Intro

Discover the top 5 Navy Federal benefits, including exclusive credit union perks, low-rate loans, and personalized banking services, offering military members and families financial security and stability through membership rewards and benefits.

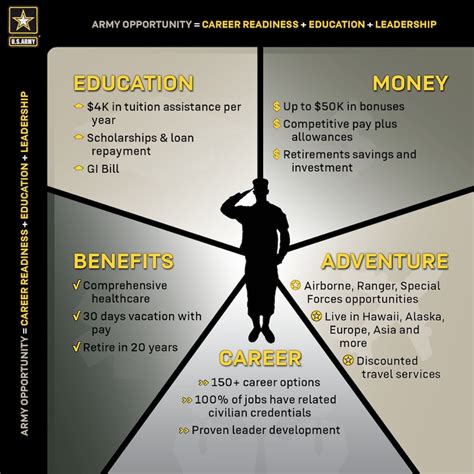

The importance of financial stability and security cannot be overstated, especially for individuals who serve in the military and their families. One institution that has been providing top-notch financial services to these groups is Navy Federal Credit Union. With its rich history and commitment to excellence, Navy Federal has become a trusted name in the financial industry. In this article, we will delve into the world of Navy Federal benefits, exploring the advantages that members can enjoy. From competitive loan rates to exclusive discounts, we will cover the top benefits that make Navy Federal a go-to choice for military personnel and their loved ones.

For those who are part of the military community, navigating the complexities of personal finance can be a daunting task. Between deployments, relocations, and other challenges, it's essential to have a financial partner that understands the unique needs of service members. Navy Federal has been serving this community for over 80 years, providing a range of financial products and services tailored to their specific requirements. Whether it's buying a home, financing a car, or saving for retirement, Navy Federal offers a suite of benefits that can help members achieve their financial goals.

As we explore the world of Navy Federal benefits, it's clear that this institution is dedicated to providing its members with the best possible financial solutions. From low-interest loans to high-yield savings accounts, Navy Federal's products are designed to help members save money, build wealth, and achieve financial stability. With its strong reputation, excellent customer service, and commitment to the military community, Navy Federal has become a leader in the financial industry. In the following sections, we will take a closer look at the top 5 Navy Federal benefits that make it an attractive choice for military personnel and their families.

Competitive Loan Rates

For example, Navy Federal's auto loan rates are often significantly lower than those offered by other lenders. With rates starting as low as 2.99% APR, members can save hundreds or even thousands of dollars in interest charges over the life of the loan. Similarly, Navy Federal's mortgage rates are highly competitive, with options for fixed-rate and adjustable-rate loans, as well as specialized products like VA loans and USDA loans. By taking advantage of these competitive loan rates, Navy Federal members can enjoy significant savings and improved financial stability.

Exclusive Discounts and Rewards

Navy Federal also offers exclusive discounts on insurance products, including auto, home, and life insurance. By bundling these products with other Navy Federal services, members can enjoy discounted rates and improved coverage. Additionally, Navy Federal's rewards program offers points or cash back on certain purchases, which can be redeemed for gift cards, travel, or other rewards. With these exclusive discounts and rewards, Navy Federal members can enjoy significant savings and improved financial benefits.

High-Yield Savings Accounts

For example, Navy Federal's Savings Account offers a competitive interest rate of 0.25% APY, with no minimum balance requirements or monthly maintenance fees. This makes it an attractive option for members who want to earn more money on their savings without worrying about fees or minimums. Additionally, Navy Federal's Money Market Savings Account offers an even higher interest rate of 0.50% APY, with tiered rates that increase as the balance grows. With these high-yield savings accounts, Navy Federal members can enjoy increased earnings and improved financial stability.

Low-Fee Banking Services

For example, Navy Federal's checking accounts offer no monthly maintenance fees, no minimum balance requirements, and no overdraft fees. This makes it an attractive option for members who want to manage their finances without worrying about fees. Additionally, Navy Federal's ATM network is extensive, with over 30,000 surcharge-free ATMs worldwide. This means that members can access their cash without incurring high fees, even when traveling or deployed. With these low-fee banking services, Navy Federal members can enjoy reduced costs and improved financial benefits.

Excellent Customer Service

For example, Navy Federal's customer service team can help members with everything from account management to loan applications. They can also provide guidance on financial planning, budgeting, and saving, helping members achieve their long-term goals. With Navy Federal's excellent customer service, members can enjoy a more supportive and personalized banking experience, with help available whenever they need it.

Navy Federal Image Gallery

What are the benefits of being a Navy Federal member?

+As a Navy Federal member, you can enjoy a range of benefits, including competitive loan rates, exclusive discounts and rewards, high-yield savings accounts, low-fee banking services, and excellent customer service.

How do I become a Navy Federal member?

+To become a Navy Federal member, you must be a member of the military, a veteran, or a family member of a military personnel. You can apply for membership online or by visiting a Navy Federal branch.

What types of loans does Navy Federal offer?

+Navy Federal offers a range of loan products, including auto loans, mortgages, personal loans, and credit cards. These loans often come with competitive interest rates and flexible repayment terms.

Can I access my Navy Federal account online or through a mobile app?

+Yes, Navy Federal offers online banking and a mobile app, allowing you to access your account, transfer funds, and pay bills from anywhere.

How do I contact Navy Federal customer service?

+You can contact Navy Federal customer service by phone, email, or online chat. The customer service team is available 24/7 to answer your questions and provide support.

In conclusion, Navy Federal offers a range of benefits that make it an attractive choice for military personnel and their families. From competitive loan rates to exclusive discounts and rewards, high-yield savings accounts, low-fee banking services, and excellent customer service, Navy Federal is committed to providing its members with the best possible financial solutions. By taking advantage of these benefits, members can enjoy significant savings, improved financial stability, and a more supportive banking experience. If you're interested in learning more about Navy Federal and its benefits, we encourage you to visit their website or contact their customer service team. Share your thoughts and experiences with Navy Federal in the comments below, and don't forget to share this article with your friends and family who may be interested in learning more about this exceptional financial institution.