Intro

Discover 5 Navy Federal HELOC rates, offering competitive home equity line of credit options with flexible terms, low interest rates, and borrowing limits, suitable for homeowners seeking debt consolidation, home improvements, or cash flow management.

The importance of understanding Navy Federal HELOC rates cannot be overstated, especially for individuals looking to tap into their home's equity to cover significant expenses or consolidate debt. Home Equity Lines of Credit (HELOCs) offer a flexible and often more affordable way to borrow money compared to other loan options, making them a popular choice among homeowners. Navy Federal Credit Union, with its member-centric approach and competitive rates, is a leading institution for those considering a HELOC.

For many, the decision to apply for a HELOC is driven by the need for funds to undertake home improvements, pay for education, or manage unexpected financial setbacks. Given the significant amount of money involved, it's crucial for potential borrowers to have a clear understanding of the rates they might be charged. Navy Federal HELOC rates, like those of other financial institutions, can vary based on several factors including the borrower's credit score, the loan-to-value ratio of the property, and prevailing market conditions.

Navigating the world of HELOCs requires a bit of knowledge about how these financial products work and what benefits they offer. A key advantage of HELOCs is their revolving credit nature, which allows borrowers to draw funds as needed and repay them according to a schedule that fits their financial situation. This flexibility, combined with the potential tax benefits of using a HELOC for home improvements, makes them an attractive option for homeowners looking to make the most of their property's value.

Navy Federal HELOC Overview

Navy Federal Credit Union offers its members a range of financial products, including HELOCs, designed to meet various needs and financial goals. Their HELOC product is notable for its competitive rates and terms that can be tailored to fit the member's financial situation. Understanding the specifics of Navy Federal's HELOC offering is essential for making informed decisions about borrowing.

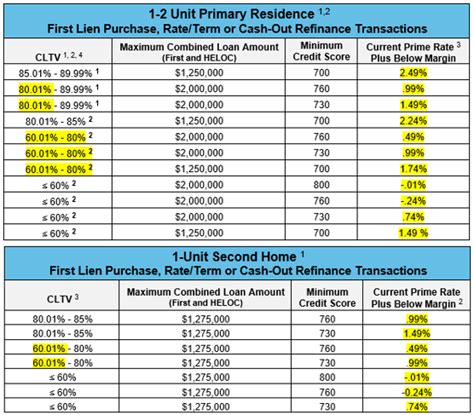

One of the key aspects of Navy Federal HELOCs is their interest rate structure. Rates can be influenced by a variety of factors, including market conditions and the borrower's creditworthiness. Generally, borrowers with higher credit scores and lower loan-to-value ratios can qualify for more favorable rates. It's also worth noting that Navy Federal, like other lenders, may offer introductory rates that are lower than the standard rate, providing an incentive for new borrowers.

Benefits of Navy Federal HELOCs

The benefits of choosing a Navy Federal HELOC are numerous. For starters, the application process is streamlined, allowing members to quickly determine their eligibility and the potential amount they can borrow. Additionally, the flexibility of a HELOC means that borrowers only pay interest on the amount they actually use, making it a cost-effective option for managing expenses or funding projects.

Another significant advantage is the potential for tax deductions on the interest paid on a HELOC, especially when the funds are used for home improvements. This can provide a substantial reduction in the overall cost of borrowing. Furthermore, Navy Federal's commitment to its members means that they often receive more personalized service and potentially better terms than they might find at a traditional bank.

How Navy Federal HELOC Rates Work

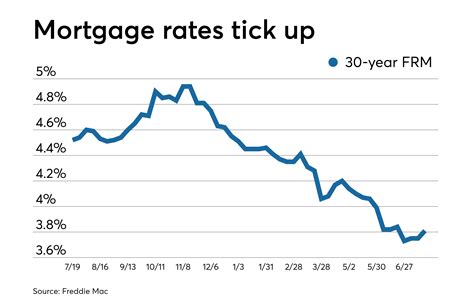

Understanding how Navy Federal HELOC rates work is crucial for any potential borrower. The rates are typically variable, meaning they can fluctuate over the life of the loan based on market conditions. However, this variability also means that rates can decrease, potentially lowering the borrower's monthly payments.

Navy Federal, like other lenders, uses a margin plus an index to determine the interest rate for a HELOC. The margin is a fixed amount that is added to the index (often a prime rate) to calculate the total interest rate. Borrowers with excellent credit may qualify for a lower margin, resulting in a more favorable interest rate.

Factors Influencing Navy Federal HELOC Rates

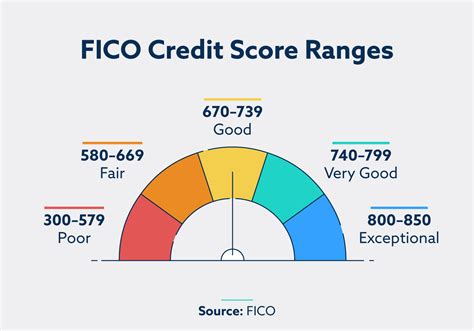

Several factors can influence the rates offered on Navy Federal HELOCs. The borrower's credit score is one of the most significant factors, as it reflects their creditworthiness and ability to repay the loan. A higher credit score can lead to a lower interest rate and more favorable loan terms.

The loan-to-value (LTV) ratio is another critical factor. This ratio compares the amount of the loan to the value of the property. Borrowers with lower LTV ratios are generally considered less risky and may qualify for better rates. Market conditions, including prevailing interest rates and economic trends, also play a role in determining HELOC rates.

Applying for a Navy Federal HELOC

The process of applying for a Navy Federal HELOC is designed to be straightforward and efficient. Members can apply online, by phone, or in person at a branch. The application will require financial information, including income, debts, and the value of the property being used as collateral.

Once the application is submitted, Navy Federal will review the member's creditworthiness and assess the property's value to determine the amount that can be borrowed and the interest rate offered. This process typically includes an appraisal of the property to confirm its value.

Navy Federal HELOC Rates Comparison

Comparing Navy Federal HELOC rates with those offered by other lenders is an essential step in finding the best deal. Borrowers should consider not only the interest rate but also other costs associated with the loan, such as origination fees, annual fees, and closing costs.

Navy Federal's rates are often competitive with, if not better than, those of traditional banks. However, the specific terms and rates can vary, so it's crucial to review and compare all the details before making a decision.

Managing Your Navy Federal HELOC

Once a Navy Federal HELOC is approved and funds are available, managing the account effectively is key to making the most of this financial tool. This includes understanding the draw period, during which funds can be borrowed, and the repayment period, when the borrowed amount plus interest must be repaid.

Borrowers should also be aware of any changes in the interest rate and how these changes might affect their monthly payments. Regular reviews of the account and adjustments as needed can help ensure that the HELOC remains a beneficial and manageable part of one's financial strategy.

Navy Federal HELOC Image Gallery

What are the benefits of a Navy Federal HELOC?

+The benefits include competitive rates, flexibility in borrowing and repayment, and potential tax deductions on interest paid.

How do I apply for a Navy Federal HELOC?

+You can apply online, by phone, or in person at a Navy Federal branch. The application will require financial information and an appraisal of your property.

What factors influence Navy Federal HELOC rates?

+Factors include your credit score, the loan-to-value ratio of your property, and prevailing market conditions.

In