Intro

Navy Federal Credit Union lawsuit overview: Explore allegations, settlements, and member impacts in this high-profile case, covering financial disputes, class action suits, and credit union governance issues.

The financial world is filled with institutions that promise to help individuals manage their money, achieve their financial goals, and secure their financial futures. Among these institutions, credit unions have gained popularity due to their member-owned structure, which often translates into better rates and more personalized services. One of the most prominent credit unions in the United States is the Navy Federal Credit Union, known for serving members of the military, veterans, and their families. However, like any other financial institution, Navy Federal Credit Union has faced its share of legal challenges, including lawsuits that question its practices and commitment to its members. Understanding these lawsuits can provide valuable insights into the workings of financial institutions and the importance of consumer protection.

The lawsuits against Navy Federal Credit Union often revolve around issues such as overdraft fees, lending practices, and data security. For instance, overdraft fee lawsuits have been a significant concern for many consumers, as they can lead to unexpected and substantial charges. These fees occur when an account holder spends more money than is available in their account, and the bank or credit union covers the transaction, charging a fee for the service. While intended to help account holders avoid declined transactions, overdraft fees can become predatory if not managed transparently and fairly. Navy Federal Credit Union, like many other financial institutions, has faced allegations of unfairly charging overdraft fees, highlighting the need for clear communication and reasonable fee structures.

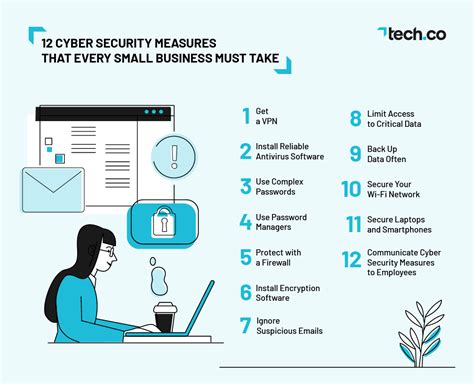

Moreover, the way financial institutions handle personal and financial data is under constant scrutiny. With the rise of digital banking, the risk of data breaches has increased, posing significant threats to consumers' financial security. Any lapse in data protection can lead to identity theft, unauthorized transactions, and other financial harms. Lawsuits related to data breaches against Navy Federal Credit Union or any other institution underscore the critical importance of robust cybersecurity measures and transparent communication with affected members.

Understanding the Legal Landscape

To navigate the complex legal landscape surrounding Navy Federal Credit Union lawsuits, it's essential to understand the types of legal actions that can be taken against financial institutions. Class-action lawsuits, for example, allow a group of individuals with similar grievances to come together and seek compensation or changes in practices. These lawsuits can be particularly effective in challenging systemic issues, such as unfair fee practices or data security lapses, that affect a large number of consumers.

Key Considerations for Consumers

For consumers who are members of Navy Federal Credit Union or any other financial institution, being aware of their rights and the legal recourse available to them is crucial. This includes understanding the terms and conditions of their accounts, being vigilant about suspicious transactions, and knowing how to report issues. Moreover, consumers should be proactive in seeking information about any legal actions against their financial institution, as these can impact their financial well-being and security.

Impact on Consumers and the Financial Industry

Lawsuits against financial institutions like Navy Federal Credit Union can have far-reaching implications for both consumers and the financial industry as a whole. For consumers, successful lawsuits can result in financial compensation for wrongdoing and changes in practices that better protect their interests. However, they can also lead to increased costs for financial institutions, which may then pass these costs on to consumers in the form of higher fees or reduced services.

For the financial industry, lawsuits can prompt regulatory changes and increased oversight, aiming to prevent similar issues in the future. This can lead to a more secure and transparent financial environment, where consumers' rights are better protected, and institutions are held to higher standards of accountability.

Steps to Protect Yourself

Given the potential risks and challenges associated with financial institutions, consumers must take proactive steps to protect themselves. This includes:

- Carefully reviewing the terms and conditions of financial products and services.

- Monitoring accounts regularly for suspicious activity.

- Understanding the fee structures associated with accounts and services.

- Being aware of data security practices and taking personal steps to enhance security, such as using strong passwords and enabling two-factor authentication.

- Staying informed about any legal actions or regulatory changes that could affect their financial institution.

Future Directions and Regulatory Oversight

The future of financial institutions like Navy Federal Credit Union will likely be shaped by regulatory oversight and legal challenges. As consumers become more aware of their rights and the importance of financial security, there will be increased pressure on institutions to prioritize transparency, fairness, and security. Regulatory bodies will play a crucial role in setting and enforcing standards that protect consumers while allowing financial institutions to operate efficiently.

Conclusion and Next Steps

In conclusion, lawsuits against Navy Federal Credit Union and other financial institutions highlight the ongoing challenges and complexities of the financial sector. As consumers, being informed and proactive is key to navigating these challenges and ensuring that financial institutions serve their members' best interests. By understanding the legal landscape, protecting oneself, and advocating for regulatory oversight, consumers can contribute to a more secure and transparent financial environment.

Navy Federal Credit Union Image Gallery

What are the common types of lawsuits against Navy Federal Credit Union?

+Common lawsuits include those related to overdraft fees, lending practices, and data security breaches.

How can consumers protect themselves from financial institution wrongdoing?

+Consumers can protect themselves by carefully reviewing terms and conditions, monitoring accounts, understanding fee structures, and staying informed about legal actions and regulatory changes.

What role do regulatory bodies play in overseeing financial institutions?

+Regulatory bodies set and enforce standards to protect consumers and ensure financial institutions operate fairly and securely, playing a crucial role in the financial sector's oversight.

We invite readers to share their thoughts and experiences regarding Navy Federal Credit Union lawsuits and the broader implications for consumer protection in the financial sector. Your insights can help foster a more informed and secure financial community. Please feel free to comment below or share this article with others who might find it informative and useful. Together, we can work towards a more transparent and consumer-centric financial environment.