Intro

Discover how Navy Federal invests digitally through online banking, mobile apps, and digital tools, enhancing member experience with secure transactions, personalized services, and financial management solutions.

The world of finance is rapidly evolving, and one of the key drivers of this evolution is the increasing demand for digital services. As a result, financial institutions are investing heavily in digital technologies to improve customer experience, reduce costs, and increase efficiency. Navy Federal Credit Union, one of the largest credit unions in the world, is no exception. With a strong commitment to innovation and customer satisfaction, Navy Federal has been at the forefront of digital transformation in the financial industry. In this article, we will explore 5 ways Navy Federal invests digitally to stay ahead of the curve.

Navy Federal's digital investments are designed to provide its members with convenient, secure, and personalized banking experiences. From mobile banking apps to digital payment systems, the credit union has implemented a range of digital solutions to meet the evolving needs of its members. With a focus on innovation and customer-centricity, Navy Federal has established itself as a leader in the digital banking space. Whether you're a long-time member or just considering joining, it's worth taking a closer look at the ways Navy Federal is investing in digital technologies to improve your banking experience.

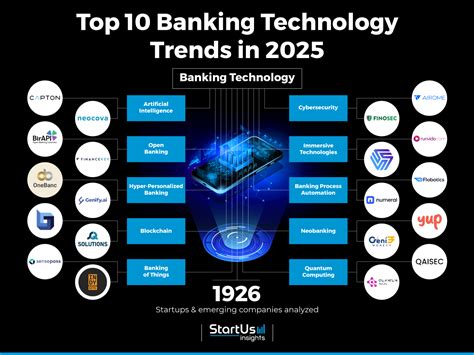

The importance of digital investments in the financial industry cannot be overstated. As consumers become increasingly comfortable with digital technologies, they expect their financial institutions to provide seamless, intuitive, and secure online experiences. Navy Federal has recognized this trend and has made significant investments in digital technologies to stay ahead of the curve. From artificial intelligence to blockchain, the credit union is exploring a range of emerging technologies to improve its services and enhance the overall member experience. With a strong commitment to innovation and customer satisfaction, Navy Federal is well-positioned to remain a leader in the digital banking space for years to come.

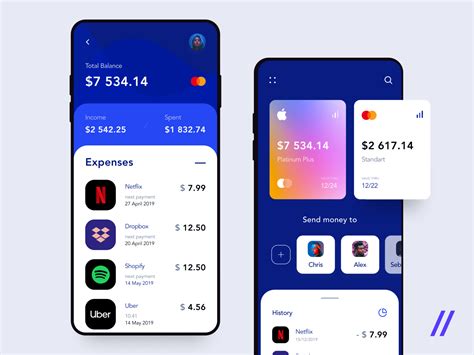

Mobile Banking and Digital Payments

In addition to its mobile banking app, Navy Federal has also introduced a range of digital payment tools to make it easier for members to manage their finances. For example, the credit union's digital wallet service allows members to store their credit and debit card information securely and make payments online or in-app. With the rise of contactless payments, Navy Federal has also invested in near-field communication (NFC) technology to enable members to make tap-to-pay transactions with their smartphones.

Artificial Intelligence and Machine Learning

Navy Federal's investment in AI and ML has also enabled the credit union to improve its customer service operations. For example, the credit union's AI-powered virtual assistants can help members with routine tasks like account inquiries and transaction tracking. By automating these tasks, Navy Federal's customer service representatives can focus on more complex issues and provide more personalized support to members. With the help of AI and ML, Navy Federal has been able to improve its customer satisfaction ratings and reduce its operational costs.

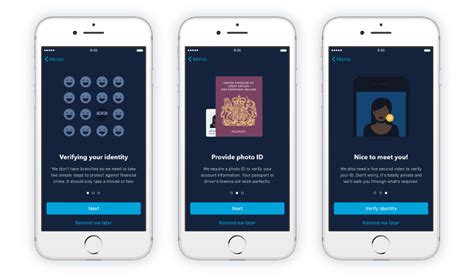

Digital Account Opening and Onboarding

The digital account opening and onboarding processes have improved the overall member experience at Navy Federal. By providing a seamless and intuitive online experience, the credit union has reduced the time and effort required to open new accounts. This has resulted in higher member satisfaction ratings and increased loyalty. Navy Federal's digital account opening and onboarding processes have also enabled the credit union to reduce its operational costs and improve its efficiency.

Cybersecurity and Data Protection

Navy Federal's commitment to cybersecurity and data protection has earned the credit union numerous awards and recognition. The credit union's digital security systems have been designed to provide multiple layers of protection, ensuring that member data is safe from unauthorized access. With the rise of cyber threats and data breaches, Navy Federal's investment in digital security has provided its members with peace of mind and confidence in the credit union's ability to protect their sensitive information.

Digital Financial Education and Literacy

Navy Federal's digital financial education and literacy programs have improved the financial well-being of its members. By providing access to personalized financial guidance and resources, the credit union has empowered its members to make informed financial decisions. The digital financial education platform has also enabled Navy Federal to reach a wider audience and provide financial education to members who may not have had access to these resources otherwise. With its commitment to digital financial education, Navy Federal has demonstrated its dedication to the financial well-being of its members.

Gallery of Digital Banking Images

Digital Banking Image Gallery

What is digital banking?

+Digital banking refers to the use of digital channels like online banking, mobile banking, and digital payment systems to manage financial transactions and access banking services.

How does Navy Federal's mobile banking app work?

+Navy Federal's mobile banking app allows members to manage their accounts, pay bills, and transfer funds on the go. The app uses advanced security measures like encryption and two-factor authentication to protect member data.

What are the benefits of digital financial education?

+Digital financial education provides members with access to personalized financial guidance and resources, empowering them to make informed financial decisions and improve their financial well-being.

How does Navy Federal protect member data online?

+Navy Federal uses advanced security measures like encryption, firewalls, and access controls to protect member data online. The credit union also provides members with education and resources to help them protect their sensitive information.

Can I open a new account online with Navy Federal?

+Yes, Navy Federal's digital account opening platform allows members to open new accounts online or through the mobile banking app. The platform uses AI-powered identity verification tools to authenticate member identities and reduce the risk of fraud.

In conclusion, Navy Federal's digital investments have transformed the way members manage their finances and access banking services. From mobile banking and digital payments to artificial intelligence and cybersecurity, the credit union has implemented a range of digital solutions to improve the member experience. With its commitment to innovation and customer satisfaction, Navy Federal has established itself as a leader in the digital banking space. We invite you to share your thoughts on Navy Federal's digital investments and how they have impacted your banking experience. Please comment below or share this article with others to continue the conversation.