Intro

Discover Navy Federal IRA options, including traditional and Roth IRAs, with competitive rates and flexible investment choices, offering retirement savings and planning solutions.

Investing in an Individual Retirement Account (IRA) is a crucial step towards securing your financial future. With numerous options available, it's essential to choose the one that best suits your needs. Navy Federal, a well-established credit union, offers a range of IRA options to its members. In this article, we will delve into the world of Navy Federal IRA options, exploring their benefits, working mechanisms, and key features.

The importance of investing in an IRA cannot be overstated. It provides a tax-advantaged way to save for retirement, allowing your money to grow over time. Navy Federal, with its long history of serving military personnel, veterans, and their families, offers a variety of IRA options to cater to different investment goals and risk tolerance. Whether you're a seasoned investor or just starting to plan for retirement, Navy Federal's IRA options are worth considering.

Navy Federal's IRA options are designed to provide members with flexibility and control over their investments. From traditional IRAs to Roth IRAs, and from certificates to mutual funds, the credit union offers a range of investment products to suit different needs. Additionally, Navy Federal's IRA options come with competitive interest rates, low fees, and personalized service, making it an attractive choice for those looking to invest in their future.

Navy Federal IRA Options

Navy Federal offers several IRA options, each with its unique features and benefits. These include:

- Traditional IRA: Contributions are tax-deductible, and earnings grow tax-deferred. Withdrawals are taxed as ordinary income.

- Roth IRA: Contributions are made with after-tax dollars, and earnings grow tax-free. Withdrawals are tax-free if certain conditions are met.

- IRA Certificates: Fixed-rate, fixed-term investments with competitive interest rates.

- IRA Mutual Funds: Diversified investment portfolios with a range of asset allocations.

Benefits of Navy Federal IRA Options

The benefits of investing in a Navy Federal IRA are numerous. Some of the key advantages include:- Tax advantages: Contributions to traditional IRAs are tax-deductible, while earnings on Roth IRAs grow tax-free.

- Competitive interest rates: Navy Federal's IRA certificates and mutual funds offer competitive interest rates to help your investments grow.

- Low fees: Navy Federal's IRA options come with low fees, making it an affordable way to invest in your future.

- Personalized service: Navy Federal's experienced financial advisors are available to help you choose the right IRA option and create a personalized investment plan.

Types of Navy Federal IRAs

Navy Federal offers several types of IRAs, each designed to meet specific investment goals and risk tolerance. These include:

- Traditional IRA: Ideal for those who want to reduce their taxable income and grow their investments tax-deferred.

- Roth IRA: Suitable for those who want to pay taxes now and enjoy tax-free growth and withdrawals.

- Rollover IRA: Designed for those who want to consolidate their retirement accounts and simplify their investments.

- Inherited IRA: For beneficiaries who inherit an IRA from a deceased spouse or parent.

Navy Federal IRA Contribution Limits

It's essential to understand the contribution limits for Navy Federal IRAs. These limits are set by the IRS and may change from year to year. For the current tax year, the contribution limits are:- $6,000 for traditional and Roth IRAs

- $7,000 for those aged 50 and older, due to the catch-up contribution

Navy Federal IRA Investment Options

Navy Federal offers a range of investment options for its IRAs, including:

- IRA Certificates: Fixed-rate, fixed-term investments with competitive interest rates.

- IRA Mutual Funds: Diversified investment portfolios with a range of asset allocations.

- IRA Shares: Investments in Navy Federal's credit union, offering a competitive dividend rate.

Navy Federal IRA Fees and Charges

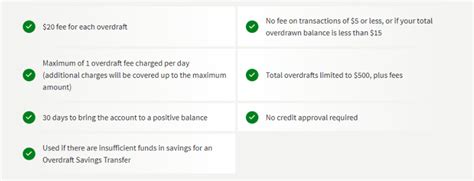

While Navy Federal's IRA options come with low fees, it's essential to understand the charges associated with each investment. These may include:- Maintenance fees: Annual fees for maintaining an IRA account.

- Management fees: Fees for managing investment portfolios.

- Early withdrawal fees: Penalties for withdrawing funds before age 59 1/2.

Navy Federal IRA Eligibility and Requirements

To be eligible for a Navy Federal IRA, you must meet certain requirements, including:

- Age: You must be under age 70 1/2 to contribute to a traditional IRA.

- Income: Your income must be below certain thresholds to contribute to a Roth IRA.

- Membership: You must be a member of Navy Federal Credit Union to open an IRA account.

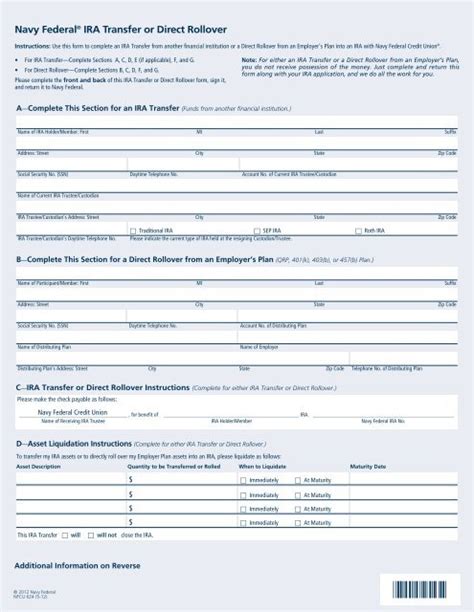

Navy Federal IRA Application Process

The application process for a Navy Federal IRA is straightforward. You can:- Apply online: Through Navy Federal's website, you can apply for an IRA account and fund it with an initial deposit.

- Visit a branch: You can visit a Navy Federal branch in person to apply for an IRA account and speak with a financial advisor.

- Call customer service: You can call Navy Federal's customer service to apply for an IRA account over the phone.

Navy Federal IRA Customer Support

Navy Federal offers excellent customer support for its IRA accounts, including:

- Phone support: You can call Navy Federal's customer service to ask questions or request assistance.

- Email support: You can email Navy Federal's customer service to ask questions or request assistance.

- Online support: You can access Navy Federal's website to manage your IRA account, view statements, and access educational resources.

Navy Federal IRA Education and Resources

Navy Federal provides a range of educational resources and tools to help you make informed investment decisions, including:- Online tutorials: Navy Federal's website offers interactive tutorials and guides to help you understand IRA options and investment strategies.

- Webinars: Navy Federal hosts webinars on various topics, including retirement planning and investment strategies.

- Financial advisors: Navy Federal's experienced financial advisors are available to provide personalized guidance and advice.

Navy Federal IRA Image Gallery

What is the minimum amount required to open a Navy Federal IRA?

+The minimum amount required to open a Navy Federal IRA is $50.

Can I contribute to a Navy Federal IRA if I'm over 70 1/2?

+No, you cannot contribute to a traditional IRA if you're over 70 1/2. However, you can contribute to a Roth IRA at any age.

How do I withdraw funds from my Navy Federal IRA?

+You can withdraw funds from your Navy Federal IRA by contacting customer service or visiting a branch. You may be subject to penalties and taxes for early withdrawals.

In conclusion, Navy Federal's IRA options provide a range of benefits and features to help you achieve your retirement goals. With competitive interest rates, low fees, and personalized service, Navy Federal's IRAs are an attractive choice for those looking to invest in their future. Whether you're a seasoned investor or just starting to plan for retirement, Navy Federal's IRA options are worth considering. We encourage you to explore Navy Federal's IRA options further and take the first step towards securing your financial future. Share your thoughts and experiences with Navy Federal's IRA options in the comments below, and don't forget to share this article with friends and family who may benefit from this information.