Intro

Resolve issues with Navy Federal dispute methods, including transaction disputes, credit card disputes, and account errors, using 5 effective ways to protect your finances and prevent fraud.

The importance of understanding how to navigate disputes with financial institutions cannot be overstated, especially when it comes to managing your hard-earned money. One of the most critical aspects of consumer protection is the ability to dispute transactions or decisions made by your bank. For members of Navy Federal Credit Union, one of the largest and most reputable credit unions in the world, knowing how to dispute issues is crucial for maintaining financial health and security. This article will delve into the process and importance of disputing with Navy Federal, providing readers with a comprehensive guide on how to handle disputes effectively.

Disputing transactions or decisions with Navy Federal is a process that, while sometimes daunting, is designed to protect consumers from unauthorized transactions, errors, or unfair practices. Whether it's a fraudulent charge on your credit card, an incorrect fee, or a dispute over a loan decision, understanding the steps to take can make a significant difference in resolving the issue promptly and in your favor. The process typically involves identifying the issue, gathering evidence, contacting Navy Federal, and following through on the resolution process.

The ability to dispute and resolve issues with financial institutions like Navy Federal is a cornerstone of consumer protection. It not only helps in rectifying immediate problems but also acts as a deterrent against future malpractices. Moreover, it underscores the importance of transparency and accountability in banking and financial services. For Navy Federal members, being aware of their rights and the procedures for dispute resolution can empower them to manage their financial affairs more effectively and confidently.

Understanding the Dispute Process

To effectively dispute an issue with Navy Federal, it's essential to understand the process and the steps involved. This includes recognizing the types of disputes that can be filed, such as those related to debit or credit card transactions, loan decisions, or account management issues. Each type of dispute may have its specific procedure and requirements for resolution. Generally, the process begins with the member identifying the issue and gathering all relevant information and evidence. This could include transaction records, communication with merchants, or any other documentation that supports the dispute.

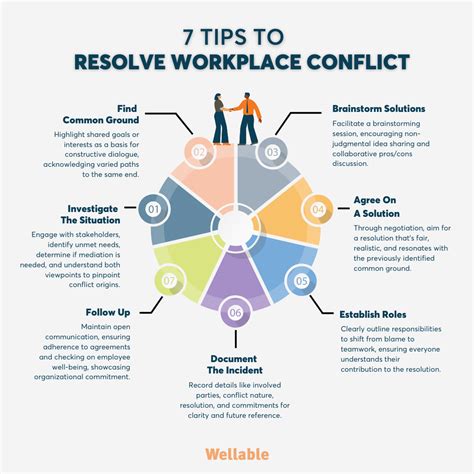

Key Steps in the Dispute Process

The key steps in disputing an issue with Navy Federal typically involve: - Identifying the dispute: Clearly defining the issue, whether it's an unauthorized transaction, a billing error, or a dispute over a financial product or service. - Gathering evidence: Collecting all relevant documents, records, and information that support the dispute. - Contacting Navy Federal: Reaching out to the credit union's customer service or dispute resolution department to report the issue and initiate the dispute process. - Following up: Ensuring that the dispute is being investigated and resolved in a timely manner, which may involve additional communication or the provision of further information.Types of Disputes with Navy Federal

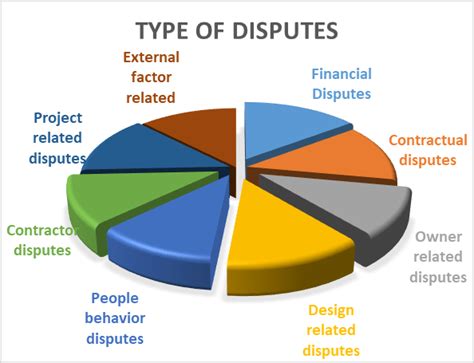

There are several types of disputes that members may encounter with Navy Federal, each with its own set of rules and procedures for resolution. These include:

- Debit and Credit Card Disputes: These involve unauthorized transactions, incorrect charges, or disputes over goods and services purchased.

- Loan Disputes: Issues related to loan applications, loan terms, or repayment problems.

- Account Management Disputes: Problems with account access, fees, or services provided by Navy Federal.

Resolving Debit and Credit Card Disputes

Resolving debit and credit card disputes often involves notifying Navy Federal promptly upon discovering an unauthorized transaction or error. The credit union will typically request information about the transaction, including the date, amount, and any communication with the merchant. Members should be prepared to provide detailed information to facilitate a quick resolution.Benefits of Dispute Resolution

The dispute resolution process with Navy Federal offers several benefits to its members, including:

- Protection Against Fraud: Quick action can prevent further unauthorized transactions and protect members' financial security.

- Correction of Errors: Resolving billing errors or incorrect fees ensures that members are not unfairly charged.

- Improved Services: Feedback from disputes can lead to improvements in Navy Federal's services and products, enhancing the overall member experience.

Enhancing Financial Security

Dispute resolution is a critical component of maintaining financial security. By understanding and utilizing the dispute process, members can protect their accounts, correct errors, and ensure that their financial transactions are accurate and secure. This not only safeguards their current financial situation but also builds trust in the financial institution, fostering a long-term relationship.Best Practices for Dispute Resolution

To navigate the dispute resolution process effectively, members should adopt several best practices, including:

- Act Promptly: The sooner a dispute is reported, the sooner it can be resolved.

- Gather Detailed Information: Keeping accurate records of transactions, communications, and evidence supports a strong dispute case.

- Stay Informed: Understanding the dispute process and the rights of members under consumer protection laws empowers them to navigate the process more effectively.

Communication is Key

Effective communication with Navy Federal is crucial throughout the dispute resolution process. Members should be clear, concise, and thorough in their communications, ensuring that all relevant information is provided to facilitate a quick and fair resolution.Gallery of Navy Federal Dispute Resolution

Navy Federal Dispute Resolution Image Gallery

Frequently Asked Questions

What is the first step in disputing a transaction with Navy Federal?

+The first step is to identify the issue and gather all relevant information and evidence related to the dispute.

How long does the dispute resolution process typically take?

+The duration of the dispute resolution process can vary depending on the complexity of the issue and the type of dispute. However, Navy Federal aims to resolve disputes in a timely manner, often within a few days to a couple of weeks.

What information should I have ready when contacting Navy Federal about a dispute?

+It's essential to have detailed information about the transaction or issue, including dates, amounts, and any communication related to the dispute. This helps Navy Federal to investigate and resolve the matter efficiently.

In conclusion, navigating disputes with Navy Federal is a process that, while it may seem complex, is designed to protect and serve the interests of its members. By understanding the types of disputes, the steps involved in the dispute process, and the benefits of dispute resolution, members can ensure their financial security and well-being. Whether dealing with debit and credit card issues, loan disputes, or account management problems, being informed and proactive is key to a successful resolution. We invite readers to share their experiences or ask questions about disputing issues with Navy Federal, and we encourage everyone to take an active role in managing their financial affairs effectively.