Intro

Discover Navy Federal HELOC loans, offering flexible home equity lines of credit with competitive rates, low fees, and convenient repayment terms for homeowners, providing financial freedom and access to cash.

The world of home financing can be complex and overwhelming, especially for those who are new to the process. One option that has gained popularity in recent years is the Home Equity Line of Credit, or HELOC. Navy Federal, a well-established credit union, offers HELOC loans to its members, providing a flexible and potentially cost-effective way to tap into the equity in their homes. In this article, we will delve into the details of Navy Federal HELOC loans, exploring their benefits, working mechanisms, and key considerations for potential borrowers.

For homeowners who have built up significant equity in their properties, a HELOC can be a valuable tool for accessing funds. Whether it's for home improvements, debt consolidation, or other major expenses, a HELOC can provide a low-interest source of credit. Navy Federal, with its reputation for competitive rates and member-friendly services, is an attractive option for those seeking a HELOC. By understanding how Navy Federal HELOC loans work and what they entail, individuals can make informed decisions about their financial options.

The importance of carefully evaluating loan options cannot be overstated. With so many different types of loans available, each with its own set of terms and conditions, it's crucial for borrowers to do their research. Navy Federal HELOC loans, like other financial products, come with their own set of benefits and potential drawbacks. By examining these aspects in detail, prospective borrowers can determine whether a Navy Federal HELOC loan aligns with their financial goals and circumstances.

Introduction to Navy Federal HELOC Loans

Benefits of Navy Federal HELOC Loans

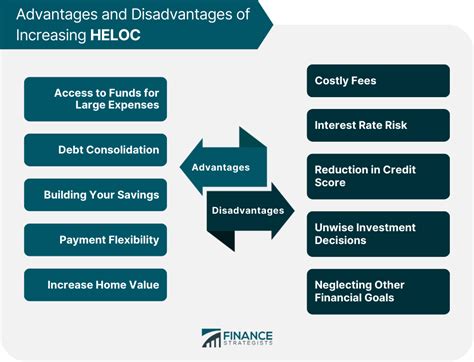

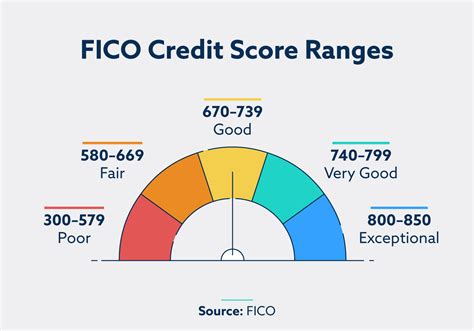

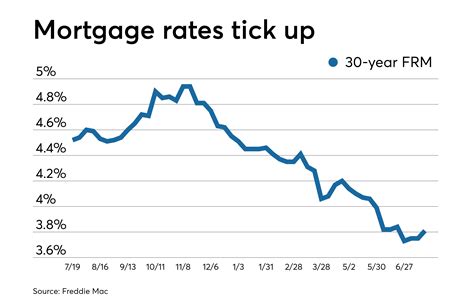

The benefits of choosing a Navy Federal HELOC loan are multifaceted. Firstly, these loans often come with competitive interest rates, especially for members with good credit scores. This can make borrowing more affordable compared to other forms of credit. Additionally, the interest paid on a HELOC may be tax-deductible, though it's essential to consult with a tax advisor to understand the specific implications. Another significant advantage is the flexibility a HELOC offers; borrowers can draw and repay funds as needed, making it a versatile financial tool for managing expenses or projects over time.How Navy Federal HELOC Loans Work

Key Considerations for Borrowers

Before applying for a Navy Federal HELOC loan, there are several key considerations that borrowers should keep in mind. Firstly, the borrower's home serves as collateral for the loan, meaning that failure to repay the loan could result in foreclosure. Additionally, borrowers should be aware of the fees associated with HELOCs, such as origination fees, annual fees, and potentially a fee for each transaction. It's also important to understand the terms of the loan, including the interest rate, which may be variable, and the repayment terms. Borrowers should carefully review their financial situation and consider whether a HELOC aligns with their long-term financial goals and risk tolerance.Steps to Apply for a Navy Federal HELOC Loan

Managing Your Navy Federal HELOC Loan

Effective management of a Navy Federal HELOC loan is crucial to avoid financial difficulties. This includes making timely payments, both during the draw period and the repayment period, to avoid late fees and negative impacts on credit scores. Borrowers should also keep track of their credit limit and avoid over-extending themselves, as this can lead to financial strain. Regularly reviewing the loan's terms and considering options for reducing the interest rate or refinancing can also be beneficial.Advantages and Disadvantages of Navy Federal HELOC Loans

Alternatives to Navy Federal HELOC Loans

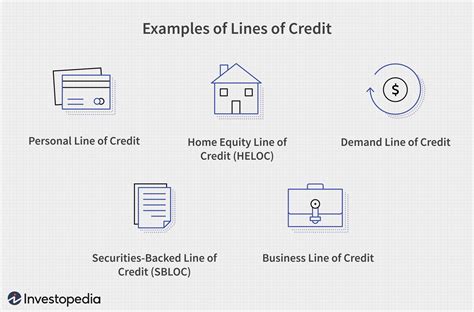

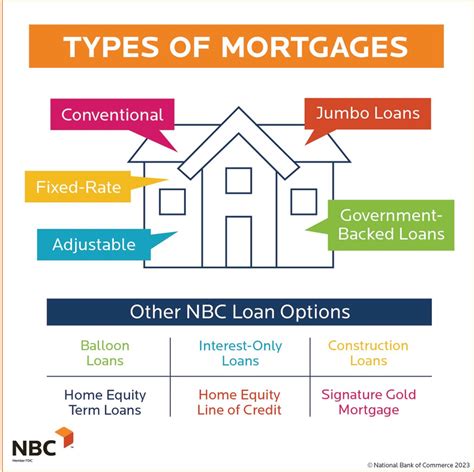

For those who may not qualify for a Navy Federal HELOC loan or prefer alternative options, there are several other choices available. These include home equity loans, which provide a lump sum upfront, personal loans, which do not require collateral, and cash-out refinancing, which involves refinancing the existing mortgage to access cash. Each of these alternatives has its own set of benefits and drawbacks, and the best option will depend on the individual's financial goals, credit score, and current financial situation.Conclusion and Next Steps

Navy Federal HELOC Loans Image Gallery

What is a Navy Federal HELOC loan?

+A Navy Federal HELOC loan is a type of loan that allows homeowners to borrow money using the equity in their home as collateral.

How do I apply for a Navy Federal HELOC loan?

+To apply for a Navy Federal HELOC loan, you can visit the Navy Federal Credit Union website, call their customer service, or visit a branch in person.

What are the benefits of a Navy Federal HELOC loan?

+The benefits of a Navy Federal HELOC loan include competitive interest rates, flexible repayment terms, and the potential for tax benefits.

We hope this comprehensive guide to Navy Federal HELOC loans has provided you with the information you need to make an informed decision about your financial options. Whether you're looking to finance home improvements, consolidate debt, or achieve other financial goals, understanding the details of Navy Federal HELOC loans can help you navigate the process with confidence. If you have any further questions or would like to share your experiences with HELOC loans, please don't hesitate to comment below. Your insights can help others in their financial journeys. Additionally, if you found this article helpful, consider sharing it with friends or family who might benefit from learning more about Navy Federal HELOC loans.