Intro

Discover how Navy Federal home loans work with 5 key benefits, including VA loans, mortgage rates, and refinancing options, tailored for military members and veterans seeking affordable housing solutions.

Navy Federal home loans have become a popular choice for many individuals, especially those with a military background. These loans offer a range of benefits, including competitive interest rates, flexible repayment terms, and lenient eligibility criteria. In this article, we will delve into the world of Navy Federal home loans, exploring how they work, their benefits, and what sets them apart from other types of mortgages.

The importance of understanding Navy Federal home loans cannot be overstated. With the ever-changing landscape of the housing market, it's essential to stay informed about the various financing options available. Whether you're a first-time homebuyer or a seasoned homeowner, Navy Federal home loans can provide a viable solution for your mortgage needs. By grasping the intricacies of these loans, you'll be better equipped to make informed decisions about your financial future.

Navy Federal home loans are designed to cater to the unique needs of military personnel, veterans, and their families. These loans offer a range of advantages, including lower interest rates, reduced fees, and more flexible repayment terms. Additionally, Navy Federal home loans often come with more lenient eligibility criteria, making it easier for borrowers to qualify. With their competitive rates and terms, it's no wonder why Navy Federal home loans have become a go-to option for many individuals in the military community.

Introduction to Navy Federal Home Loans

Benefits of Navy Federal Home Loans

Types of Navy Federal Home Loans

How to Apply for a Navy Federal Home Loan

Navy Federal Home Loan FAQs

Navy Federal Home Loans Image Gallery

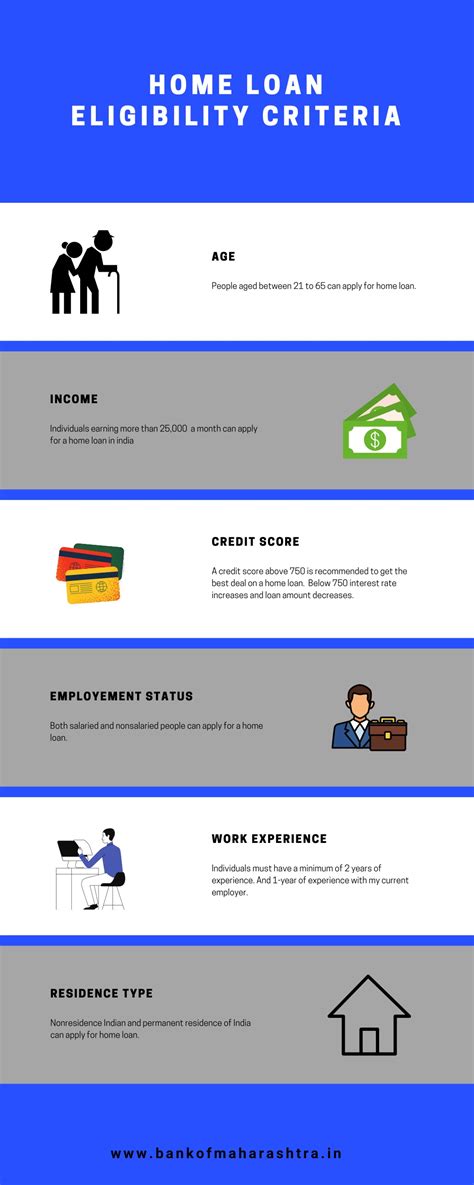

What are the eligibility criteria for Navy Federal home loans?

+To be eligible for a Navy Federal home loan, you must be a member of the military, a veteran, or a family member. You'll also need to meet the credit score and income requirements.

How do I apply for a Navy Federal home loan?

+You can apply for a Navy Federal home loan online or in-person at a branch location. You'll need to provide financial documents, including pay stubs, bank statements, and tax returns.

What are the benefits of Navy Federal home loans?

+Navy Federal home loans offer a range of benefits, including competitive interest rates, flexible repayment terms, and lenient eligibility criteria. You may also be able to avoid paying private mortgage insurance (PMI).

In conclusion, Navy Federal home loans offer a range of benefits and advantages for individuals in the military community. By understanding how these loans work and what sets them apart from other types of mortgages, you'll be better equipped to make informed decisions about your financial future. Whether you're a first-time homebuyer or a seasoned homeowner, Navy Federal home loans can provide a viable solution for your mortgage needs. We invite you to share your thoughts and experiences with Navy Federal home loans in the comments below. If you found this article helpful, please consider sharing it with others who may be interested in learning more about these loan products.