Intro

Discover 5 ways Navy Federal consolidates debt, simplifying finances through credit card consolidation, loan refinancing, and debt management plans, offering relief from debt stress and promoting financial stability.

Debt consolidation has become a crucial strategy for individuals looking to simplify their financial lives and reduce the burden of multiple debts. Navy Federal, a well-established credit union, offers various solutions to help members consolidate their debt and achieve financial stability. In this article, we will delve into the world of debt consolidation, exploring the importance of managing debt and the ways Navy Federal can assist in this process.

Managing debt effectively is essential for maintaining a healthy financial profile. When individuals have multiple debts with high interest rates and varying payment terms, it can become overwhelming to keep track of payments and make progress on reducing the principal amounts. This is where debt consolidation comes into play, allowing individuals to combine their debts into a single, more manageable loan with a lower interest rate and a single monthly payment. Navy Federal, with its member-centric approach, provides a range of options for consolidating debt, making it easier for individuals to regain control of their finances.

The benefits of debt consolidation are numerous, including reduced monthly payments, lower interest rates, and the simplicity of having only one loan to manage. Moreover, consolidating debt can help improve credit scores over time, as making regular payments on a single loan is often easier than juggling multiple debts. Navy Federal, understanding the challenges of debt management, has designed its consolidation options to cater to the diverse needs of its members, ensuring that each individual can find a solution that best fits their financial situation.

Understanding Debt Consolidation Options

Before diving into the specific ways Navy Federal consolidates debt, it's essential to understand the concept of debt consolidation and how it works. Debt consolidation involves taking out a new loan to pay off multiple existing debts, resulting in a single loan with a lower interest rate and a single monthly payment. This strategy can be particularly beneficial for individuals with high-interest debts, such as credit card balances, personal loans, or other types of debt with high APRs.

5 Ways Navy Federal Consolidates Debt

Navy Federal offers several options for consolidating debt, each designed to meet the unique needs of its members. These options include:

- Personal Loans: Navy Federal provides personal loans with competitive interest rates and flexible repayment terms, making it easier for members to consolidate their debt into a single, manageable loan.

- Balance Transfer Credit Cards: Navy Federal's balance transfer credit cards allow members to transfer high-interest debt from other credit cards to a new card with a lower interest rate, often with a 0% introductory APR.

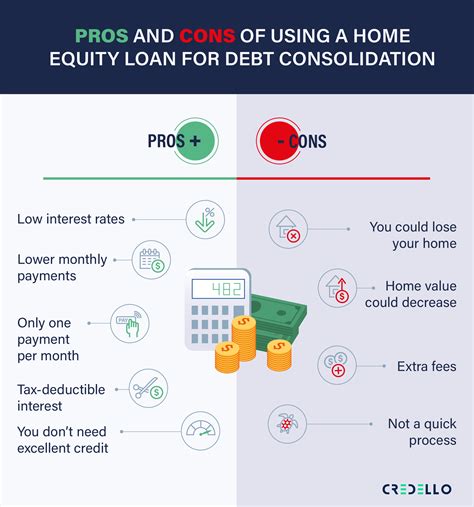

- Home Equity Loans: For members who own homes, Navy Federal offers home equity loans that can be used to consolidate debt, taking advantage of the potentially lower interest rates associated with secured loans.

- Debt Consolidation Loans: Specifically designed for debt consolidation, these loans offer fixed interest rates and repayment terms, providing members with a clear plan for paying off their debt.

- Credit Counseling: Navy Federal also offers credit counseling services, providing members with personalized advice and guidance on managing their debt and creating a plan for becoming debt-free.

Benefits of Consolidating Debt with Navy Federal

Consolidating debt with Navy Federal comes with several benefits, including lower interest rates, reduced monthly payments, and the simplicity of managing a single loan. Additionally, Navy Federal's member-centric approach ensures that each individual receives personalized service and support throughout the debt consolidation process.

Key Considerations

When considering debt consolidation with Navy Federal, it's essential to weigh the pros and cons and understand the terms of the new loan. This includes:- Interest rates: Are they lower than the rates on the existing debts?

- Fees: Are there any origination fees, balance transfer fees, or other charges associated with the new loan?

- Repayment terms: Are the terms flexible, and is the monthly payment affordable?

- Credit score impact: How will consolidating debt affect credit scores, both in the short and long term?

Managing Debt Effectively

Effective debt management is crucial for achieving financial stability and security. This involves creating a budget, prioritizing debt payments, and making timely payments on the consolidated loan. Navy Federal's financial tools and resources can assist members in managing their debt, providing them with the knowledge and support needed to make informed financial decisions.

Strategies for Success

To successfully manage debt and achieve financial freedom, consider the following strategies:- Create a budget that accounts for all income and expenses.

- Prioritize debt payments, focusing on high-interest debts first.

- Make timely payments on the consolidated loan to avoid late fees and negative credit reporting.

- Monitor credit scores and report, addressing any errors or discrepancies promptly.

- Avoid accumulating new debt while paying off the consolidated loan.

Conclusion and Next Steps

In conclusion, Navy Federal offers a range of solutions for consolidating debt, each designed to help members achieve financial stability and security. By understanding the benefits and considerations of debt consolidation and implementing effective debt management strategies, individuals can regain control of their finances and work towards a debt-free future.

Debt Consolidation Image Gallery

What is debt consolidation, and how does it work?

+Debt consolidation involves taking out a new loan to pay off multiple existing debts, resulting in a single loan with a lower interest rate and a single monthly payment.

What are the benefits of consolidating debt with Navy Federal?

+The benefits of consolidating debt with Navy Federal include lower interest rates, reduced monthly payments, and the simplicity of managing a single loan.

How do I get started with debt consolidation at Navy Federal?

+To get started with debt consolidation at Navy Federal, you can visit their website, contact their customer service, or visit a local branch to discuss your options with a financial representative.

Will consolidating debt with Navy Federal affect my credit score?

+Consolidating debt with Navy Federal may have a temporary impact on your credit score, but making timely payments on the new loan can help improve your credit score over time.

What types of debt can I consolidate with Navy Federal?

+Navy Federal allows you to consolidate various types of debt, including credit card balances, personal loans, and other high-interest debts.

We invite you to share your thoughts and experiences with debt consolidation in the comments below. If you found this article informative and helpful, please consider sharing it with others who may benefit from learning about Navy Federal's debt consolidation options. By taking the first step towards managing your debt, you can begin your journey towards financial freedom and stability.