Intro

Get the Navy Federal Direct Deposit Form to set up automatic payroll deposits, ensuring timely and secure transactions with Navy Federal Credit Unions direct deposit services and benefits.

The Navy Federal Credit Union is a well-established financial institution that provides its members with a wide range of banking services, including direct deposit. Direct deposit is a convenient and secure way to receive payments, such as paychecks, Social Security benefits, and tax refunds, directly into your bank account. In this article, we will discuss the Navy Federal direct deposit form, its benefits, and how to set it up.

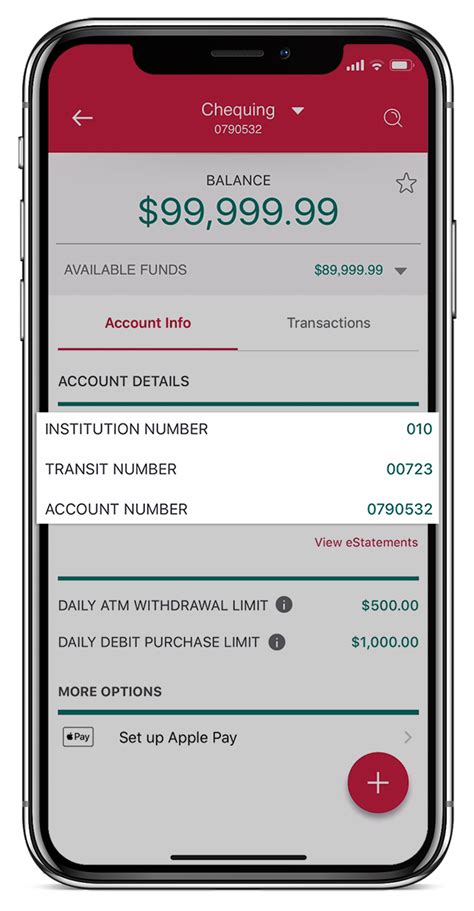

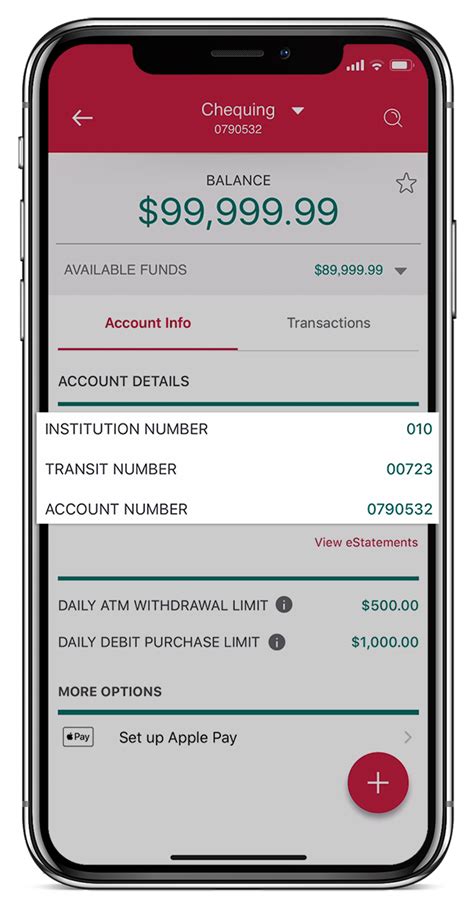

Direct deposit is a popular payment method that offers numerous benefits, including convenience, security, and speed. With direct deposit, you can receive your payments quickly and securely, without the need to physically deposit a check. This can help you avoid long lines at the bank, lost or stolen checks, and late fees. Additionally, direct deposit can help you manage your finances more effectively, as you can easily track your payments and balances online or through the Navy Federal mobile app.

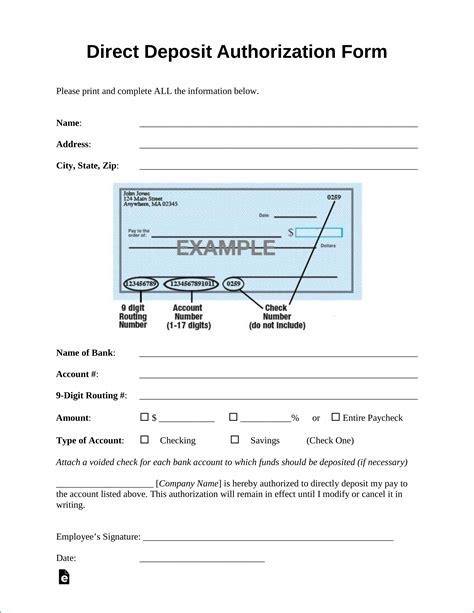

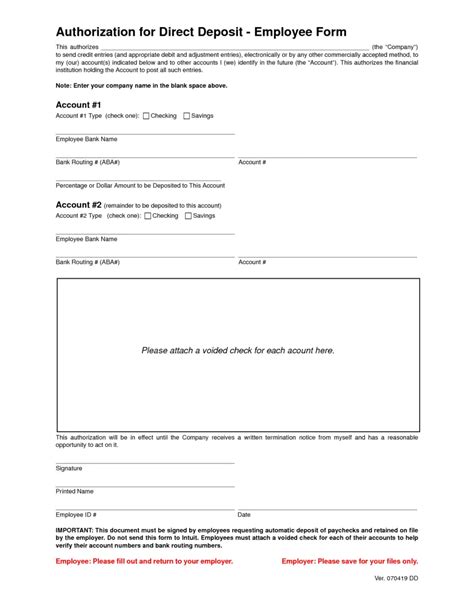

To set up direct deposit with Navy Federal, you will need to complete a direct deposit form. The form will require you to provide your account information, including your account number and routing number, as well as the type of payment you want to receive via direct deposit. You can obtain the direct deposit form by visiting the Navy Federal website, contacting their customer service, or visiting a local branch.

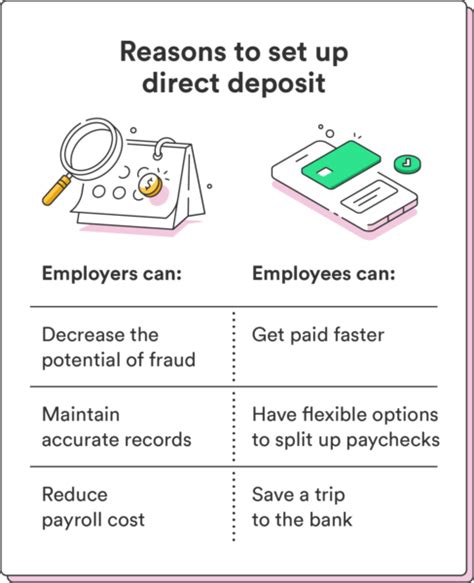

Benefits of Direct Deposit

The benefits of direct deposit are numerous. Some of the most significant advantages include:

- Convenience: Direct deposit allows you to receive payments quickly and securely, without the need to physically deposit a check.

- Security: Direct deposit reduces the risk of lost or stolen checks, as well as check fraud.

- Speed: Direct deposit allows you to access your funds faster, as payments are typically deposited into your account on the same day they are received.

- Cost savings: Direct deposit can help you avoid late fees and other charges associated with paper checks.

Types of Payments That Can Be Made via Direct Deposit

Direct deposit can be used to receive a wide range of payments, including:

- Paychecks

- Social Security benefits

- Tax refunds

- Pension payments

- Retirement account distributions

- Annuity payments

How to Set Up Direct Deposit

To set up direct deposit with Navy Federal, you will need to follow these steps:

- Obtain a direct deposit form: You can download the form from the Navy Federal website, contact their customer service, or visit a local branch.

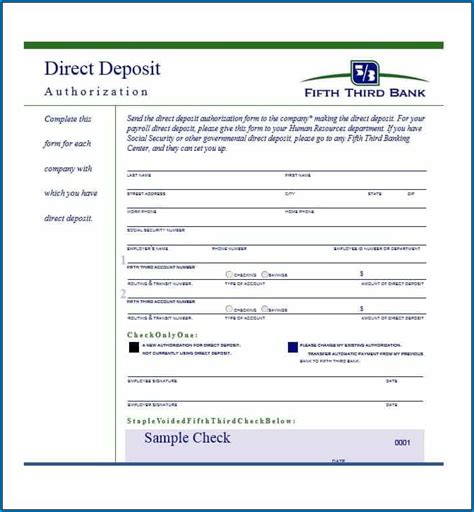

- Complete the form: Fill out the form with your account information, including your account number and routing number, as well as the type of payment you want to receive via direct deposit.

- Submit the form: Return the completed form to Navy Federal, either by mail, fax, or in person.

- Verify your account: Navy Federal will verify your account information to ensure that your payments are deposited correctly.

Required Information for Direct Deposit Form

To complete the direct deposit form, you will need to provide the following information:

- Your name and address

- Your account number and routing number

- The type of payment you want to receive via direct deposit

- The payment amount and frequency

- Your employer's name and address (if applicable)

Common Issues with Direct Deposit

While direct deposit is a convenient and secure way to receive payments, there are some common issues that can arise. Some of the most common problems include:

- Incorrect account information: If your account information is incorrect, your payments may not be deposited correctly.

- Payment delays: Payments may be delayed if there are issues with the payment processing system.

- Insufficient funds: If you do not have sufficient funds in your account, you may be charged overdraft fees.

Troubleshooting Tips

If you experience any issues with direct deposit, there are several troubleshooting tips you can try:

- Verify your account information: Ensure that your account information is correct and up to date.

- Contact Navy Federal: Reach out to Navy Federal's customer service team for assistance.

- Check your payment schedule: Verify that your payments are being deposited on the correct schedule.

Security Measures for Direct Deposit

Navy Federal takes the security of your account information seriously. To protect your account, they use a variety of security measures, including:

- Encryption: Navy Federal uses encryption to protect your account information when it is transmitted online.

- Firewalls: Navy Federal uses firewalls to prevent unauthorized access to their systems.

- Secure servers: Navy Federal stores your account information on secure servers that are protected by multiple layers of security.

Additional Security Tips

To further protect your account, you can take the following security measures:

- Use strong passwords: Choose passwords that are difficult to guess and avoid using the same password for multiple accounts.

- Monitor your account activity: Regularly review your account activity to detect any suspicious transactions.

- Keep your account information up to date: Ensure that your account information is correct and up to date to prevent any issues with direct deposit.

Direct Deposit and Mobile Banking

Navy Federal's mobile banking app allows you to manage your account on the go. With the app, you can:

- Check your account balances and transaction history

- Transfer funds between accounts

- Pay bills and send money to friends and family

- Deposit checks remotely

Mobile Banking Security

Navy Federal's mobile banking app is designed to be secure and convenient. To protect your account, the app uses:

- Encryption: The app uses encryption to protect your account information when it is transmitted online.

- Secure login: The app requires a secure login to access your account information.

- Alerts: The app can send you alerts to notify you of any suspicious activity on your account.

Navy Federal Direct Deposit Image Gallery

What is direct deposit?

+Direct deposit is a payment method that allows you to receive payments, such as paychecks, Social Security benefits, and tax refunds, directly into your bank account.

How do I set up direct deposit?

+To set up direct deposit, you will need to complete a direct deposit form and provide your account information, including your account number and routing number.

What are the benefits of direct deposit?

+The benefits of direct deposit include convenience, security, and speed. Direct deposit allows you to receive payments quickly and securely, without the need to physically deposit a check.

Can I use direct deposit for multiple accounts?

+Yes, you can use direct deposit for multiple accounts. You will need to complete a separate direct deposit form for each account.

How do I troubleshoot issues with direct deposit?

+If you experience any issues with direct deposit, you can try verifying your account information, contacting Navy Federal's customer service team, or checking your payment schedule.

In summary, the Navy Federal direct deposit form is a convenient and secure way to receive payments directly into your bank account. By following the steps outlined in this article, you can set up direct deposit and start enjoying the benefits of this payment method. If you have any questions or concerns, you can contact Navy Federal's customer service team for assistance. We hope this article has been helpful in explaining the Navy Federal direct deposit form and its benefits. If you have any further questions or would like to share your experiences with direct deposit, please feel free to comment below.