuable insights and strategies to help you achieve your objectives.

Security and Insurance

Navy Federal Credit Union prioritizes the security and protection of its members' accounts and personal information. The credit union employs advanced security measures, including encryption, firewalls, and multi-factor authentication, to safeguard against unauthorized access and cyber threats.

Additionally, Navy Federal Credit Union offers insurance products to help protect members and their families from unforeseen events. These products include life insurance, disability insurance, and auto insurance, among others. By offering these insurance options, the credit union helps members to mitigate risk and ensure that they and their loved ones are protected, even in the face of unexpected challenges or setbacks.

Conclusion and Next Steps

In conclusion, finding a Navy Federal Credit Union near you can be a significant step towards achieving your financial goals. With its comprehensive range of services, competitive rates, and commitment to community involvement, the credit union is well-positioned to meet the financial needs of military personnel, Department of Defense employees, and their families. Whether you're looking to open a new account, apply for a loan, or simply manage your everyday banking, Navy Federal Credit Union's branches and digital banking platforms offer the convenience and support you need.To get started, visit the Navy Federal Credit Union website to locate a branch near you and explore the services and benefits available. You can also contact the credit union's customer service team for more information or to discuss your specific financial needs. By taking these steps, you can begin to leverage the advantages of Navy Federal Credit Union membership and work towards a more secure and prosperous financial future.

Gallery of Navy Federal Credit Union

Navy Federal Credit Union Image Gallery

What are the benefits of joining Navy Federal Credit Union?

+Joining Navy Federal Credit Union offers numerous benefits, including competitive rates on loans and savings accounts, lower fees, and a wide range of financial services tailored to the needs of military personnel and their families.

How do I find a Navy Federal Credit Union near me?

+You can find a Navy Federal Credit Union near you by using the credit union's online locator tool, which allows you to search for branches and ATMs by zip code, city, or state.

What services does Navy Federal Credit Union offer?

+Navy Federal Credit Union offers a comprehensive range of services, including checking and savings accounts, loans, investment products, insurance services, and financial education resources.

We hope this information has been helpful in your search for a Navy Federal Credit Union near you. If you have any further questions or would like to share your experiences with Navy Federal Credit Union, please don't hesitate to comment below. Your insights can help others make informed decisions about their financial services. Additionally, if you found this article useful, consider sharing it with friends and family who may benefit from the information. Together, we can support each other in achieving our financial goals and building a more secure financial future.