Intro

Discover expert 5 Navy Federal Tips for managing finances, including credit score optimization, loan guidance, and investment strategies, to enhance financial stability and security.

In today's fast-paced financial world, managing your money effectively is more crucial than ever. For members of the military, veterans, and their families, Navy Federal Credit Union offers a wide range of financial services and tools designed to help them achieve their financial goals. With its rich history and commitment to serving the military community, Navy Federal has become a trusted partner for many. In this article, we will delve into five Navy Federal tips that can help you make the most of your membership and improve your financial well-being.

The importance of financial literacy and planning cannot be overstated, especially for those who serve or have served in the military. The unique challenges and opportunities that come with military life require a tailored approach to financial management. Navy Federal, with its deep understanding of the military community's needs, provides a comprehensive suite of products and services designed to address these challenges. From savings and checking accounts to loans, credit cards, and investment products, Navy Federal offers a one-stop solution for all your financial needs.

Understanding how to navigate and utilize these services effectively is key to maximizing the benefits of your Navy Federal membership. Whether you are looking to save for a big purchase, pay off debt, build credit, or plan for retirement, having the right strategies and tools at your disposal can make all the difference. In the following sections, we will explore five essential tips for getting the most out of Navy Federal, covering topics from account management and credit building to investment and long-term planning.

Understanding Navy Federal Membership Benefits

Managing Your Accounts Effectively

Benefits of Digital Banking

The shift towards digital banking has revolutionized the way we manage our finances. With Navy Federal's digital banking services, you can: - Access your accounts 24/7 - Pay bills and transfer funds securely - Deposit checks remotely - Monitor your account activity and set up alerts - Manage your credit card accounts and rewardsBuilding Credit with Navy Federal

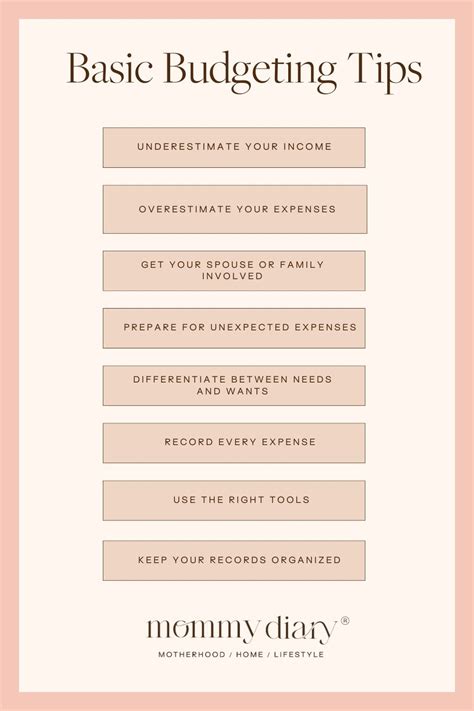

Tips for Credit Building

- Apply for a credit card or loan to start building your credit history - Make all payments on time to demonstrate responsible credit behavior - Keep your credit utilization ratio below 30% to show lenders you can manage your debt - Monitor your credit report regularly to ensure it's accurate and up-to-dateInvesting with Navy Federal

Investment Strategies

- Start early to take advantage of compound interest - Diversify your portfolio to manage risk - Consider working with a financial advisor to create a personalized investment plan - Educate yourself on different types of investments to make informed decisionsPlanning for Retirement

Retirement Planning Tips

- Start saving for retirement as early as possible - Take advantage of tax-advantaged retirement accounts - Consider consulting with a financial advisor to create a personalized retirement plan - Review and adjust your retirement plan regularly to ensure you're on track to meet your goalsNavy Federal Tips Image Gallery

What are the benefits of being a Navy Federal member?

+As a Navy Federal member, you have access to competitive loan and deposit rates, low fees, exclusive discounts, financial counseling, investment services, and insurance products tailored to the military community.

How can I build credit with Navy Federal?

+You can build credit by applying for a Navy Federal credit card or loan, making timely payments, and keeping your credit utilization ratio low. Monitoring your credit report regularly is also crucial.

What investment options are available through Navy Federal?

+Navy Federal offers a range of investment products, including mutual funds, ETFs, and brokerage accounts. You can also work with a financial advisor to create a personalized investment plan.

In conclusion, maximizing your Navy Federal membership requires a deep understanding of the benefits, services, and tools available to you. By applying the tips outlined in this article, you can effectively manage your accounts, build credit, invest for the future, and plan for retirement. Remember, achieving financial stability and security is a journey that requires patience, discipline, and the right guidance. Take the first step today by exploring how Navy Federal can help you reach your financial goals. Share your thoughts and experiences with Navy Federal in the comments below, and don't forget to share this article with anyone who might benefit from these valuable tips.