Intro

Discover how Navy Federal home loans work with 5 key benefits, including VA loans, mortgage rates, and refinancing options, tailored for military members and veterans seeking affordable housing solutions.

The process of securing a home loan can be daunting, especially for first-time buyers. However, with the right guidance and support, it can be a smooth and successful experience. Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a range of home loan options to its members. In this article, we will explore how Navy Federal home loans work and the benefits they offer to borrowers.

Navy Federal home loans are designed to provide affordable and flexible financing options to members who are looking to purchase, refinance, or renovate a home. With competitive interest rates, low fees, and a range of loan programs to choose from, Navy Federal is an excellent choice for anyone looking to secure a home loan. Whether you're a first-time buyer, a seasoned homeowner, or a veteran, Navy Federal has a home loan option that can meet your needs.

From conventional loans to VA loans, Navy Federal offers a variety of home loan programs that cater to different financial situations and goals. For example, their conventional loans offer flexible terms and low down payment options, while their VA loans provide competitive interest rates and no down payment requirements for eligible veterans. With Navy Federal, you can choose from a range of loan terms, including 10, 15, 20, and 30 years, allowing you to select the option that best fits your budget and financial plans.

How Navy Federal Home Loans Work

Navy Federal home loans are designed to be easy to understand and navigate. The process typically begins with a pre-approval, which gives you an idea of how much you can borrow and what your monthly payments will be. Once you've found a home and made an offer, you'll need to submit a formal loan application, which will require documentation such as pay stubs, bank statements, and tax returns. Navy Federal's experienced loan officers will guide you through the process, ensuring that you have all the necessary documents and information to complete your application.

Benefits of Navy Federal Home Loans

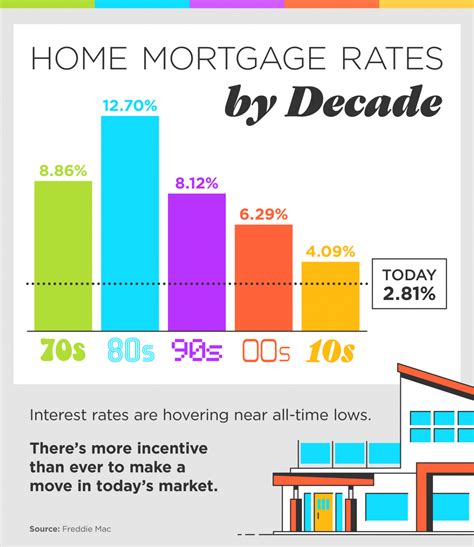

The benefits of Navy Federal home loans are numerous. For one, they offer competitive interest rates, which can help you save money on your monthly payments. They also have low fees, including no origination fees on many of their loan programs. Additionally, Navy Federal offers a range of loan options, including conventional, VA, and FHA loans, allowing you to choose the program that best fits your needs. With Navy Federal, you can also take advantage of their experienced loan officers, who will guide you through the entire process and ensure that you have a smooth and successful experience.Types of Navy Federal Home Loans

Navy Federal offers a range of home loan options to its members. These include:

- Conventional loans: These loans offer flexible terms and low down payment options, making them a great choice for anyone looking to purchase or refinance a home.

- VA loans: These loans are designed for eligible veterans and offer competitive interest rates and no down payment requirements.

- FHA loans: These loans are insured by the Federal Housing Administration and offer low down payment options and lenient credit score requirements.

- USDA loans: These loans are designed for borrowers who are looking to purchase a home in a rural area and offer low down payment options and competitive interest rates.

Eligibility Requirements for Navy Federal Home Loans

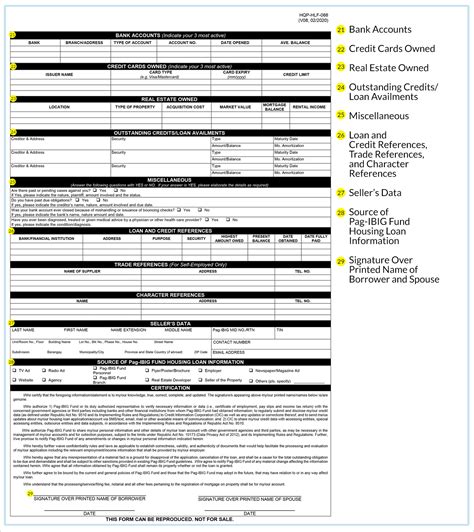

To be eligible for a Navy Federal home loan, you'll need to meet certain requirements. These include: * Being a member of Navy Federal Credit Union * Having a good credit score * Meeting the income and debt-to-income requirements for the loan program you're applying for * Having a stable employment history * Meeting the property requirements for the loan program you're applying forApplication Process for Navy Federal Home Loans

The application process for Navy Federal home loans is straightforward. Here are the steps you'll need to follow:

- Get pre-approved: This will give you an idea of how much you can borrow and what your monthly payments will be.

- Find a home: Once you've been pre-approved, you can start looking for a home.

- Submit a formal loan application: This will require documentation such as pay stubs, bank statements, and tax returns.

- Wait for processing: Navy Federal's experienced loan officers will review your application and ensure that you have all the necessary documents and information.

- Close on your loan: Once your application has been approved, you'll need to sign the final documents and close on your loan.

Tips for Getting Approved for a Navy Federal Home Loan

To increase your chances of getting approved for a Navy Federal home loan, here are some tips to follow: * Check your credit report: Make sure your credit report is accurate and up-to-date. * Pay off debt: Reducing your debt-to-income ratio can help you qualify for a better interest rate. * Save for a down payment: The more you can put down, the lower your monthly payments will be. * Get pre-approved: This will give you an idea of how much you can borrow and what your monthly payments will be.Navy Federal Home Loan Rates and Terms

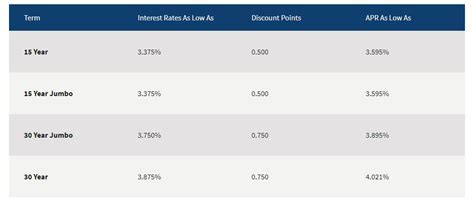

Navy Federal home loan rates and terms are competitive and flexible. They offer a range of loan terms, including 10, 15, 20, and 30 years, allowing you to select the option that best fits your budget and financial plans. Their interest rates are also competitive, with options for fixed-rate and adjustable-rate loans. Additionally, Navy Federal offers low fees, including no origination fees on many of their loan programs.

Advantages of Navy Federal Home Loans

The advantages of Navy Federal home loans are numerous. Here are some of the benefits you can expect: * Competitive interest rates: Navy Federal offers competitive interest rates, which can help you save money on your monthly payments. * Low fees: Navy Federal has low fees, including no origination fees on many of their loan programs. * Flexible terms: Navy Federal offers a range of loan terms, including 10, 15, 20, and 30 years, allowing you to select the option that best fits your budget and financial plans. * Experienced loan officers: Navy Federal's experienced loan officers will guide you through the entire process and ensure that you have a smooth and successful experience.Navy Federal Home Loan Customer Service

Navy Federal home loan customer service is top-notch. Their experienced loan officers are available to answer your questions and guide you through the entire process. They also have a range of online resources, including a mortgage calculator and a loan application portal, making it easy to apply for and manage your loan. Additionally, Navy Federal has a strong reputation for customer satisfaction, with many members praising their excellent service and support.

Common Mistakes to Avoid When Applying for a Navy Federal Home Loan

When applying for a Navy Federal home loan, there are several common mistakes to avoid. Here are some tips to keep in mind: * Not checking your credit report: Make sure your credit report is accurate and up-to-date. * Not paying off debt: Reducing your debt-to-income ratio can help you qualify for a better interest rate. * Not saving for a down payment: The more you can put down, the lower your monthly payments will be. * Not getting pre-approved: This will give you an idea of how much you can borrow and what your monthly payments will be.Navy Federal Home Loan Image Gallery

What are the benefits of a Navy Federal home loan?

+The benefits of a Navy Federal home loan include competitive interest rates, low fees, and flexible terms. Additionally, Navy Federal offers a range of loan programs, including conventional, VA, and FHA loans, allowing you to choose the program that best fits your needs.

How do I apply for a Navy Federal home loan?

+To apply for a Navy Federal home loan, you'll need to submit a formal loan application, which will require documentation such as pay stubs, bank statements, and tax returns. You can apply online or in-person at a Navy Federal branch.

What are the eligibility requirements for a Navy Federal home loan?

+To be eligible for a Navy Federal home loan, you'll need to meet certain requirements, including being a member of Navy Federal Credit Union, having a good credit score, and meeting the income and debt-to-income requirements for the loan program you're applying for.

How long does the Navy Federal home loan process take?

+The Navy Federal home loan process typically takes several weeks to several months, depending on the complexity of the loan and the speed at which you provide the necessary documentation.

Can I refinance my existing mortgage with a Navy Federal home loan?

+Yes, you can refinance your existing mortgage with a Navy Federal home loan. Navy Federal offers a range of refinance options, including cash-out refinancing and rate-and-term refinancing.

In summary, Navy Federal home loans offer a range of benefits, including competitive interest rates, low fees, and flexible terms. With a range of loan programs to choose from, including conventional, VA, and FHA loans, you can select the option that best fits your needs. By following the tips and guidelines outlined in this article, you can increase your chances of getting approved for a Navy Federal home loan and achieve your dream of homeownership. Whether you're a first-time buyer or a seasoned homeowner, Navy Federal has the expertise and resources to help you navigate the home loan process and find the perfect loan for your needs. So why wait? Apply for a Navy Federal home loan today and take the first step towards owning your dream home. We invite you to share your thoughts and experiences with Navy Federal home loans in the comments below.